|

|

|

|

|||||

|

|

UBS Group AG UBS shares touched a new 52-week high of $39.71 during last Friday's trading session. However, the stock closed the session a little lower at $39.54.

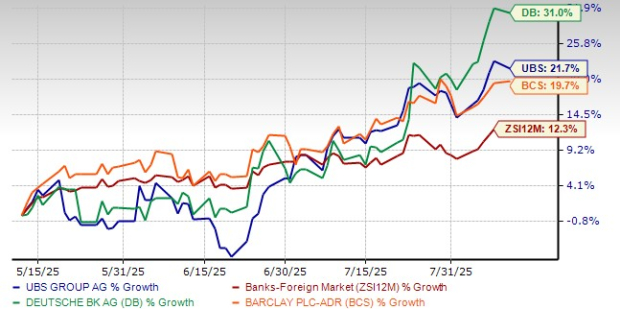

Over the past three months, UBS shares have gained 21.7% outperforming the industry’s 12.3%. Further, while it fared better than its close peer, Barclays PLC BCS, it underperformed Deutsche Bank AG DB.

The recent rally partly reflects investor attention on UBS’s robust second-quarter 2025 performance. The net profit attributable to shareholders surged to $2.39 billion from $1.14 billion a year earlier, driven by gains in Global Wealth Management, Asset Management, and Investment Bank units. Further, its revenues increased 1.7% year over year to $12.11 billion.

Additionally, UBS’s operating expenses fell 5.6% to $9.75 billion in comparison to the previous-year quarter. As a result, the company was able to achieve 70% of its targeted $13 billion in gross cost savings from the Credit Suisse merger. This highlights strong progress on integration goals.

Strategic Expansion and Partnerships: UBS Group has expanded its global presence and improved its operations through strategic partnerships and acquisitions. In April 2025, UBS partnered with 360 ONE WAM Ltd, India's leading wealth and asset manager. Per the transaction, the company purchased warrants to acquire a 4.95% share and sell its Indian wealth business to 360 ONE, while continuing to serve Singapore clients from UBS Singapore.

In June 2023, UBS completed the acquisition of Credit Suisse through a regulatory-assisted deal, which is expected to enhance its wealth and asset management capabilities and strengthen its capital-light businesses. Following this, UBS Switzerland AG assumed all rights and obligations of Credit Suisse (Schweiz) AG. In May 2024, UBS AG merged with Credit Suisse AG, integrating clients and operations based on business needs. By July 2024, UBS merged UBS Switzerland AG with Credit Suisse (Schweiz) AG and integrated 95 branches in Switzerland by early 2025.

The company plans to migrate more Swiss clients to its system in the upcoming quarter. In the fourth quarter of 2024, UBS transferred Global Wealth Management client accounts from Luxembourg, Hong Kong, Singapore, and Japan to its platforms, moving more than 90% of accounts outside Switzerland. The main phase of Swiss client migrations is executed by the company during the second quarter of 2025 and aims to complete the Swiss booking center migrations by the end of the first quarter of 2026. These moves are expected to strengthen UBS’s presence in key markets and support long-term growth.

Credit Suisse Integration and Cost Synergies: UBS is successfully integrating Credit Suisse and is on track to achieve cost savings. The company plans to reduce its Non-Core and Legacy portfolio, aiming to free up over $6 billion in capital by the end of 2026. It has already cut risk-weighted assets in this division by 62%, surpassing initial goals.

UBS now targets reducing these assets to below $8 billion by the end of 2025 and around $1.6 billion by the end of 2026. The firm is well-positioned to improve client experiences and lower costs further by 2026, targeting $13 billion in gross cost savings. Since late 2022, UBS has saved $9.1 billion, achieving about 70% of its goal.

Solid Capital Position: UBS maintains a robust capital position, providing flexibility for strategic initiatives. As of June 30, 2025, its CET1 capital ratio stood at 14.4%, above management guidance of around 14%. The CET1 leverage ratio remained stable at 4.4%, also exceeding the target of more than 4%. UBS aims to achieve an underlying return on CET1 capital of approximately 15% by 2026-end and 18% by 2028-end. Thus, strong CET1 ratios and capital release plans underpin UBS’s ability to navigate macro uncertainty and pursue growth.

Solid Revenue Growth: UBS has delivered consistent top-line expansion, with overall revenues registering a three-year (2021–2024) CAGR of 11%. Within this, net interest income (NII) grew at a 4.9% CAGR and fee income at an 8% CAGR. This momentum carried into the first half of 2025, supported by robust performances across Wealth Management, Asset Management, and the Investment Bank. NII remained elevated, driven by repricing initiatives and improving loan demand, while fee income benefited from increased advisory and asset management activity. These dynamics reflect UBS’s balanced revenue mix and are expected to continue fueling growth in the coming quarters.

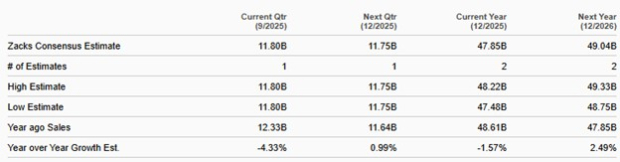

The consensus mark for UBS’s 2025 sales suggests a year-over-year decline of 1.57%, followed by a year-over-year growth of 2.49% in 2026.

Earnings Strength: Over the next three to five years, the company's earnings per share (EPS) are expected to witness a growth of 47.7% outperforming the industry’s growth of 11%. Additionally, UBS surpassed estimates in each of the trailing four quarters, with an average earnings surprise of 51.9%.

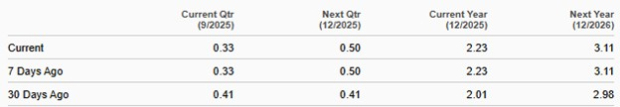

The consensus estimate for earnings indicates a 46.7% and 39.3% rise for 2025 and 2026, respectively. Over the past month, the Zacks Consensus Estimate for earnings for 2025 and 2026 has been revised upward.

Elevated Expenses: UBS’s rising expense base remains a key operational challenge. Operating expenses have registered 14.3% CAGR over the past four years, driven by integration costs and technology investments. Expenses declined in the first half of 2025, though continued investments in digital infrastructure and integration costs are expected to keep the expense base elevated in the near term, potentially hindering bottom-line growth.

Concerning Capital Distribution Activities: The company faces concerns over its capital distribution strategy. In April 2025, it raised its dividend by 26% to 90 cents per share and aims for further increases in 2026. In April 2024, the company announced a two-year plan to buy back up to $4 billion in common stock. It completed its planned repurchase of up to $1 billion in the first half of 2025, including $0.5 billion in the second quarter. In June 2025, it approved a new two-year repurchase program to buy back up to an additional $2 billion of shares in the second half of 2025. These efforts are contingent on maintaining a CET1 capital ratio of around 14% and achieving financial targets.

However, UBS’s uneven quarterly performance and elevated debt-to-equity ratio of 3.77, well above the industry average of 0.87, raise questions about the sustainability of its capital distributions. Meanwhile, the debt-to-equity ratios of Deutsche Bank and Barclays are 1.39 and 5.70, respectively.

In terms of valuation, UBS stock appears expensive relative to the industry. The company is currently trading at a 12-month trailing price-to-earnings P/E ratio of 14.3X, higher than the industry’s 10.17X. Meanwhile, Deutsche Bank holds a P/E ratio of 9.5X, while Barclays Plc’s P/E ratio stands at 7.8X.

UBS faces challenges such as rising expenses and concerns about the sustainability of its capital distribution amid uneven quarterly performance and a relatively high debt-to-equity ratio. The company’s valuation also appears stretched compared to industry peers, which may concern some investors.

However, UBS’s solid capital position, successful integration of Credit Suisse, and consistent growth in net interest income provide a strong foundation for future growth. Its strategic partnerships, ongoing digital transformation, and disciplined cost-saving efforts further enhance its competitive advantage. With stable earnings estimates and a clear path toward efficient gains, UBS is well positioned to deliver long-term shareholder value.

Currently, UBS sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-21 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite