|

|

|

|

|||||

|

|

Residential solar energy company Sunrun (NASDAQ:RUN) reported revenue ahead of Wall Street’s expectations in Q2 CY2025, with sales up 8.7% year on year to $569.3 million. Its GAAP profit of $1.07 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Sunrun? Find out by accessing our full research report, it’s free.

“We are delivering the best product and experience for customers, underwriting volumes with strong unit margins, driving cost and efficiency improvements, and growing our generation capabilities as the nation’s largest distributed power plant operator, hitting records this summer in providing energy capacity for the grid. This focus resulted in Sunrun setting a new record in the second quarter for Contracted Net Value Creation as we achieved an all time high 70% storage attachment rate. Not only is Sunrun providing Americans with the reliable and affordable energy they need to power their lives, we are scaling our generation business, and helping to stabilize the electricity grid while we do it,” said Mary Powell, Sunrun’s Chief Executive Officer.

Helping homeowners use solar energy to power their homes, Sunrun (NASDAQ:RUN) provides residential solar electricity, specializing in panel installation and leasing services.

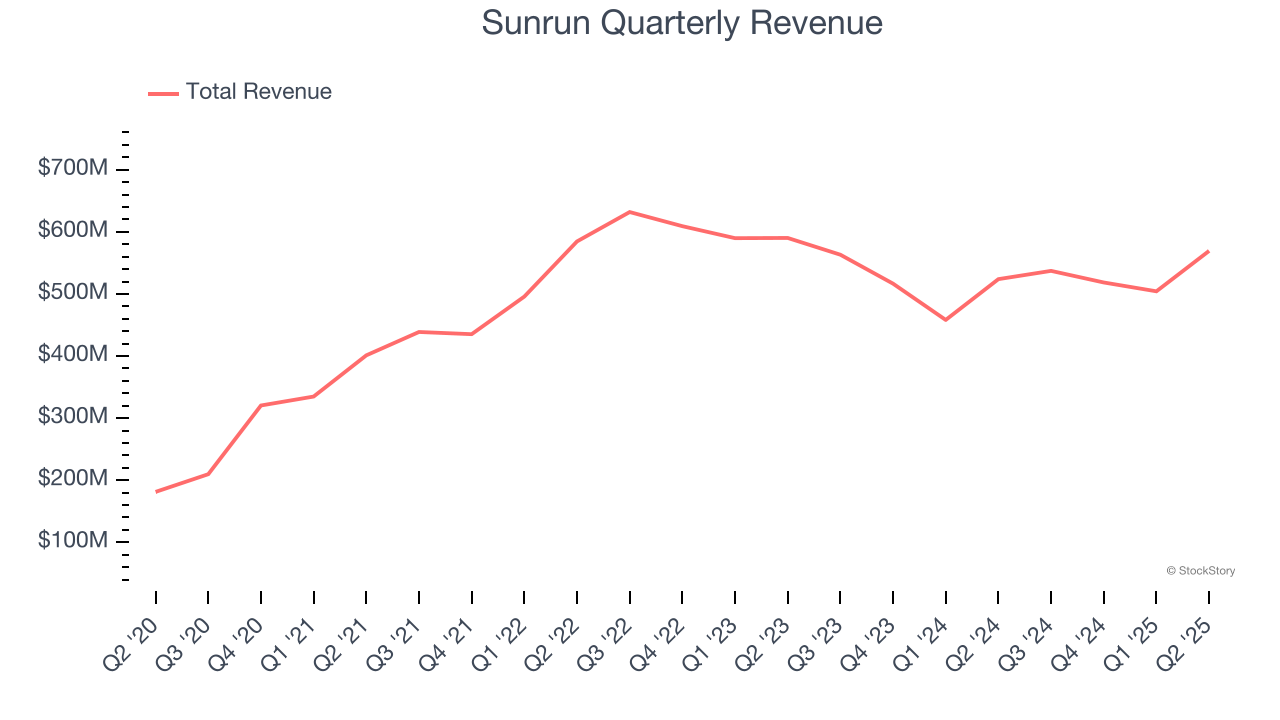

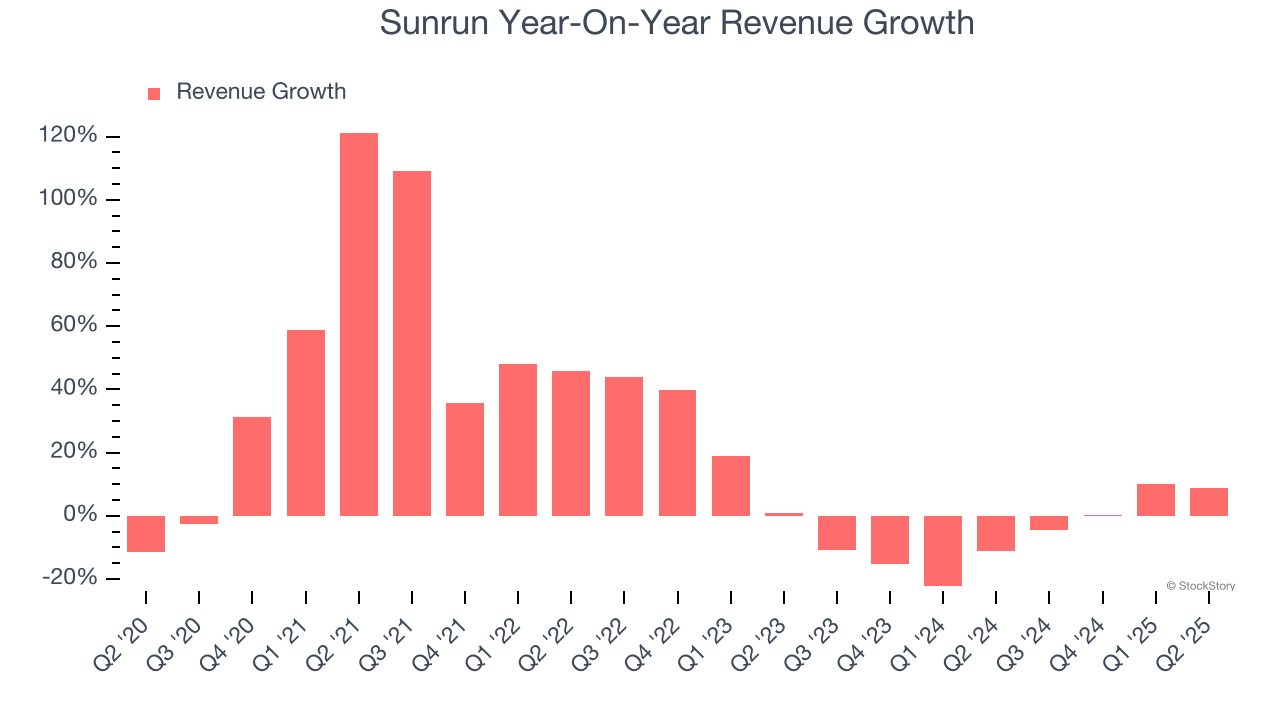

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Sunrun grew its sales at an incredible 20.1% compounded annual growth rate. Its growth beat the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Sunrun’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 6.2% over the last two years. Sunrun isn’t alone in its struggles as the Renewable Energy industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

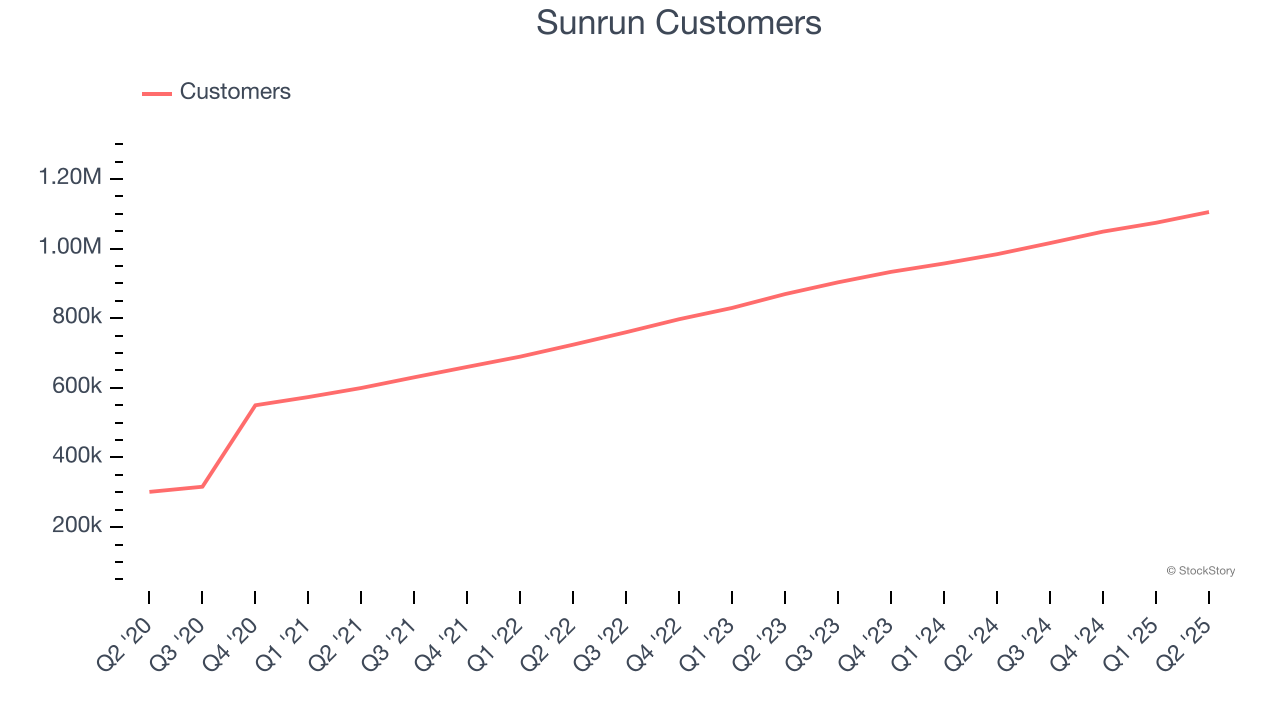

We can better understand the company’s revenue dynamics by analyzing its number of customers, which reached 1.11 million in the latest quarter. Over the last two years, Sunrun’s customer base averaged 14.2% year-on-year growth. Because this number is better than its revenue growth, we can see the average customer spent less money each year on the company’s products and services.

This quarter, Sunrun reported year-on-year revenue growth of 8.7%, and its $569.3 million of revenue exceeded Wall Street’s estimates by 4%.

Looking ahead, sell-side analysts expect revenue to grow 10.2% over the next 12 months, an improvement versus the last two years. This projection is healthy and suggests its newer products and services will fuel better top-line performance.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

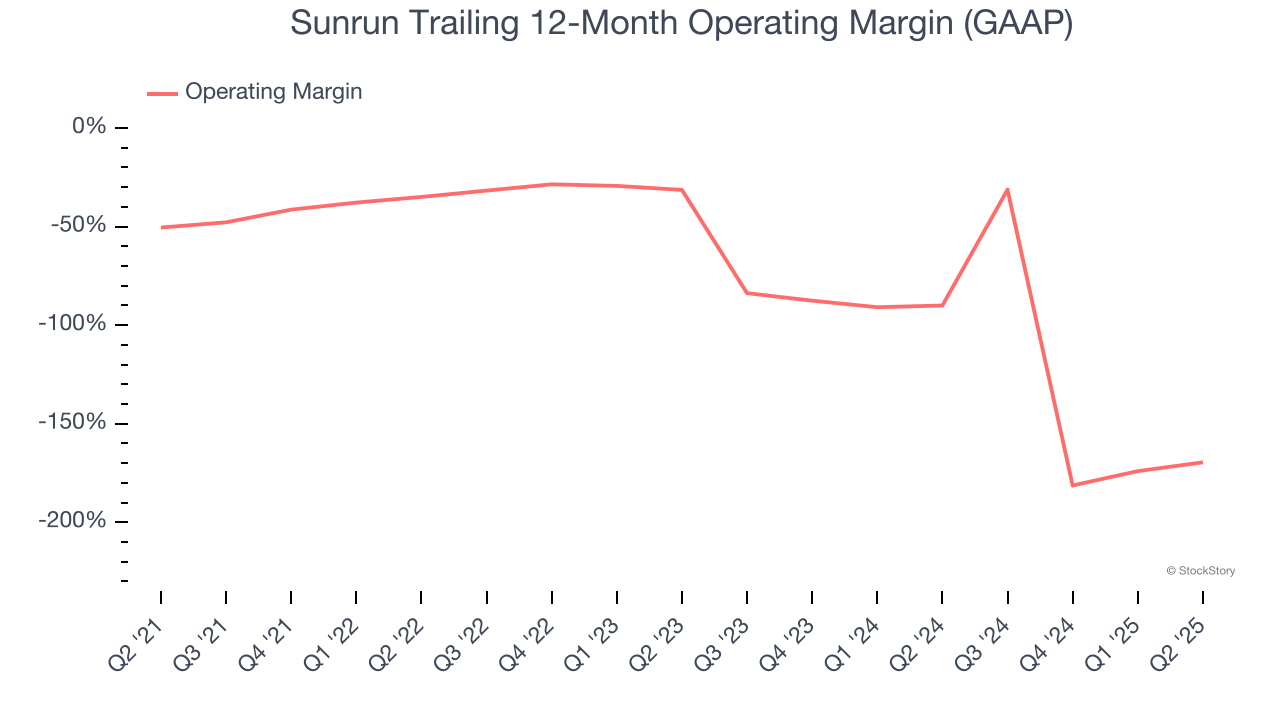

Sunrun’s high expenses have contributed to an average operating margin of negative 76.8% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Analyzing the trend in its profitability, Sunrun’s operating margin decreased significantly over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Sunrun’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q2, Sunrun generated a negative 19.7% operating margin.

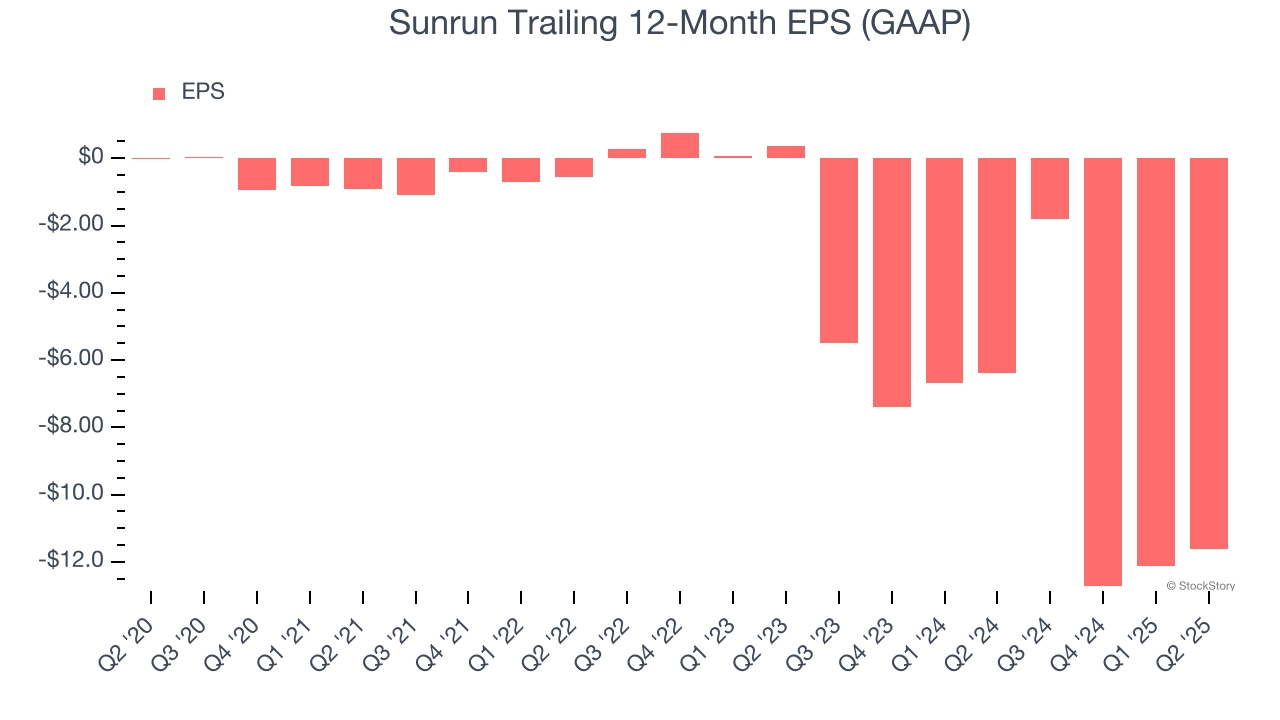

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sunrun’s earnings losses deepened over the last five years as its EPS dropped 313% annually. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Sunrun’s low margin of safety could leave its stock price susceptible to large downswings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

Sadly for Sunrun, its EPS declined by more than its revenue over the last two years, dropping 475%. This tells us the company struggled to adjust to shrinking demand.

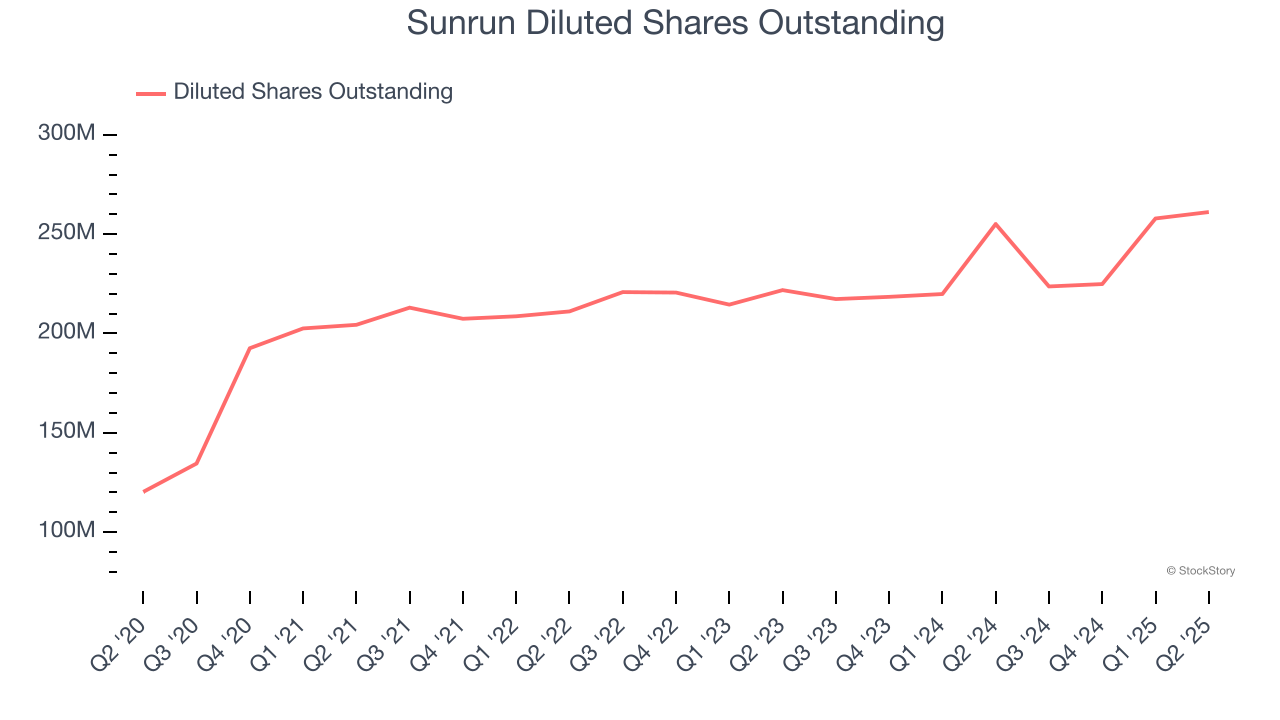

We can take a deeper look into Sunrun’s earnings to better understand the drivers of its performance. A two-year view shows Sunrun has diluted its shareholders, growing its share count by 17.7%. This dilution overshadowed its increased operating efficiency and has led to lower per share earnings.

In Q2, Sunrun reported EPS at $1.07, up from $0.55 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Sunrun to improve its earnings losses. Analysts forecast its full-year EPS of negative $11.62 will advance to negative $0.65.

We were impressed by how significantly Sunrun blew past analysts’ revenue, EPS, and EBITDA expectations this quarter. Zooming out, we think this was a solid print. The stock traded up 15.4% to $10.40 immediately following the results.

Indeed, Sunrun had a rock-solid quarterly earnings result, but is this stock a good investment here? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.

| 1 hour | |

| 4 hours | |

| Feb-13 | |

| Feb-13 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-09 | |

| Feb-09 | |

| Feb-09 | |

| Feb-09 | |

| Feb-08 | |

| Feb-05 | |

| Feb-05 | |

| Feb-05 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite