|

|

|

|

|||||

|

|

Energy Transfer set several volume records in the second quarter.

The MLP's earnings growth slowed due to fewer growth catalysts and commodity price headwinds.

It has several growth catalysts ahead in 2026 and beyond.

Energy Transfer (NYSE: ET) recently reported its second-quarter financial and operational results. The company's energy midstream operations were firing on all cylinders during the period, as evidenced by the numerous volume records it set. While its earnings growth rate slowed in the quarter, a re-acceleration awaits.

Here's a closer look at the master limited partnership's (MLP) second-quarter results and outlook for what's ahead.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

Energy Transfer generated nearly $3.9 billion of adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) during the second quarter. That was about 3% higher than the year-ago period. Meanwhile, its distributable cash flow (DCF) dipped 4% to nearly $2 billion. While the company's growth rates have slowed from last year, when its adjusted EBITDA rose 13% and its DCF increased by 10% to new partnership records (fueled by several acquisitions), a re-acceleration is right around the corner.

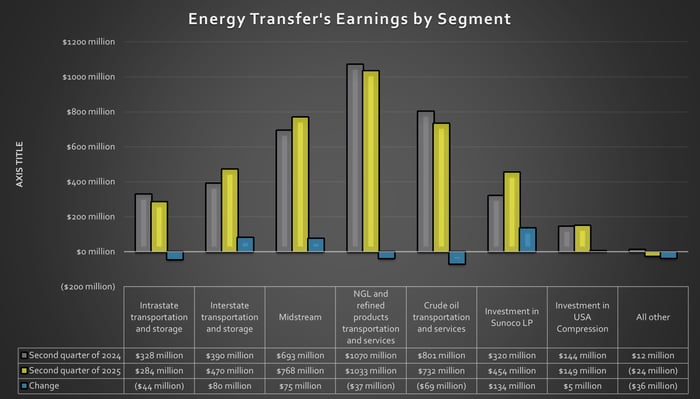

Here's a snapshot of its earnings by segment:

Data source: Energy Transfer. Chart by the author.

As the chart shows, Energy Transfer got boosts from its interstate transportation and storage and midstream segments. It also benefited from its investment in Sunoco LP, which contributed substantial additional income in the period following its acquisition of NuStar. This helped offset lower earnings in its crude oil, NGL (natural gas liquids), and intrastate segments due to the impact of lower commodity prices and higher expenses.

While those headwinds caused the MLP's earnings growth rates to slow in the second quarter, its volumes continued to rise. It set new partnership records in the following categories during the period:

The midstream company benefited from healthy market conditions and the residual impact of recent expansion initiatives, including last year's acquisition of WTG Midstream.

Continued commodity price headwinds will likely mute Energy Transfer's earnings growth rate through the second half of the year. The MLP currently expects its adjusted EBITDA to be at or slightly below the lower end of its 2025 guidance range of $16.1 billion-$16.5 billion. That implies about 4% growth from last year's level.

However, it has a lot of momentum heading into 2026 and beyond. Energy Transfer recently placed its Lenorah II and Badger processing plants into service. It has also placed its Nederland Flexport NGL Export Expansion project into ethane and propane services, with ethylene service expected in the fourth quarter. These projects will supply it with incremental earnings in the coming quarters. The company should also get a boost from Sunoco's pending acquisition of Parkland, which should close later this year.

Meanwhile, there are more expansion projects on the way next year. The company expects to put its Mustang Draw gas processing plant into service in the second quarter and finish Phase I of its major Hugh Brinson gas pipeline and Frac IX by the end of the year. These projects will give it a lot of earnings growth momentum throughout 2026 and into 2027.

Additionally, Energy Transfer has secured several new expansion projects that enhance and extend its growth outlook through the end of the decade. It recently approved Hugh Brinson Phase II (constructed concurrently with Phase I), the Delaware Basin NGL Pipe Looping project (first half of 2027), the Bethel Storage Expansion (late 2028), and the $5.3 billion Transwestern Pipeline (fourth quarter 2029). These projects will provide it with incremental sources of growing cash flow into the next decade.

The midstream giant has several more proposed expansion projects under development, including the long-delayed Lake Charles LNG export terminal and the CloudBurst AI data center gas supply project. Securing these and other expansions would further enhance and extend the company's long-term growth outlook.

In addition to its organic growth, Energy Transfer has ample financial flexibility to continue making strategic acquisitions as opportunities arise. Future deals would help further bolster its already strong growth profile.

Energy Transfer delivered solid second-quarter results as growing volumes helped mute the impact of lower commodity prices. While that headwind will likely slow its growth this year, a major wave of expansion projects should reinvigorate the company in 2026 and beyond. That growth should give it plenty of fuel to continue increasing its 7.5%-yielding distribution. It makes the MLP an enticing investment opportunity for those seeking income and growth, and who are comfortable receiving the Schedule K-1 Federal Tax Form it sends each year and doing what's needed with that.

Before you buy stock in Energy Transfer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Energy Transfer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $636,563!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,108,033!*

Now, it’s worth noting Stock Advisor’s total average return is 1,047% — a market-crushing outperformance compared to 181% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of August 4, 2025

Matt DiLallo has positions in Energy Transfer. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

| Feb-10 | |

| Feb-06 | |

| Feb-06 | |

| Feb-04 | |

| Feb-03 | |

| Feb-03 | |

| Feb-03 | |

| Feb-03 | |

| Feb-03 | |

| Feb-02 | |

| Feb-02 | |

| Feb-02 | |

| Feb-02 | |

| Feb-02 | |

| Feb-02 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite