|

|

|

|

|||||

|

|

Axsome Therapeutics AXSM incurred an adjusted loss of 97 cents per share in the second quarter of 2025, narrower than the Zacks Consensus Estimate of a loss of $1.00. The company had incurred a loss of $1.67 per share in the year-ago quarter.

Axsome’s total revenues surged 72% year over year to $150 million in the second quarter, beating the Zacks Consensus Estimate of $140 million. The year-over-year increase in revenues can be attributed to strong sales of Auvelity (AXS-05).

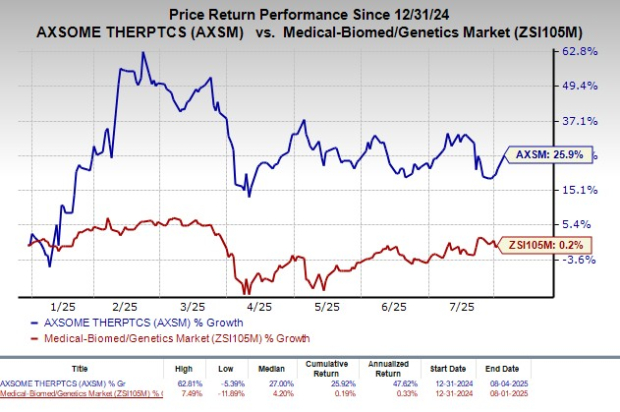

Year to date, shares of Axsome have rallied 25.9% compared with the industry’s rise of 0.2%.

Total revenues in the second quarter consisted of product revenues from Auvelity, Sunosi (solriamfetol) and the newest drug, Symbravo (meloxicam and rizatriptan), as well as royalty revenues.

Net product revenues were $148.9 million in the quarter compared with $86.5 million reported in the year-ago period. Royalty revenues totaled $1.1 million in the quarter, reflecting royalties on Sunosi’s sales in out-licensed territories.

Product revenues in the second quarter benefited from the strong sales uptake of AXSM’s lead marketed product, Auvelity, for major depressive disorder (MDD) and Sunosi for narcolepsy.

Auvelity recorded sales of $119.6 million, up 84% year over year and 24% sequentially. Sales of the drug beat our model estimate of $111.8 million.

Per Axsome, around 192,000 prescriptions were recorded for Auvelity in the reported quarter, reflecting a sequential increase of 15% and a year-over-year increase of 56%.

Sunosi’s net product sales were $30 million in the second quarter, up 35% from the year-ago quarter’s level. Total prescriptions for Sunosi in the United States grew 13% year over year to 50,000. Sunosi total prescriptions increased 9% on a sequential basis.

Axsome acquired U.S. rights to Sunosi from Jazz Pharmaceuticals JAZZ in May 2022. It began selling Sunosi in the U.S. market in May 2022 and in certain international markets in November 2022.

Jazz had received approval for Sunosi as a treatment for narcolepsy in 2019.

Axsome out-licensed its ex-U.S. marketing rights of Sunosi to Pharmanovia in February 2023. JAZZ is entitled to receive a high single-digit royalty from AXSM on net sales of Sunosi in the United States.

The FDA approved Symbravo in January 2025 for the acute treatment of migraine with or without aura in adults. The drug was launched in June. Symbravo recorded sales worth $0.4 million in this partial quarter since its launch.

Research and development expenses (including stock-based compensation) were $49.5 million, down 0.8% from the year-ago quarter’s level. The decrease was due to the completion of the label expansion studies of Sunosi and AXS-05 as a treatment for agitation in Alzheimer’s disease (AD).

Selling, general and administrative expenses (including stock-based compensation) totaled $130.3 million, up 25.8% year over year. The increase was due to higher commercial activities for Auvelity and the ongoing launch activities for Symbravo and other costs.

As of June 30, 2025, Axsome had cash and cash equivalents worth $303 million compared with $300.9 million as of March 31, 2025.

Axsome is evaluating Auvelity in several label expansion studies for other central nervous system (CNS) disorders.

The company is gearing up to submit a supplemental new drug application (sNDA) for AXS-05 to the FDA for treating AD agitation in the third quarter of 2025.

Axsome also plans to start a pivotal phase II/III study of AXS-05 for treating smoking cessation later in the fourth quarter of 2025.

Other pipeline candidates include AXS-12 and AXS-14, which target multiple CNS indications.

AXS-12 is currently being developed in multiple studies for the treatment of narcolepsy. AXSM plans to submit a new drug application (NDA) for AXS-12 for treating cataplexy in patients with narcolepsy to the FDA in the fourth quarter of 2025.

In June, Axsome received a Refusal to File (RTF) letter from the FDA related to its NDA for AXS-14 (esreboxetine) for the management of fibromyalgia.

To address the regulatory body’s feedback in the previously disclosed RTF letter, Axsome plans to initiate a fixed-dose, phase III, 12-week study on AXS-14 for treating fibromyalgia in the fourth quarter of 2025.

Axsome is evaluating solriamfetol in separate phase III studies for treating attention-deficit hyperactivity disorder (ADHD) and MDD.

The company plans to initiate a phase III study on solriamfetol for treating ADHD in pediatric patients in the fourth quarter of 2025.

Axsome plans to initiate a phase III study on solriamfetol in MDD patients with excessive daytime sleepiness later in the fourth quarter of 2025.

The company is also evaluating solriamfetol in separate phase III studies for treating binge eating disorder (BED) and excessive sleepiness associated with shift work disorder (SWD).

Top-line data from the ENGAGE study and the SUSTAIN study, evaluating solriamfetol for treating BED and SWD in adults, respectively, are expected in 2026.

Axsome Therapeutics, Inc. price-consensus-eps-surprise-chart | Axsome Therapeutics, Inc. Quote

Axsome currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the biotech sector are CorMedix CRMD and Immunocore IMCR, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for CorMedix’s earnings per share have increased from 93 cents to 97 cents for 2025. During the same time, earnings per share estimates for 2026 have increased from $1.64 to $1.65. Year to date, shares of CRMD have rallied 52.7%.

CorMedix’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 25.82%.

In the past 60 days, estimates for Immunocore’s 2025 loss per share have narrowed from 86 cents to 68 cents. Loss per share estimates for 2026 have narrowed from $1.34 to $1.10 during the same period. IMCR stock has increased 10.3% year to date.

Immunocore’s earnings beat estimates in three of the trailing four quarters while missing the same on the remaining occasion, the average surprise being 76.18%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite