|

|

|

|

|||||

|

|

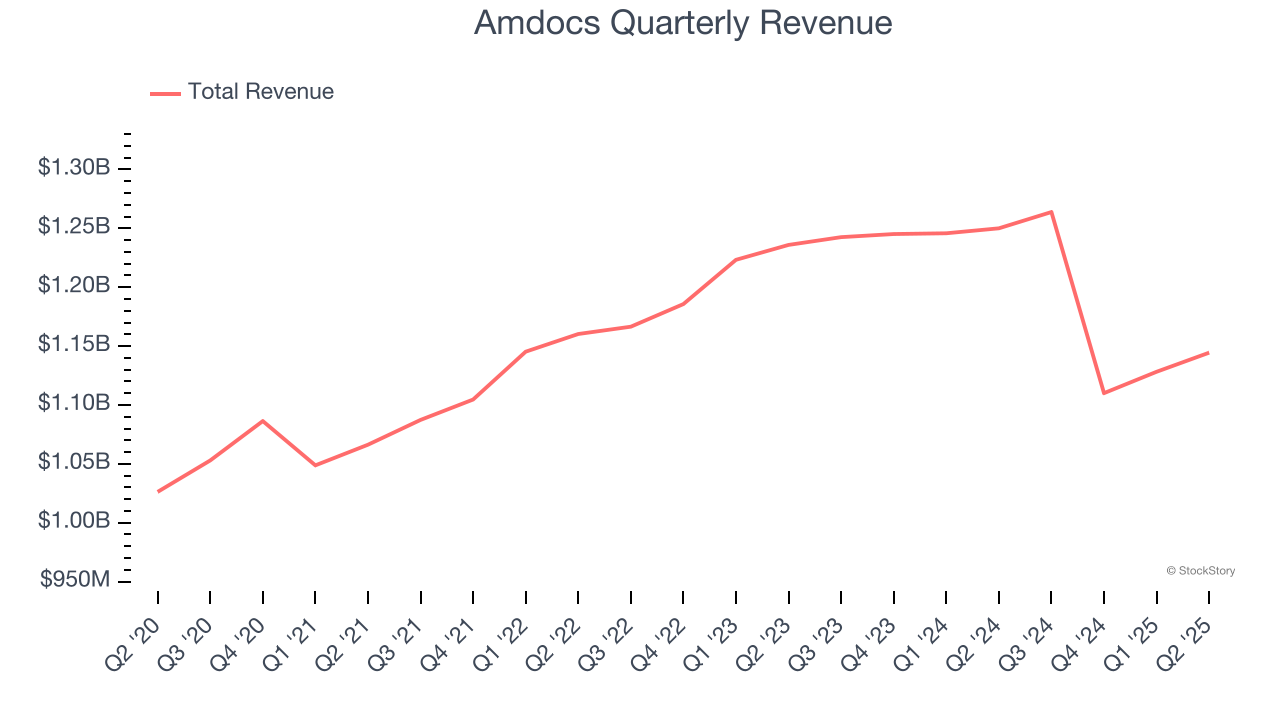

Telecom software provider Amdocs (NASDAQ:DOX) announced better-than-expected revenue in Q2 CY2025, but sales fell by 8.4% year on year to $1.14 billion. The company expects next quarter’s revenue to be around $1.15 billion, close to analysts’ estimates. Its non-GAAP profit of $1.72 per share was 0.6% above analysts’ consensus estimates.

Is now the time to buy Amdocs? Find out by accessing our full research report, it’s free.

"Amdocs achieved solid financial results and important business milestones in Q3 as we continued to support the strategic business imperatives of our customers with our innovative cloud, digital and AI-based solutions. Revenue of $1.14 billion exceeded the midpoint of our guidance, led by sequential growth in all regions and a record quarter in Europe where we continue to strengthen our customer partnerships. In the UK, BT has recently awarded Amdocs a digital transformation project, starting date to be finalized, that will enhance their consumer customer experience as part of a multi-year managed services engagement. Amdocs has also been selected by Elisa in Finland for a digital B2B modernization on Google Cloud. Additionally, we are encouraged to have won several strategic GenAI-related deals, providing Amdocs with a foundation on which to showcase our value and to gradually scale in this emerging domain. These deals include a leading service provider in the US which has signed an expanded multi-year agreement to transform its billing, commerce, and order management through GenAI powered solutions," said Shuky Sheffer, president and chief executive officer of Amdocs Management Limited.

Powering the digital experiences of approximately 400 communications companies worldwide, Amdocs (NASDAQ:DOX) provides software and services that help telecommunications and media companies manage customer relationships, monetize services, and automate network operations.

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $4.65 billion in revenue over the past 12 months, Amdocs is one of the larger companies in the business services industry and benefits from a well-known brand that influences purchasing decisions. However, its scale is a double-edged sword because it’s challenging to maintain high growth rates when you’ve already captured a large portion of the addressable market. To expand meaningfully, Amdocs likely needs to tweak its prices, innovate with new offerings, or enter new markets.

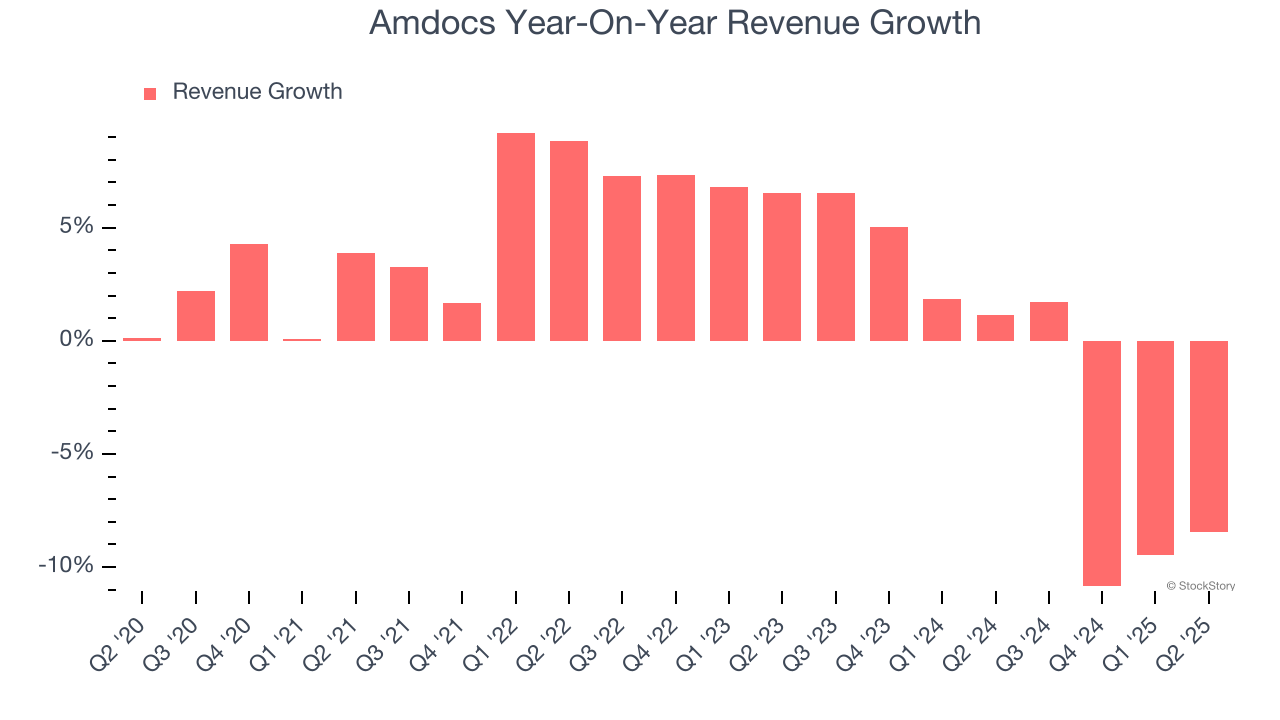

As you can see below, Amdocs’s sales grew at a sluggish 2.3% compounded annual growth rate over the last five years. This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. Amdocs’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 1.7% annually.

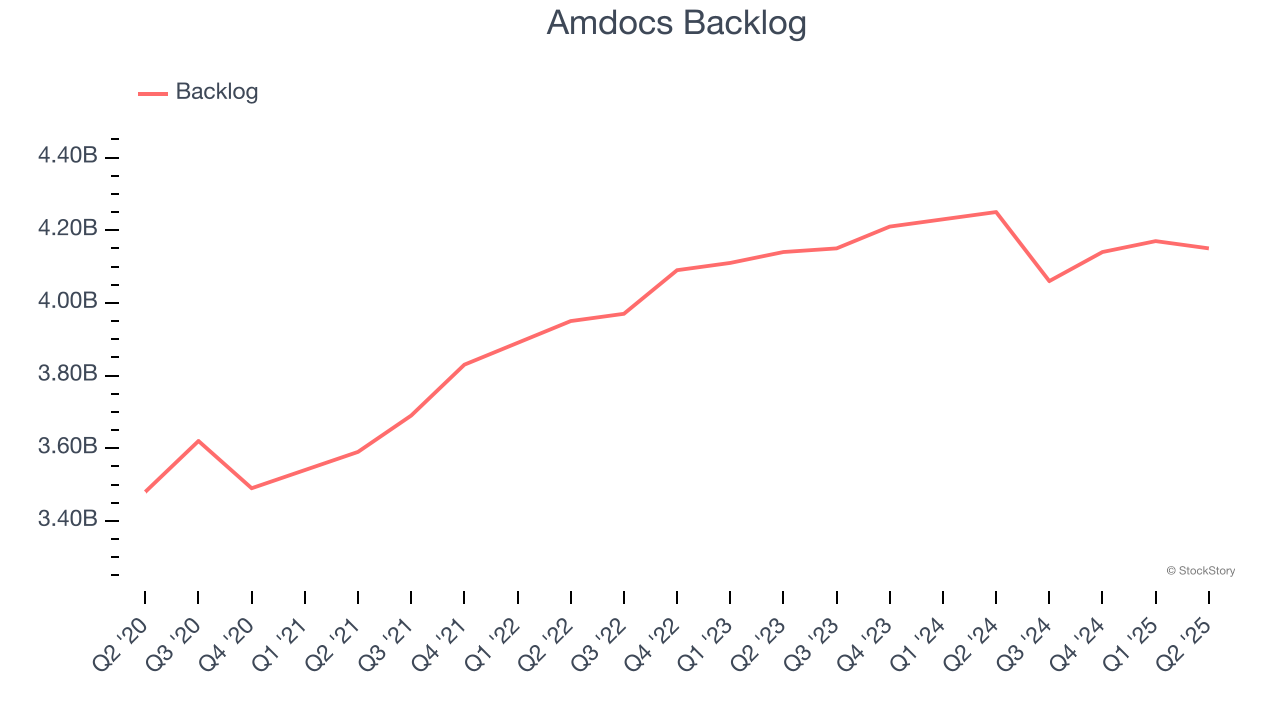

We can better understand the company’s revenue dynamics by analyzing its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Amdocs’s backlog reached $4.15 billion in the latest quarter and was flat over the last two years. Because this number is better than its revenue growth, we can see the company accumulated more orders than it could fulfill and deferred revenue to the future. This could imply elevated demand for Amdocs’s products and services but raises concerns about capacity constraints.

This quarter, Amdocs’s revenue fell by 8.4% year on year to $1.14 billion but beat Wall Street’s estimates by 0.8%. Company management is currently guiding for a 9.4% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to remain flat over the next 12 months. While this projection suggests its newer products and services will catalyze better top-line performance, it is still below average for the sector.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

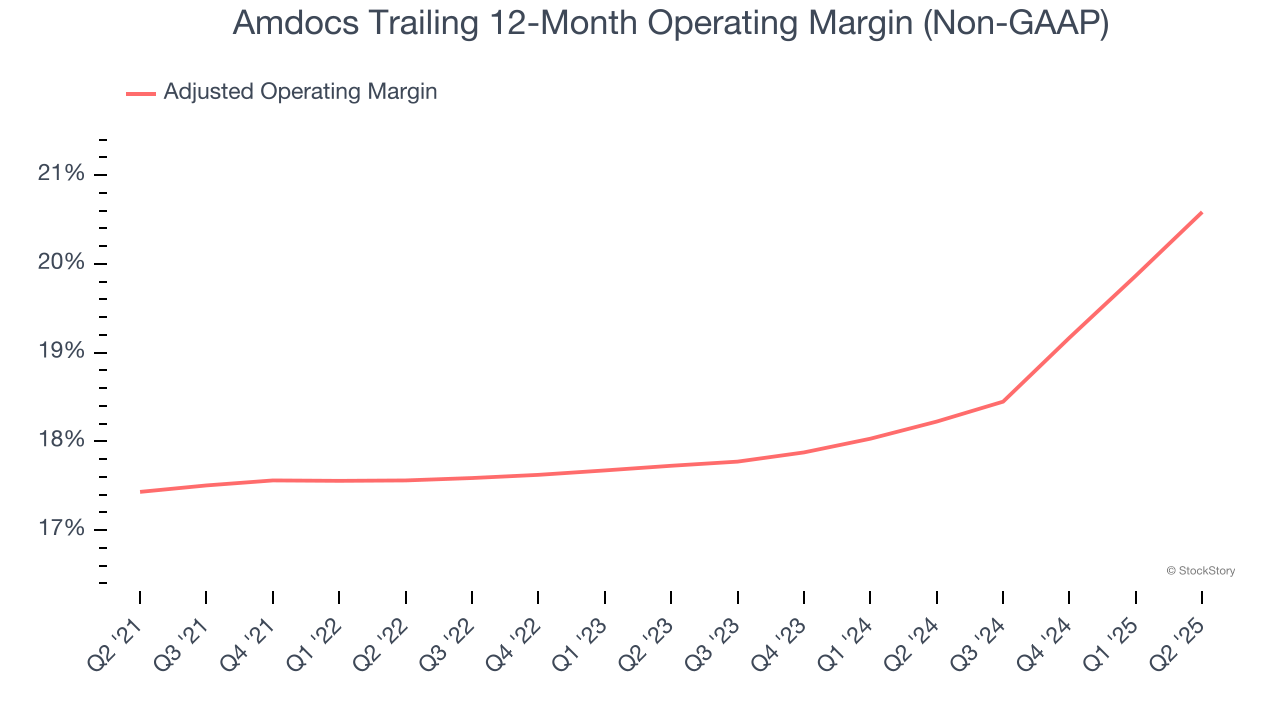

Amdocs has been a well-oiled machine over the last five years. It demonstrated elite profitability for a business services business, boasting an average adjusted operating margin of 18.3%.

Analyzing the trend in its profitability, Amdocs’s adjusted operating margin rose by 3.2 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q2, Amdocs generated an adjusted operating margin profit margin of 21.4%, up 2.8 percentage points year on year. This increase was a welcome development, especially since its revenue fell, showing it was more efficient because it scaled down its expenses.

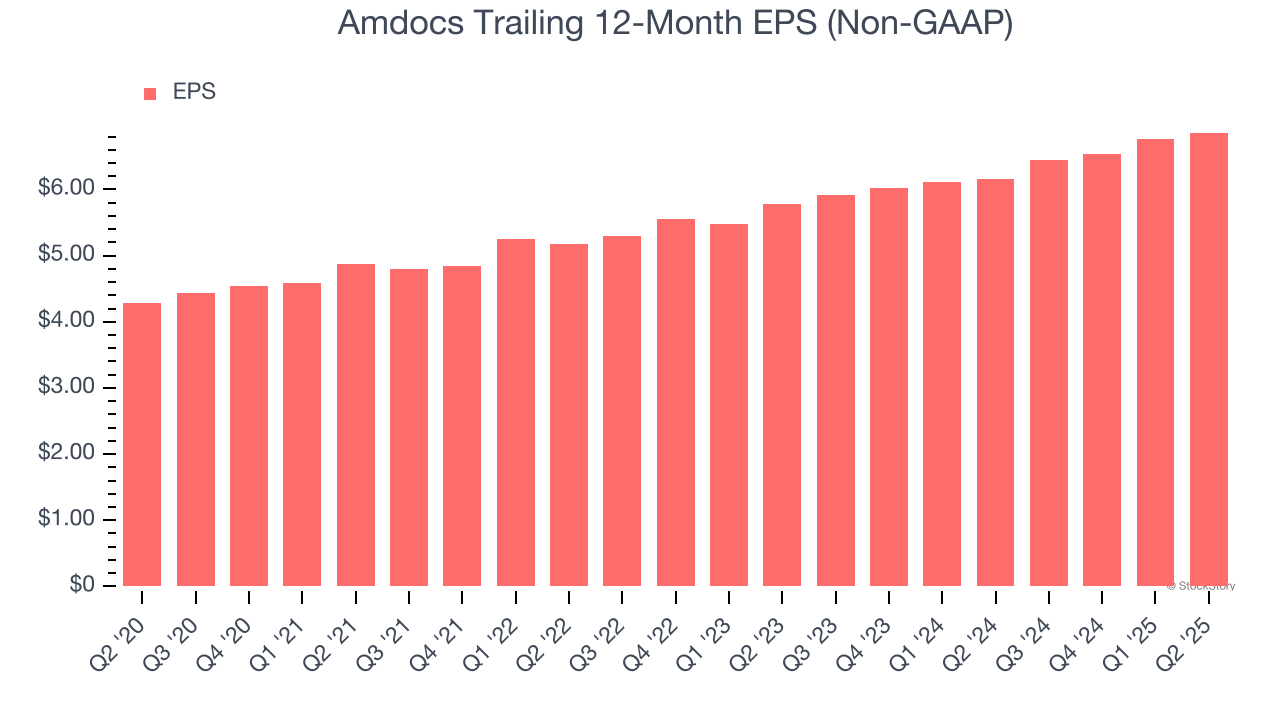

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Amdocs’s EPS grew at a solid 9.8% compounded annual growth rate over the last five years, higher than its 2.3% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

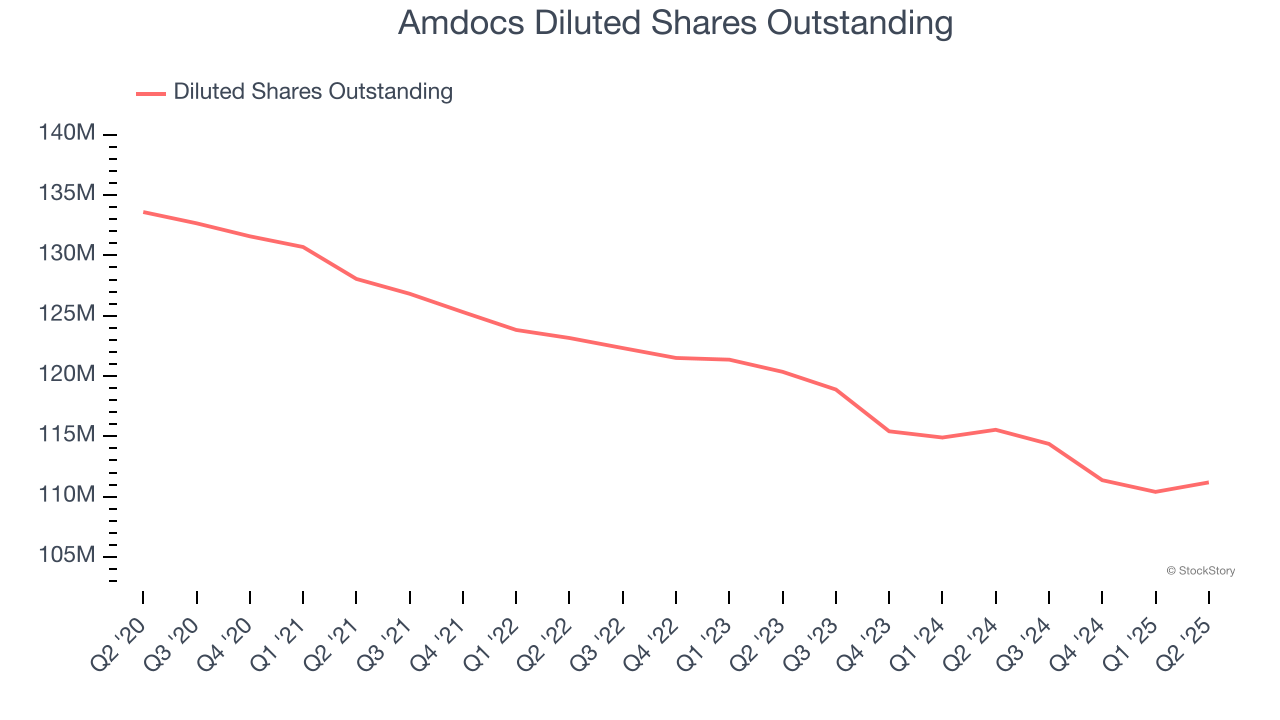

We can take a deeper look into Amdocs’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, Amdocs’s adjusted operating margin expanded by 3.2 percentage points over the last five years. On top of that, its share count shrank by 16.8%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Amdocs, its two-year annual EPS growth of 8.9% is similar to its five-year trend, implying stable earnings.

In Q2, Amdocs reported adjusted EPS at $1.72, up from $1.62 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Amdocs’s full-year EPS of $6.86 to grow 8.8%.

We were impressed by how significantly Amdocs blew past analysts’ full-year EPS guidance expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. Overall, this print had some key positives. The stock traded up 4.5% to $88.42 immediately after reporting.

Should you buy the stock or not? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.

| Mar-05 | |

| Mar-03 | |

| Mar-03 | |

| Mar-02 | |

| Mar-02 | |

| Mar-02 | |

| Mar-02 | |

| Mar-02 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 | |

| Feb-23 | |

| Feb-22 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite