|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

BigBear.ai Holdings, Inc. BBAI is scheduled to report second-quarter 2025 results on Aug. 11, after the closing bell, and the key focus will be on whether the company’s recent strategic alignment and contract wins can reverse the revenue softness seen in prior quarters.

In the last reported quarter, BigBear.ai reported revenues of $34.8 million, up 5% year over year but missing the consensus estimate by 3.2%. The quarter was driven by growth in DHS and digital identity contracts, while adjusted EBITDA loss widened to $7 million due to higher R&D and SG&A expenses amid government funding delays. Gross margin improved slightly to 21.3% (up 20 basis points or bps), and backlog rose 30% to $385 million, signaling strong demand. The company ended the quarter with $108 million in cash and reduced its debt by $58 million, reinforcing financial stability. During the first-quarter earnings call, management reaffirmed its full-year guidance, reflecting confidence in second-half acceleration, driven by growth in core markets and select adjacencies.

This artificial intelligence (AI) provider surpassed earnings estimates in three of the trailing four quarters and missed on one occasion, with an average surprise of 6.2%.

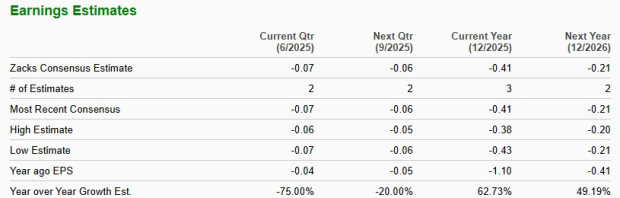

The Zacks Consensus Estimate for the second-quarter earnings per share has remained unchanged at a loss of 7 cents over the past 30 days. The estimated figure indicates a decline from the year-ago reported loss of 4 cents. The consensus mark for revenues is $40.99 million, suggesting a 3% year-over-year increase.

For 2025, BigBear.ai is expected to register a 5.5% increase from a year ago in revenues. Its bottom line is expected to witness an improvement to a loss of 41 cents per share from $1.10 a year ago. Below is what to expect in the second quarter for BBAI stock.

Defense & National Security Contracts as Core Growth Catalysts

A major contributor to second-quarter performance is expected to be the company’s growing traction in the U.S. defense and intelligence sector. The most prominent highlight is BigBear.ai’s new contract to deliver and maintain the Department of Defense Joint Staff J35's Orion Decision Support Platform. This win not only validates BigBear.ai’s AI-driven decision-making capabilities but also establishes a long-term foothold at the highest levels of defense infrastructure. CEO Kevin McAleenan emphasized that such mission-critical contracts are central to the company's dual mandate of deepening its presence in core markets while expanding into adjacencies. The execution and revenue recognition from this contract could meaningfully contribute to the second-quarter results.

Border and Travel Security Expansion Strengthens Domestic AI Presence

Another second-quarter growth lever is BigBear.ai’s expansion in AI-driven solutions for border and travel security. The company successfully deployed advanced AI capabilities at major U.S. airports including Dallas Fort Worth, Denver International, Los Angeles International, and the Port of Seattle. With government emphasis on efficiency and modernization in public services, such deployments may continue to scale in the second quarter, contributing both to revenue and backlog conversion. The company appears well-aligned with shifting federal procurement priorities that increasingly favor commercially viable, advanced tech solutions.

Growing Role in Manufacturing and Shipbuilding Modernization

BigBear.ai also highlighted deepening relationships with U.S. industrial leaders, especially Austal USA in the shipbuilding sector. The application of BigBear.ai’s ConductorOS and Shipyard.ai products aims to modernize and digitize key elements of manufacturing, improving supply chain visibility and operational agility. These engagements are expected to drive incremental growth in the second quarter as deployment activity increases. Additionally, the company noted its strategic intent to adapt commercial solutions for federal applications and vice versa—a model that could yield faster sales cycles and repeat business across both sectors.

International Expansion and Strategic Partnerships Open New Channels

The company is beginning to realize the benefits of increased focus on international opportunities. In the first quarter, BigBear.ai partnered with Smith Detection to integrate its AI-powered threat detection with advanced scanning hardware, opening access to global markets through new distribution channels. These international pilots and collaborations are now moving toward monetization. The second quarter could reflect the early revenue impact from such exports, especially as the company aims to support allied nations with American-developed AI under a mission-aligned commercialization strategy.

Innovation-Driven Differentiation and Technology Maturation

BigBear.ai’s continued investment in R&D, despite near-term EBITDA losses, signals its commitment to long-term product differentiation. The company has transitioned several projects into general availability, which means more products are now commercially viable and ready for deployment. These include technologies such as veriScan, Trueface, Pangiam Threat Detection, and Pro Model AI, which are being used across security, identity verification, and supply chain domains. The commercial readiness of these tools positions the company to benefit in the second quarter from earlier R&D efforts, especially as demand for applied AI solutions accelerates in both government and industry.

Margins Discussion

Although BigBear.ai’s gross margin in the first quarter was impacted by stock-based compensation and government contract timing, adjusted gross margins are expected to improve in the second quarter as high-margin AI products scale and recent R&D investments begin to monetize. However, elevated SG&A due to lumpy government funding could remain a near-term drag. The company’s adjusted EBITDA may still reflect modest losses, but narrowing from the first quarter as backlog conversion and efficiency gains kick in.

Our proven model does not conclusively predict an earnings beat for BigBear.ai for the quarter to be reported. That is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy), or 3 (Hold) for this to happen. This is not the case here, as you will see below.

Earnings ESP: BBAI has an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: The company currently carries a Zacks Rank #3.

You can see the complete list of today’s Zacks #1 Rank stocks here.

BigBear.ai stock has gained 130.2% over the April-June 2025 period, outperforming the Zacks Computers - IT Services industry and the Zacks Computer & Technology sector, reflecting rising investor enthusiasm around defense-AI convergence.

BBAI stock is now trading at a 35.1% discount to its 52-week high of $10.36 and a premium of 469.5% to its 52-week low of $1.1650.

BBAI’s April-June Share Price Performance

In terms of the forward 12-month price/sales (P/S), BBAI shares are currently trading at a discount to its industry.

BBAI’s P/S Ratio (Forward 12-Month) vs. Industry

BigBear.ai competes in a crowded AI field, with rivals like Palantir Technologies PLTR and C3.ai AI commanding strong brand recognition and scale. Palantir is deeply embedded in the defense and intelligence sectors with its Gotham and Foundry platforms. However, BigBear.ai carves a distinct niche by focusing on real-time, tactical AI for mission-critical environments—highlighted by its Orion platform for the DoD and AI-powered border security initiatives.

Unlike Palantir’s broader data platforms, BBAI emphasizes operational AI at the edge, offering agile, specialized solutions. Meanwhile, C3.ai concentrates on large-scale enterprise deployments in energy, manufacturing, and finance. Though C3.ai is expanding into defense, BigBear.ai maintains a stronger national security presence, reinforced by its Pangiam legacy and deep subject-matter expertise.

Overall, BBAI’s edge lies in its domain-specific, mission-driven approach—positioning it well to deliver tailored AI solutions in both government and commercial sectors heading into the second quarter of 2025.

Despite revenue softness in prior quarters, the company is entering the earnings season on stronger footing, driven by new defense contracts like the Orion platform, expanding AI deployments in border security, and deepening ties with industrial and shipbuilding clients. Strategic international partnerships and the maturation of R&D projects into revenue-generating AI solutions suggest a potential turning point in top-line growth and margin trajectory.

The company’s reaffirmed full-year guidance, 30% backlog growth, and a solid liquidity position bolster management's confidence in a second-half acceleration. Meanwhile, BBAI’s differentiated tactical AI focus continues to set it apart from larger rivals like Palantir and C3.ai.

Given its current Zacks Rank, valuation discount to peers, and rising defense-AI momentum, holding BBAI stock now appears a prudent strategy as second-quarter earnings could catalyze further upside.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-21 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite