|

|

|

|

|||||

|

|

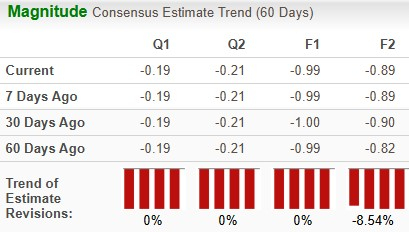

AST SpaceMobile ASTS is scheduled to report second-quarter 2025 earnings on Aug 11, 2025, after market closes. The Zacks Consensus Estimate for revenues and earnings is pegged at $5.15 million and a loss of 19 cents per share, respectively. Over the past 60 days, the earnings estimate for ASTS for fiscal 2025 has remained unchanged, and for fiscal 2026, it has declined by 8.54%.

The company delivered a negative four-quarter earnings surprise of 2.59%, on average. In the last reported quarter, the company delivered a negative earnings surprise of 17.65%.

Our proven model does not conclusively predict an earnings beat for ASTS this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy), or 3 (Hold) increases the chances of an earnings beat. This is not the case here. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

ASTS currently has an ESP of +26.32% with a Zacks Rank #4 (Sell). You can see the complete list of today’s Zacks #1 Rank stocks here.

During the quarter, ASTS formed a strategic collaboration with Vodafone Idea (Vi), a prominent network service provider in India, to bring satellite-based mobile connectivity directly to smartphones across the country.

Under this partnership, AST SpaceMobile is set to deploy and manage the satellite constellation, while Vi will manage the ground network infrastructure. Once operational, this will open up new possibilities in the domain of emergency response, disaster management, agriculture, remote learning, remote work and several other applications. The company also collaborated with Fairwinds Technologies to evaluate the applicability of space-based mobile broadband in defense applications.

In the quarter under review, the company has retired $225 million aggregate principal amount of the 2032 convertible notes to reduce its debt burden and cash interest obligations. This represents approximately half of the 2032 convertible notes, with an aggregate principal amount of about $235 million remaining outstanding. This has enabled ASTS to free up cash for research and development activities to propel long-term growth.

However, the company operates in a highly competitive mobile satellite services market. The company is facing stiff competition from other major players such as SpaceX’s Starlink and Globalstar. Hence, to maintain its competitive edge, ASTS has to continuously innovate its services, which increases operating expenses and lowers margins. Moreover, the company relies on third-party launch providers. Any failure, delay, or underperformance by these providers could disrupt the timely deployment of its satellites, potentially disrupting its operations.

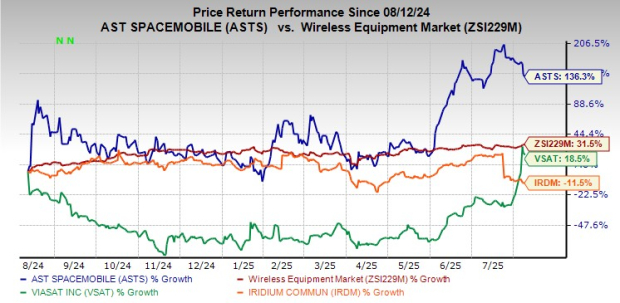

Over the past year, ASTS has gained 136.3% compared to the industry’s growth of 31.5%. However, it has outperformed peers like Viasat Inc. VSAT and Iridium Communications, Inc. IRDM over this period. Viasat has increased 18.5%, while Iridium has declined 11.5% during this period.

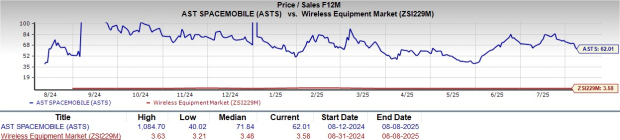

From a valuation standpoint, ASTS is currently trading at a premium compared to the industry. Going by the price/sales ratio, the company’s shares currently trade at 62.01 forward sales, higher than 3.58 for the industry.

AST SpaceMobile is planning to deploy around 60 satellites in the coming two years. The company is still operating in the pre-commercial phase without any consistent source of revenue. The deployment of its full constellation requires significant capital spending, and with limited operational history, any major investment in the company is a high-risk bet. Regulatory policy changes in countries where ASTS operates can also impact its business.

Moreover, the company is affected by unfavorable macroeconomic conditions. Rising inflation, higher interest rates, and volatility in the capital markets negatively impact its operations. The company is also affected by rising satellite costs owing to higher tariffs. Fluctuation in satellite material prices owing to such factors raises uncertainty related to AST SpaceMobile’s growth prospects in the near term.

In addition, Viasat is steadily ramping up its investment in the broadband communication platform to launch reliable direct-to-device satellite services. The company is forming a collaboration with major telecom operators worldwide to demonstrate the applicability of its service offerings. Iridium has also accelerated its effort to develop direct-to-device services. These factors could pose a major challenge to ASTS’s growth initiative in the future.

A comprehensive patent portfolio, collaboration with major telecom operators such as Verizon, AT&T and Vodafone may give ASTS an edge in the long run. But with growing geopolitical volatility, tariff uncertainty and other macroeconomic challenges, ASTS’ growth prospects look muted in the near term.

Its premium valuation remains a concern. Downward estimate revision underscores bearish sentiment over the stock’s growth potential. Hence, investors will be better off if they avoid investing in this stock currently.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 4 hours | |

| 8 hours | |

| 8 hours | |

| 8 hours | |

| 10 hours | |

| 11 hours | |

| 12 hours | |

| Feb-22 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite