|

|

|

|

|||||

|

|

Solar tracking systems manufacturer Array (NASDAQ:ARRY) reported revenue ahead of Wall Street’s expectations in Q2 CY2025, with sales up 41.6% year on year to $362.2 million. The company’s full-year revenue guidance of $1.2 billion at the midpoint came in 6.1% above analysts’ estimates. Its non-GAAP profit of $0.25 per share was 27.9% above analysts’ consensus estimates.

Is now the time to buy Array? Find out by accessing our full research report, it’s free.

“ARRAY remains focused on commercial execution—delivering 20% sequential revenue growth, with continued new booking momentum and actions taken to produce an improved quality, higher-margin orderbook. Over the last quarter, we also announced several transformative business updates through our definitive agreement to acquire APA Solar and the launch of Hail XP™. Additionally, we successfully issued new convertible notes, repaid our higher-cost term loan in full, and unlocked balance sheet constraints. With these updates, we significantly enhance our customer-focused product offerings, improve our capital structure and debt maturity profile, and better position ARRAY for long-term growth,” said Chief Executive Officer, Kevin G. Hostetler.

Going public in October 2020, Array (NASDAQ:ARRY) is a global manufacturer of ground-mounting tracking systems for utility and distributed generation solar energy projects.

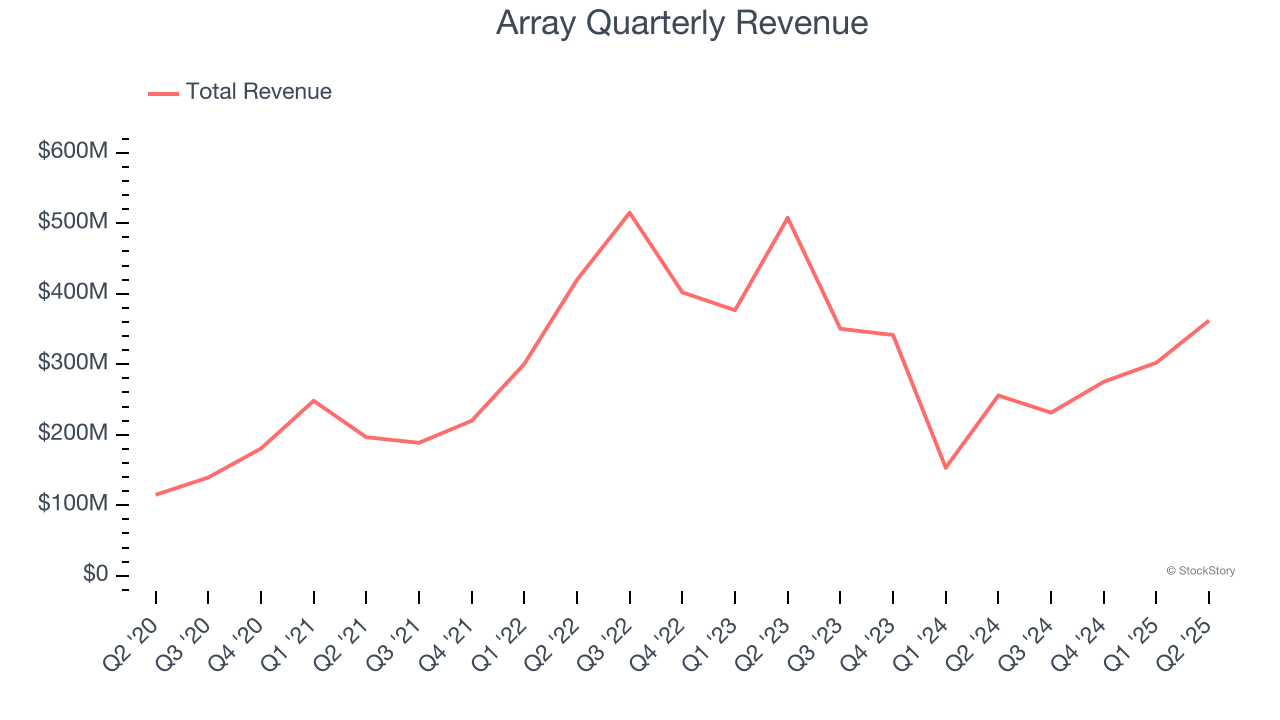

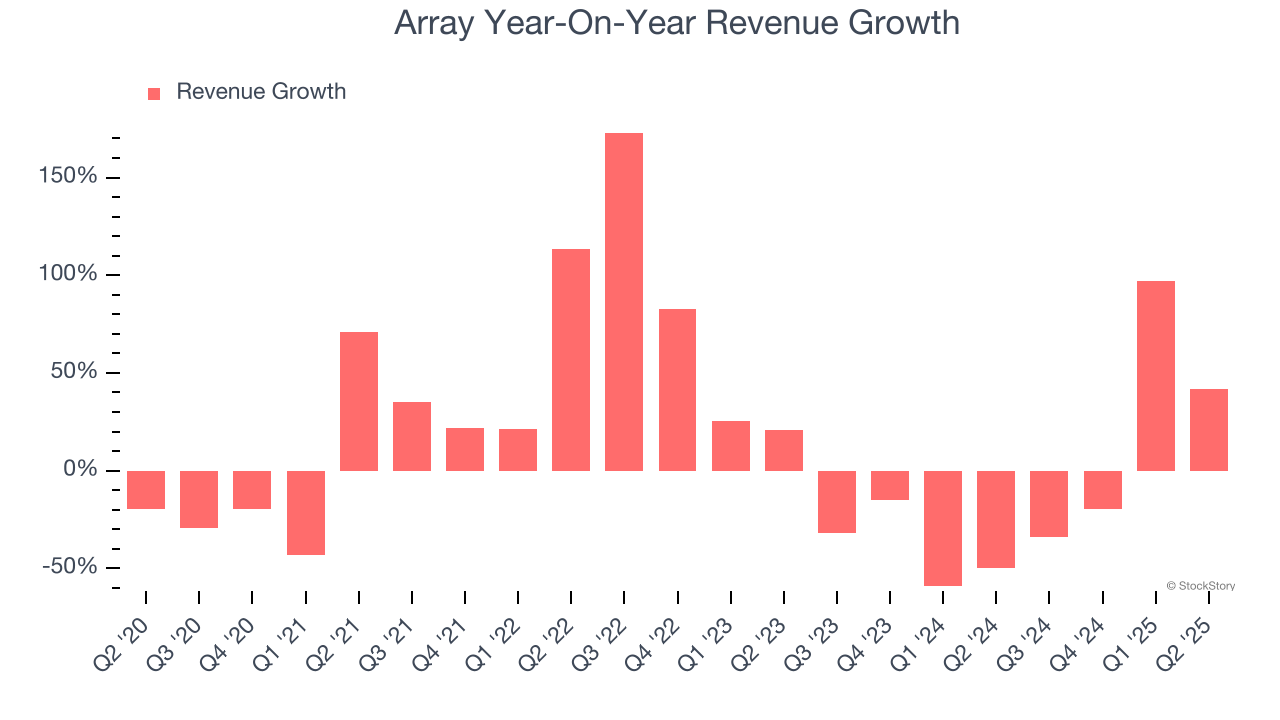

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Array grew its sales at a sluggish 3.7% compounded annual growth rate. This fell short of our benchmark for the industrials sector and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Array’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 19.4% annually. Array isn’t alone in its struggles as the Renewable Energy industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

This quarter, Array reported magnificent year-on-year revenue growth of 41.6%, and its $362.2 million of revenue beat Wall Street’s estimates by 24.3%.

Looking ahead, sell-side analysts expect revenue to grow 1.6% over the next 12 months. Although this projection indicates its newer products and services will fuel better top-line performance, it is still below average for the sector.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

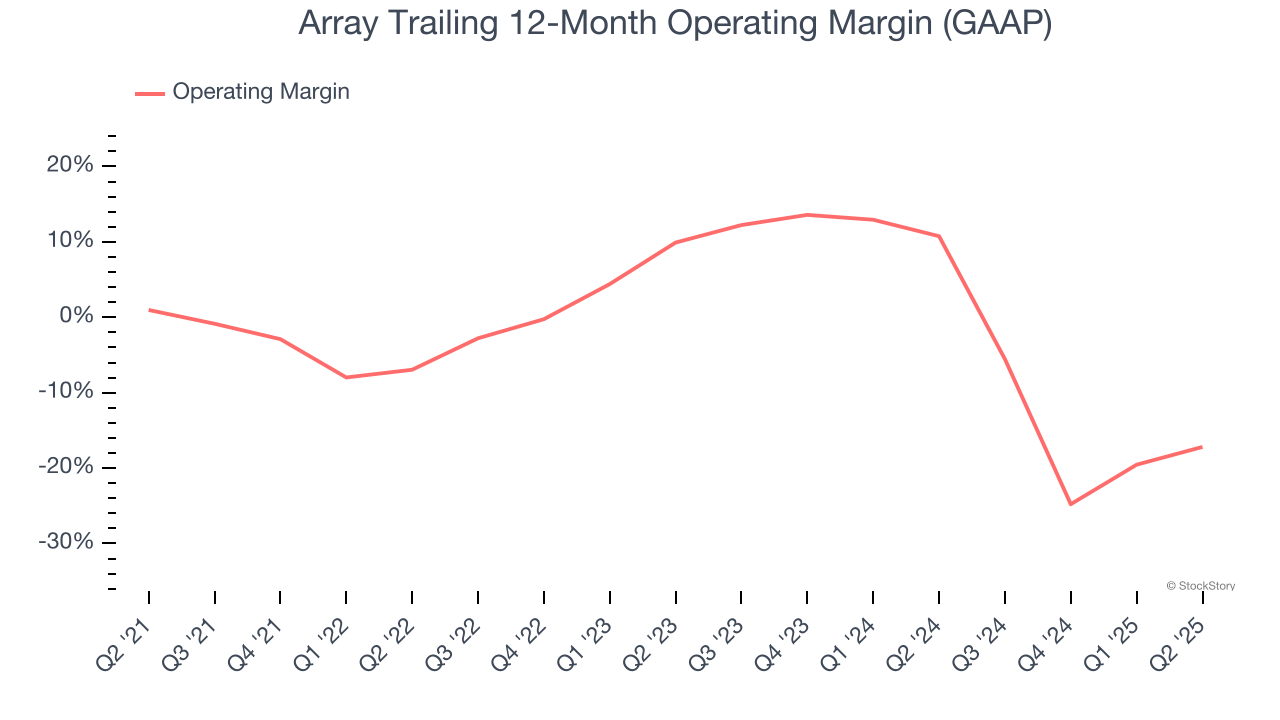

Array was roughly breakeven when averaging the last five years of quarterly operating profits, inadequate for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

Looking at the trend in its profitability, Array’s operating margin decreased by 18.2 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Array’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, Array generated an operating margin profit margin of 12.8%, down 2.7 percentage points year on year. Since Array’s gross margin decreased more than its operating margin, we can assume its recent inefficiencies were driven more by weaker leverage on its cost of sales rather than increased marketing, R&D, and administrative overhead expenses.

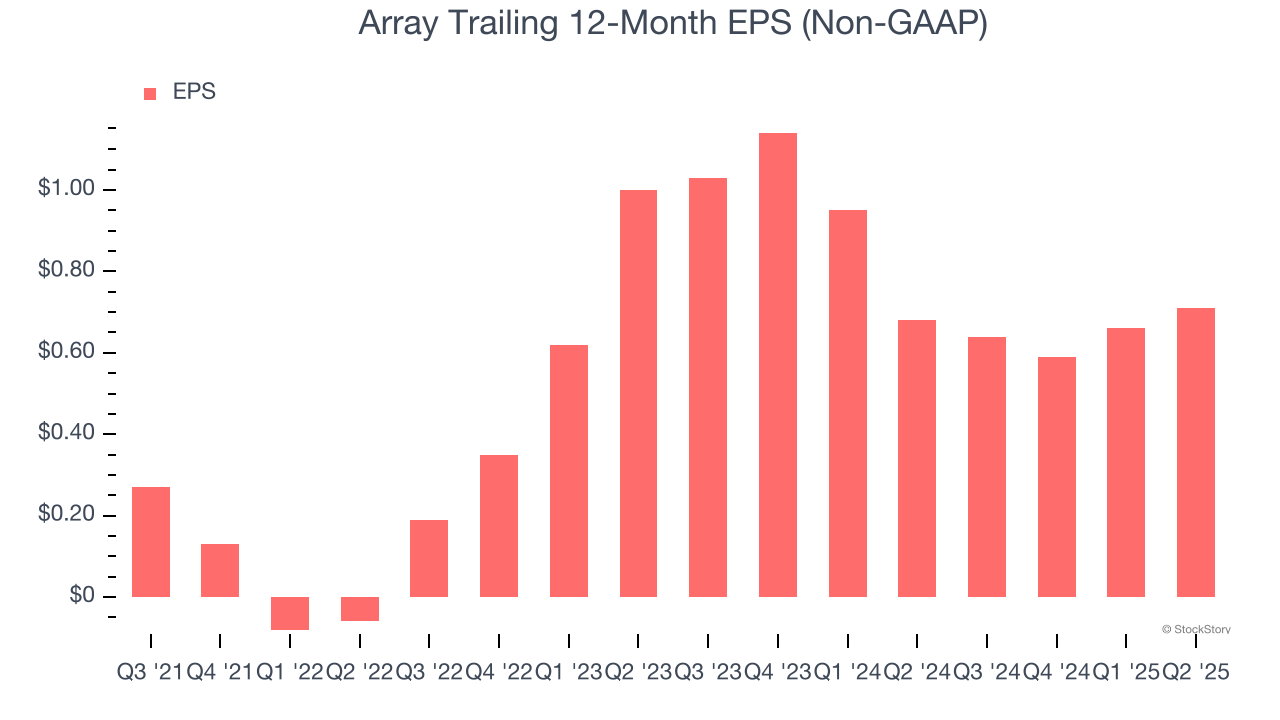

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Array’s full-year EPS grew at a remarkable 12.3% compounded annual growth rate over the last four years, better than the broader industrials sector.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Sadly for Array, its EPS and revenue declined by 15.7% and 19.4% annually over the last two years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Array’s low margin of safety could leave its stock price susceptible to large downswings.

In Q2, Array reported adjusted EPS at $0.25, up from $0.20 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Array’s full-year EPS of $0.71 to shrink by 2.2%.

We were impressed by how significantly Array blew past analysts’ EPS expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. On the other hand, its adjusted operating income missed and its EBITDA fell short of Wall Street’s estimates. Overall, this print was mixed but still had some key positives. The stock traded up 4.7% to $6.12 immediately after reporting.

Should you buy the stock or not? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.

| Mar-06 | |

| Mar-06 | |

| Feb-28 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-20 | |

| Feb-20 |

Nvidia Stock, After Big Meta Chip News, Sets Up Ahead Of Quarterly Earnings Report

ARRY

Investor's Business Daily

|

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite