|

|

|

|

|||||

|

|

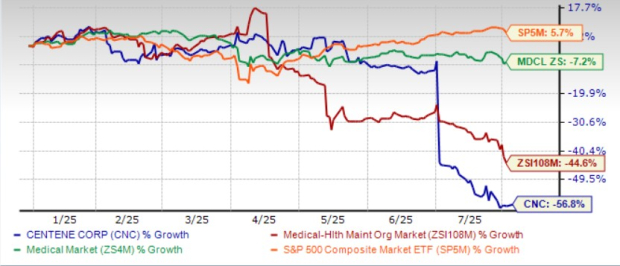

Shares of Centene Corporation CNC have lost 56.8% year to date, underperforming its industry, sector and the Zacks S&P 500 composite.

Centene is one of the largest providers of government-sponsored healthcare in the United States, with a significant presence across Medicaid, Medicare Advantage, ACA marketplace plans and specialty services. However, elevated healthcare utilization and medical cost pressure eclipsed the company, leading to a loss in the second quarter of 2025—its first quarterly loss in over a decade. Its health benefits ratio (HBR) spiked to 93%, a level not seen in years.

CNC is now trending below its 50-day simple moving average (SMA), indicating the possibility of a downside ahead.

Shares of Humana HUM and Cigna CI, two other health care plan providers, have lost 3.5% and 2.5%, respectively, year to date.

Humana is one of the largest health care plan providers in the United States. It continues to expand its membership base, particularly within Medicare Advantage and state-based programs, which remain key growth engines. Humana benefits from strong premium growth, strategic acquisitions, and a robust cash position, all of which act as major tailwinds for the company.

Cigna’s strategic acquisitions like Express Scripts and collaborations with Centene and Virgin Pulse support long-term growth. Cigna streamlined its portfolio with divestitures to Chubb, New York Life and HCSC, focusing on core health services.

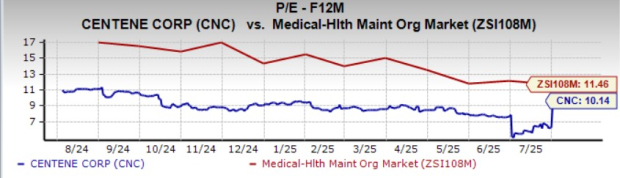

The stock is undervalued compared with its industry. It is currently trading at a price-to-earnings multiple of 10.14, lower than the industry average of 11.46.

Centene is relatively cheap compared to Humana but expensive when compared to Cigna.

Centene’s bottom line is being hurt by higher operating costs. Since 2007, total operating costs have been increasing significantly. Operating expenses totaled $49.2 billion in the second quarter of 2025, which escalated 27.4% year over year on higher medical costs, premium tax expense and selling, general and administrative expenses. Medical costs alone jumped 26.1% year over year.

A spike in second-quarter HBR forced management to slash its 2025 earnings per share guidance to about $1.75 from the previous expectation of above $7.00.

Although Marketplace membership continued to grow, revenues were negatively impacted by a previously disclosed shortfall in anticipated 2025 risk adjustment transfer payments. Further compounding the issue were elevated levels of medical utilization. Centene has faced considerable pressure from higher-than-expected utilization rates, particularly within its Medicaid and Medicare Advantage lines of business.

In fact, enrollment in some of Centene’s most profitable lines of business has declined recently. The company lost members in Medicaid and Medicare Advantage.

Centene’s balance sheet remains laden with a high debt level most probably due to the company’s acquisitions being financed majorly by borrowings. Long-term debt amounted to $17.6 billion as of June 30. 2025, higher than cash and cash equivalents of $14.5 billion. Nonetheless, Centene aims to achieve the debt-to-capitalization ratio in the high 30s over the longer term.

Centene is a key player in government-sponsored healthcare, with operations spanning Medicaid, Medicare Advantage, ACA Marketplace, Tricare and correctional health, supported by a diverse and steadily growing membership base. Over the past decade, acquisitions such as Health Net, WellCare and Magellan Health have significantly expanded the company’s footprint and service portfolio, reinforcing its foundation for long-term revenue growth.

The commercial Marketplace business has shown strong momentum, with membership rising 12.4% as of Dec. 31, 2024.

Despite ongoing headwinds, Centene is well-positioned to reprice its Marketplace plans in 2026, targeting meaningful margin improvement. At the same time, management remains confident that with disciplined pricing and operational execution, the Medicare Advantage business will continue to advance in 2026 and reach breakeven by 2027.

Management views the One Big Beautiful Bill Act, or OBBB, enacted in the United States in July 2025, as having established a new and stable policy floor for its programs.

OBBB introduces approximately $1 trillion in federal Medicaid cuts over the next decade. Also, due to Medicaid eligibility verification every six months, administrative cost is likely to increase.

The act also cuts ACA subsidies, which could reduce enrollment in individual marketplace plans. Centene holds roughly 23% market share in that segment. Yet this opens up the scope for developing new individual products and expanding into private segments to partially compensate for Medicaid losses.

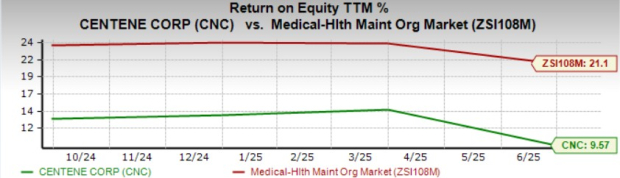

Return on equity (“ROE”) in the trailing 12 months was 9.7%, underperforming the industry average of 21.1%. Return on equity, a profitability measure, reflects how effectively a company is utilizing its shareholders’ funds.

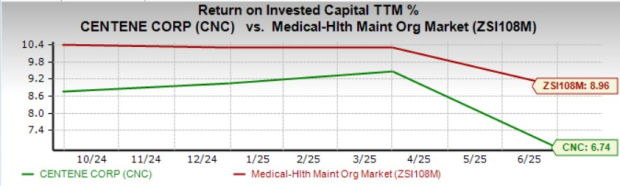

The same holds true for return on invested capital (ROIC). Its ROIC in the trailing 12 months was 6.7%, lower than the industry average of 9%.

The Zacks Consensus Estimate for 2025 earnings implies a 70% year-over-year decrease, while the same for 2026 suggests a 51% increase.

The consensus estimate for 2025 and 2026 earnings has moved 48.3% and 36.2% south, respectively, in the past seven days.

Centene is expected to face notable headwinds under the OBBB Act, including reduced membership, tightening profit margins and rising operational costs. The company’s Medicaid business is already strained by increasing expenditures related to behavioral health, home-based care and costly medications.

Centene’s unfavorable return on capital, an expected near-term decline in earnings, rising debt and muted analyst sentiments surrounding the company signal that CNC is a risky bet. It is better to stay away from this Zacks Rank #5 (Strong Sell) stock at the moment.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 20 hours | |

| 22 hours | |

| 22 hours | |

| 23 hours | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-20 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite