|

|

|

|

|||||

|

|

Medical equipment and services company Steris (NYSE:STE). announced better-than-expected revenue in Q2 CY2025, with sales up 8.7% year on year to $1.39 billion. Its non-GAAP profit of $2.34 per share was 3.4% above analysts’ consensus estimates.

Is now the time to buy STERIS? Find out by accessing our full research report, it’s free.

With a mission critical role in preventing healthcare-associated infections, STERIS (NYSE:STE) provides infection prevention products, sterilization services, and medical equipment that help healthcare facilities and life science companies maintain sterile environments.

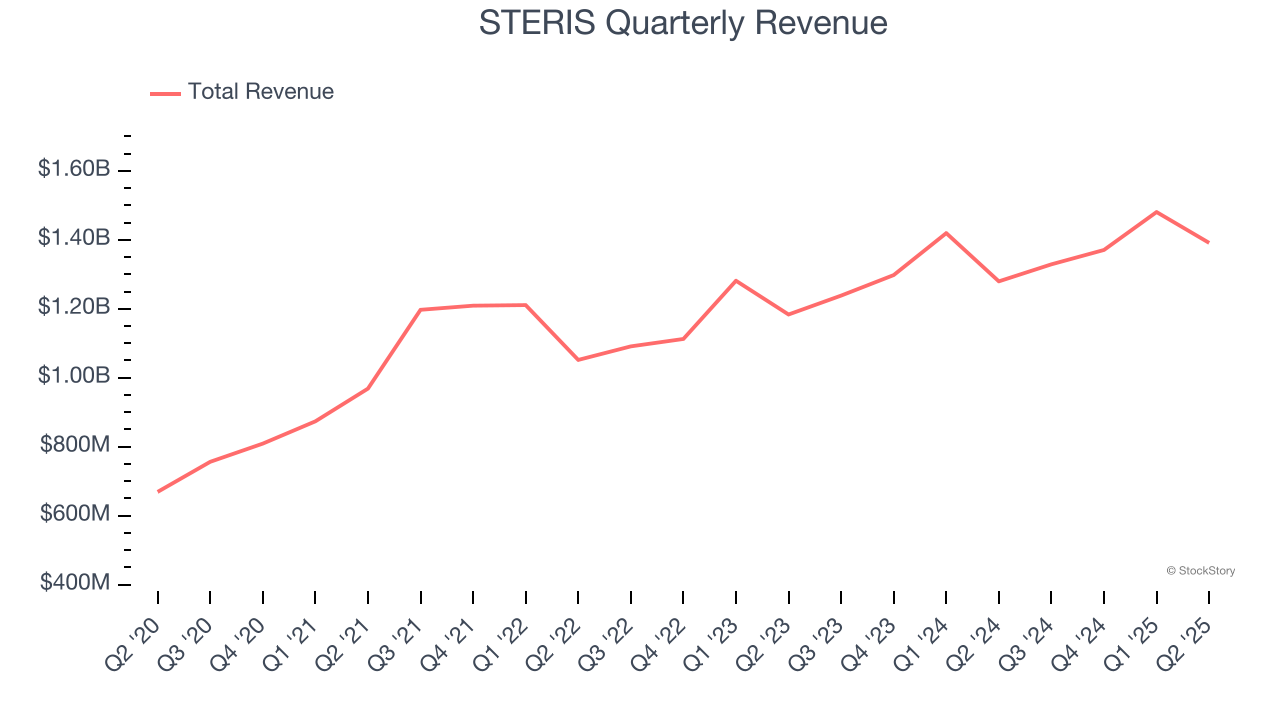

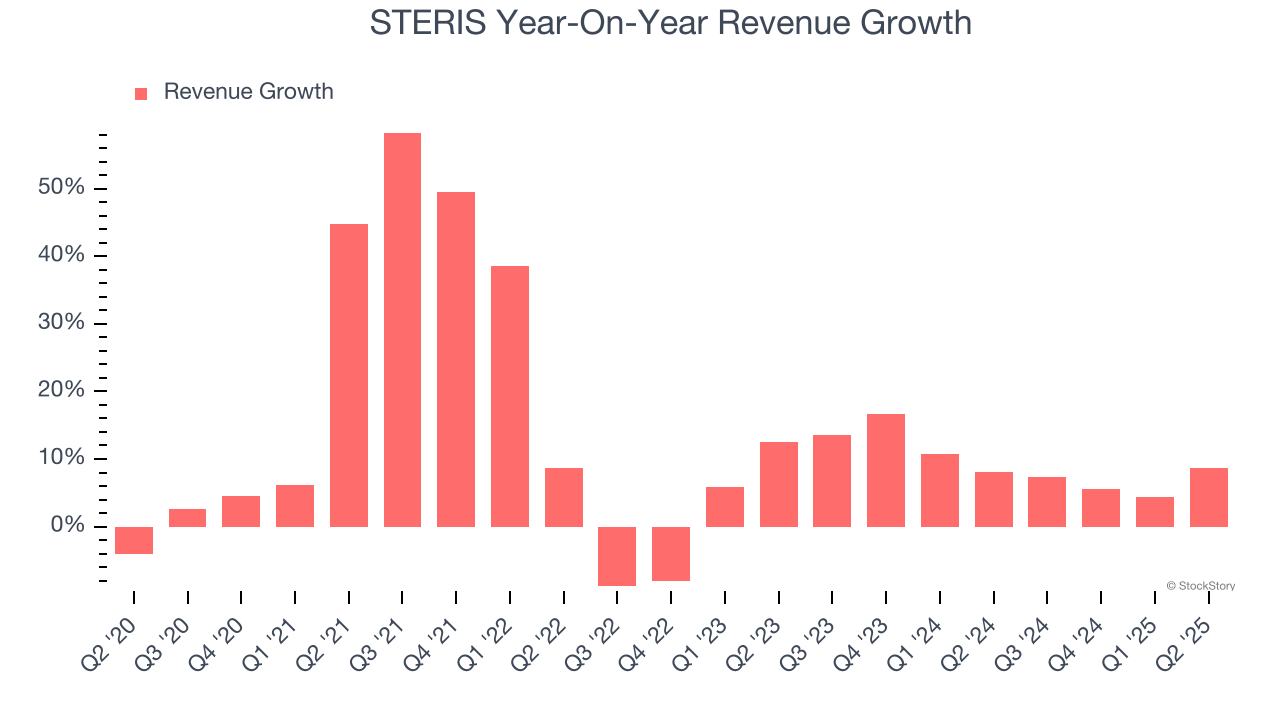

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Luckily, STERIS’s sales grew at a solid 13.2% compounded annual growth rate over the last five years. Its growth beat the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. STERIS’s annualized revenue growth of 9.2% over the last two years is below its five-year trend, but we still think the results were respectable.

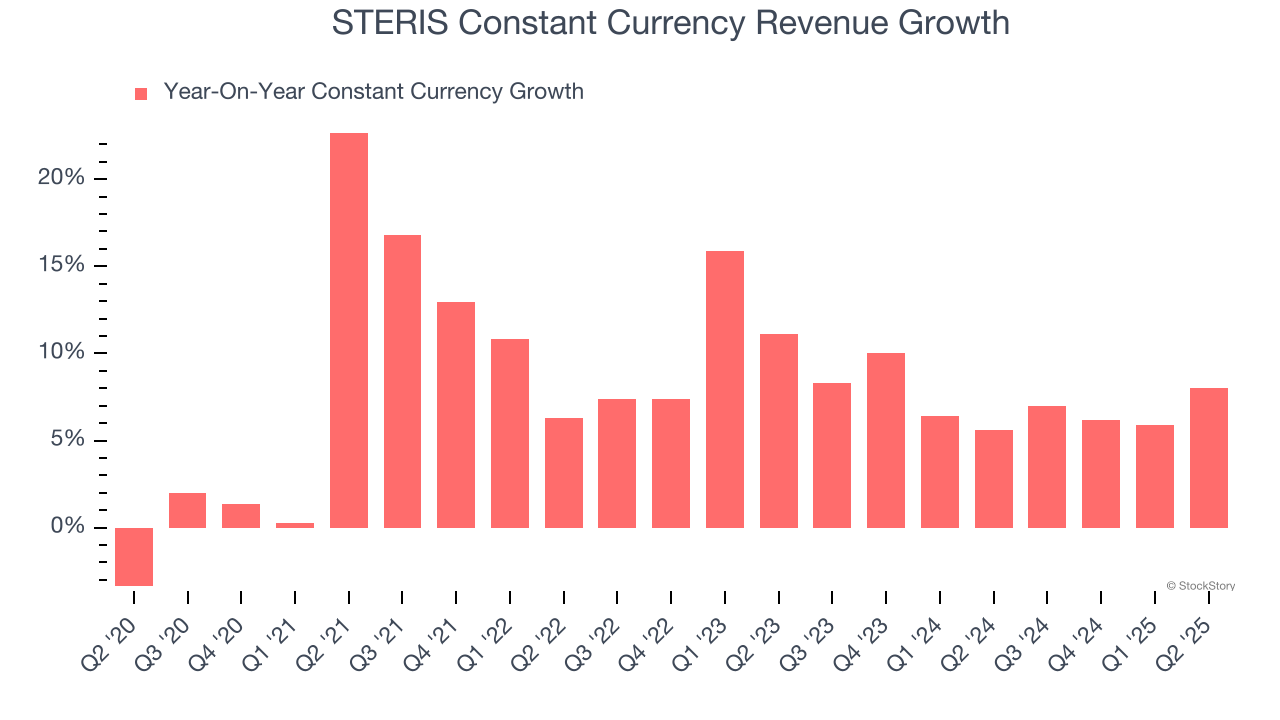

We can dig further into the company’s sales dynamics by analyzing its constant currency revenue, which excludes currency movements that are outside their control and not indicative of demand. Over the last two years, its constant currency sales averaged 7.2% year-on-year growth. Because this number is lower than its normal revenue growth, we can see that foreign exchange rates have boosted STERIS’s performance.

This quarter, STERIS reported year-on-year revenue growth of 8.7%, and its $1.39 billion of revenue exceeded Wall Street’s estimates by 2.3%.

Looking ahead, sell-side analysts expect revenue to grow 6% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is above average for the sector and indicates the market is baking in some success for its newer products and services.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

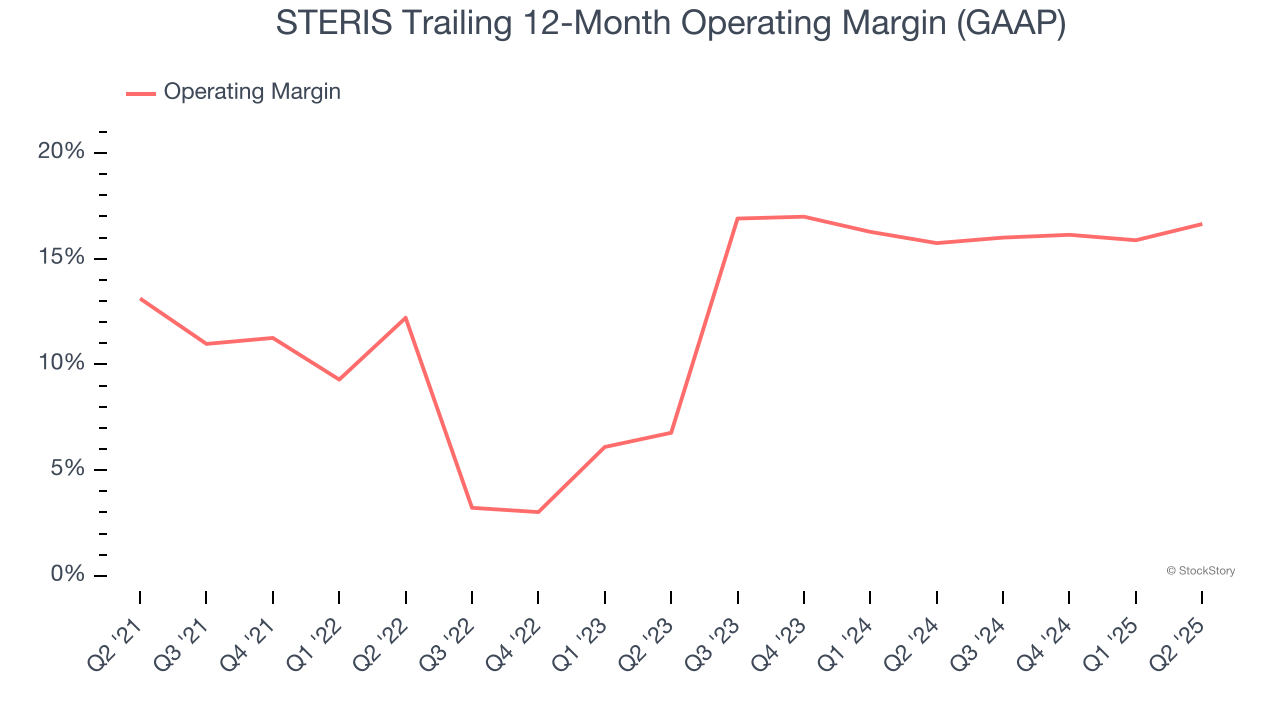

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

STERIS has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 13.1%, higher than the broader healthcare sector.

Analyzing the trend in its profitability, STERIS’s operating margin rose by 3.5 percentage points over the last five years, as its sales growth gave it operating leverage. This performance was mostly driven by its recent improvements as the company’s margin has increased by 9.9 percentage points on a two-year basis.

This quarter, STERIS generated an operating margin profit margin of 17.7%, up 3.2 percentage points year on year. This increase was a welcome development and shows it was more efficient.

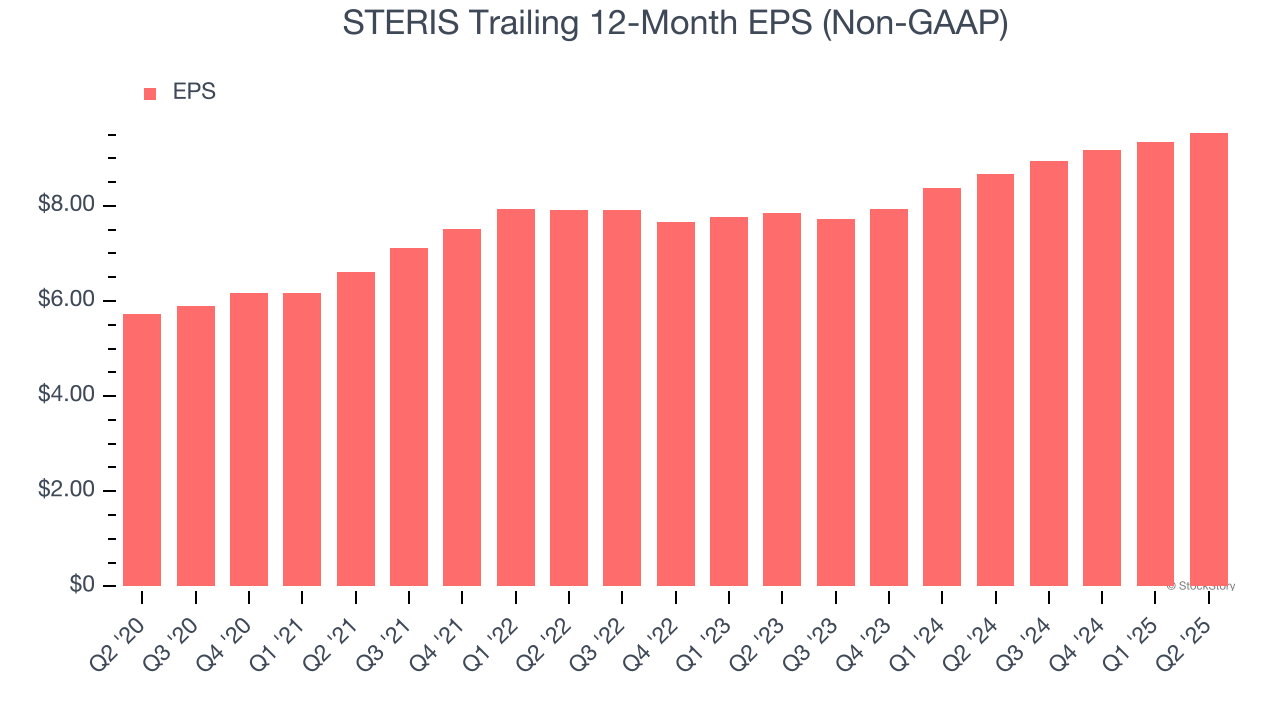

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

STERIS’s EPS grew at a remarkable 10.7% compounded annual growth rate over the last five years. Despite its operating margin improvement during that time, this performance was lower than its 13.2% annualized revenue growth, telling us that non-fundamental factors such as interest and taxes affected its ultimate earnings.

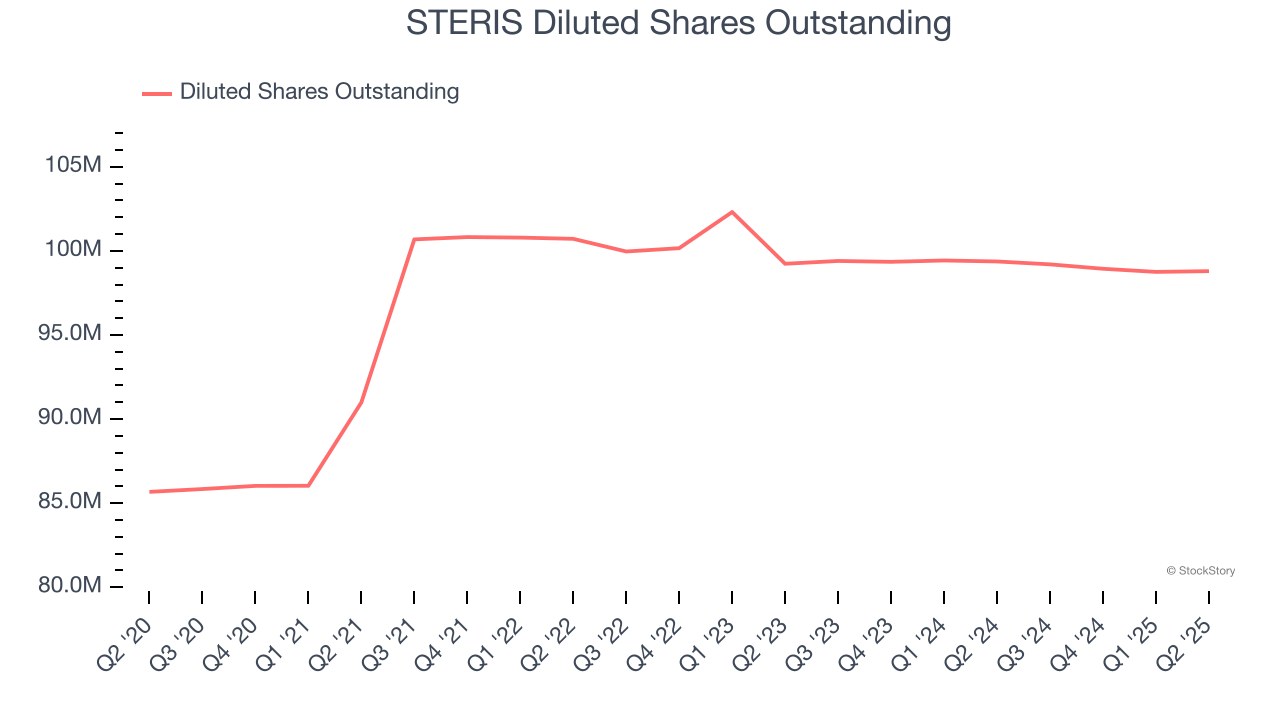

We can take a deeper look into STERIS’s earnings to better understand the drivers of its performance. A five-year view shows STERIS has diluted its shareholders, growing its share count by 15.3%. This dilution overshadowed its increased operating efficiency and has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q2, STERIS reported adjusted EPS at $2.34, up from $2.14 in the same quarter last year. This print beat analysts’ estimates by 3.4%. Over the next 12 months, Wall Street expects STERIS’s full-year EPS of $9.54 to grow 7.4%.

We enjoyed seeing STERIS beat analysts’ constant currency revenue expectations this quarter. We were also happy its revenue and EPS both outperformed Wall Street’s estimates. Overall, this print had some key positives. The stock remained flat at $221.22 immediately after reporting.

Is STERIS an attractive investment opportunity right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.

| Feb-15 | |

| Feb-11 | |

| Feb-09 | |

| Feb-07 | |

| Feb-05 | |

| Feb-05 | |

| Feb-05 | |

| Feb-04 | |

| Feb-04 | |

| Feb-04 | |

| Feb-04 | |

| Feb-04 | |

| Feb-04 | |

| Feb-03 | |

| Feb-03 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite