|

|

|

|

|||||

|

|

Ultragenyx Pharmaceutical RARE reported second-quarter 2025 loss of $1.17 per share, narrower than the Zacks Consensus Estimate of a loss of $1.27. The company had incurred a loss of $1.52 per share in the year-ago quarter.

Ultragenyx’s total revenues amounted to $166.5 million in the reported quarter, up 13% year over year, on the back of higher product sales. The top line beat the Zacks Consensus Estimate of $162 million.

The company markets four drugs, namely Crysvita, Mepsevii, Dojolvi and Evkeeza. Crysvita is approved for treating X-linked hypophosphatemia, an inherited disorder and tumor-induced osteomalacia, an ultra-rare disease. Mepsevii is approved to treat Mucopolysaccharidosis VII, also known as Sly syndrome. Dojolvi is approved for treating all forms of long-chain fatty acid oxidation disorders. Evkeeza is indicated for homozygous familial hypercholesterolemia (HoFH)

In 2022, Ultragenyx announced a license and collaboration agreement with Regeneron Pharmaceuticals REGN for Evkeeza, which is approved in multiple geographies as a first-in-class therapy for use together with diet and other low-density lipoprotein-cholesterol-lowering therapies to treat adults and adolescents aged 12 years and older with HoFH. Per the deal, RARE has obtained the rights to develop, commercialize and distribute Evkeeza outside the United States. The regions include the European Economic Area. The collaboration with Regeneron for Evkeeza gives Ultragenyx a fourth approved product that adds to the top line. However, REGN solely commercializes Evkeeza in the United States.

Crysvita’s total revenues were $120.4 million, up 6% year over year, driven by increased demand for approved indications. Crysvita’s net product revenues in the second quarter of 2025 included $79 million from North America, $35 million from Latin America and Turkey, and $7 million from Europe.

Mepsevii product revenues increased 35% year over year to $8.3 million in the reported quarter. Dojolvi product revenues were $23.2 million, up 20%, driven by new patient demand. Evkeeza recorded sales of $14.6 million in the first quarter, up significantly as Ultragenyx continues to launch the drug in its territories outside of the United States.

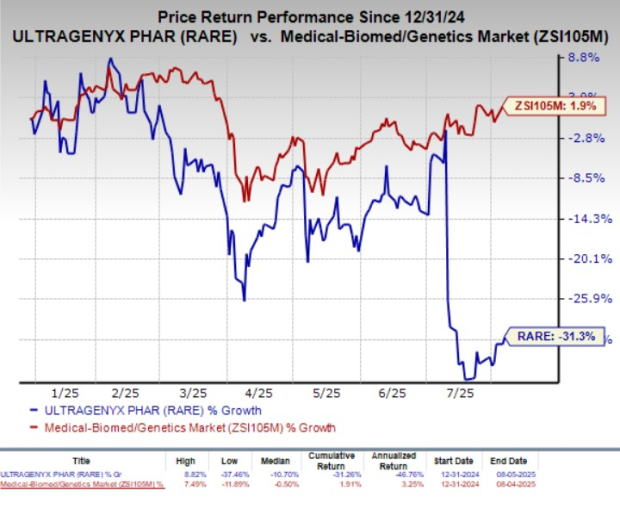

Year to date, shares of Ultragenyx have lost 31.3% against the industry’s 1.9% growth.

Operating expenses of $274.4 million in the quarter grew 4% year over year due to increased investments in multiple late-stage pipeline programs and marketing costs for approved drugs. Operating expenses included research and development expenses of $164.7 million (up 2%), selling, general and administrative expenses of $86.6 million (up 7%), and cost of sales of $23 million (up 8%).

Cash, cash equivalents and marketable debt securities amounted to $539 million as of June 30, 2025, compared with $563 million as of March 31, 2025.

Ultragenyx expects total revenues in 2025 between $640 million and $670 million, representing growth of approximately 14-20% compared to 2024. Crysvita revenues are expected in the range of $460-$480 million (up 12-17% year over year), while Dojolvi revenues are expected between $90 million and $100 million (up 2-14% year over year) in 2025.

The company will maintain its focus on expense management while strategically investing in upcoming commercial launches and advancing multiple phase III programs, which are expected to reduce net cash used in operations in 2025 compared with 2024.

Last month, Ultragenyx faced a massive setback when the FDA issued a complete response letter (CRL) for its biologics license application (BLA) for UX111, which is being developed as a treatment for patients with MPS IIIA. In the CRL, the FDA requested more information and enhancements concerning certain chemistry, manufacturing and controls elements and findings from recent manufacturing facility inspections. Per Ultragenyx, the issues raised are facility- and process-related, not tied to product quality, and can be addressed quickly. It plans to work closely with the FDA in the coming months to resolve the observations, after which it expects to resubmit the BLA, triggering a review period of up to six months.

Ultragenyx and its partner, Mereo BioPharma, are jointly developing UX143 (setrusumab) monoclonal antibody forpediatric and young adult patients with osteogenesis imperfecta (OI) in two late-stage studies, Orbit and Cosmic. In July, the companies reported that the Orbit and Cosmic studies are on track for a final analysis by the end of 2025, in line with the original timeline, instead of stopping the study early as they had hoped.

During the second quarter, the FDA granted the Breakthrough Therapy designation to Ultragenyx’s GTX-102, its investigational antisense oligonucleotide, for treating Angelman syndrome (AS). Last year, RARE initiated dosing in the pivotal phase III Aspire study evaluating the efficacy and safety of GTX-102 for AS. Enrollment in the study has been completed, with data expected in the second half of 2026. The company is also planning to initiate an open-label clinical study, named Aurora, in the second half of 2025 to evaluate the safety and efficacy of GTX-102 for treating other AS genotypes in other patient age groups. This additional study aims to enable treatment for a broader range of AS patients.

Ultragenyx is also planning to submit a BLA for its investigational AAV8 gene therapy, DTX401, to treat glycogen storage disease type Ia in the fourth quarter of 2025. The company is evaluating UX701, an investigational AAV9 gene therapy, in a phase I/II/III Cyprus2+ study to treat Wilson disease.

Ultragenyx Pharmaceutical Inc. price-consensus-eps-surprise-chart | Ultragenyx Pharmaceutical Inc. Quote

Ultragenyx currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the biotech sector are Arvinas ARVN and Immunocore IMCR, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for Arvinas’ 2025 loss per share have narrowed from $1.51 to $1.50. Loss per share estimates for 2026 have narrowed from $3.08 to $2.98 during the same period. ARVN stock has plunged 60.3% year to date.

Arvinas’ earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 82.09%.

In the past 60 days, estimates for Immunocore’s 2025 loss per share have narrowed from 86 cents to 68 cents. Loss per share estimates for 2026 have narrowed from $1.34 to $1.10 during the same period. IMCR stock has increased 10.2% year to date.

Immunocore’s earnings beat estimates in three of the trailing four quarters while missing the same on the remaining occasion, the average surprise being 76.18%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 16 hours | |

| 18 hours | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite