|

|

|

|

|||||

|

|

Global media and entertainment company iHeartMedia (NASDAQ:IHRT) reported Q2 CY2025 results topping the market’s revenue expectations, but sales were flat year on year at $933.7 million. The company expects next quarter’s revenue to be around $982.9 million, close to analysts’ estimates. Its GAAP loss of $0.54 per share was 98.1% below analysts’ consensus estimates.

Is now the time to buy iHeartMedia? Find out by accessing our full research report, it’s free.

“Our second quarter performance was solid and slightly ahead of our initial expectations, with our Q2 adjusted EBITDA of $156 million at the upper end of our previously provided guidance range and 4% above prior year and our consolidated revenue for the quarter was above our guidance range, up 0.5% above prior year,” said Bob Pittman, Chairman and CEO of iHeartMedia.

Occasionally featuring celebrity hosts like Ryan Seacrest on its shows, iHeartMedia (NASDAQ:IHRT) is a leading multimedia company renowned for its extensive network of radio stations, digital platforms, and live events across the globe.

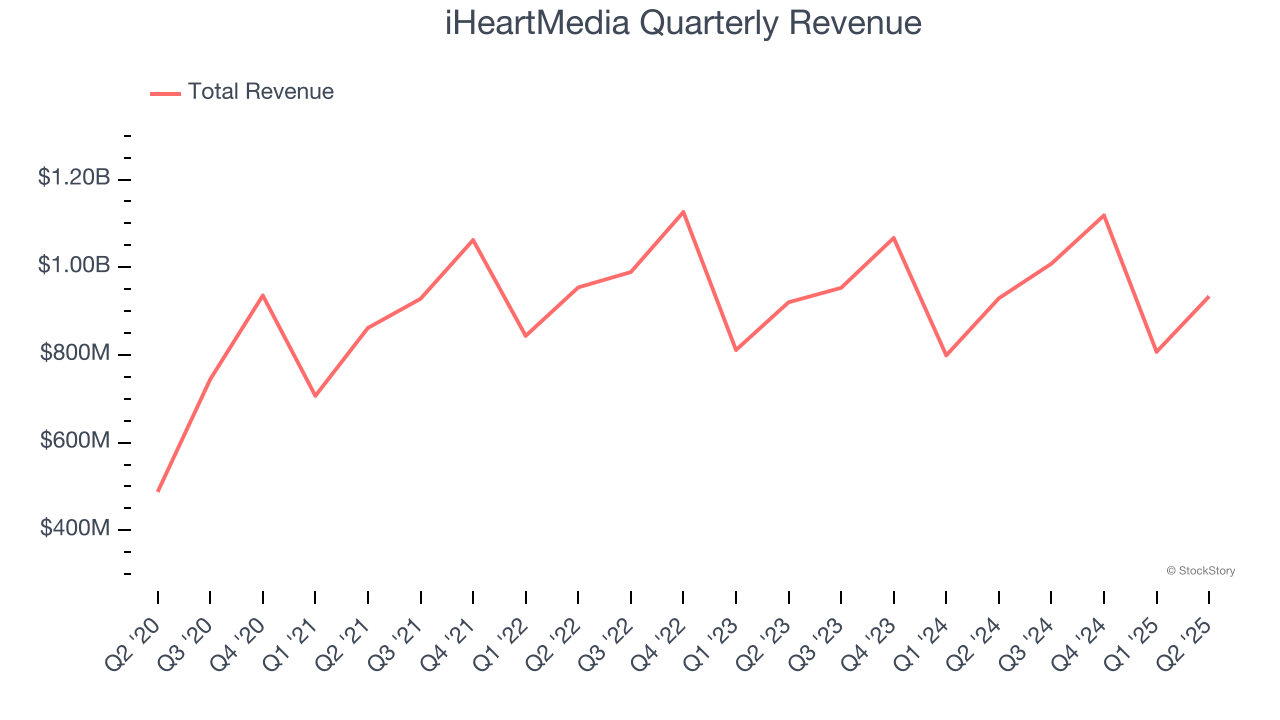

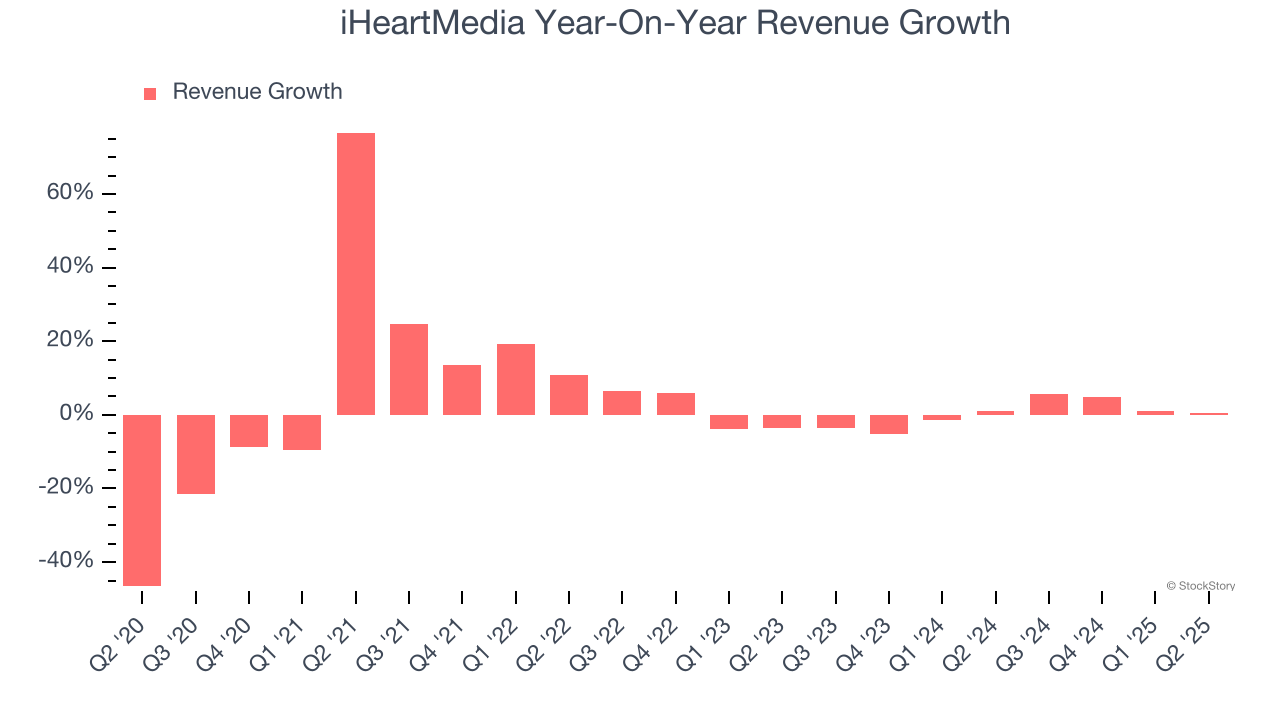

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, iHeartMedia grew its sales at a sluggish 3.6% compounded annual growth rate. This was below our standard for the consumer discretionary sector and is a rough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. iHeartMedia’s recent performance shows its demand has slowed as its revenue was flat over the last two years.

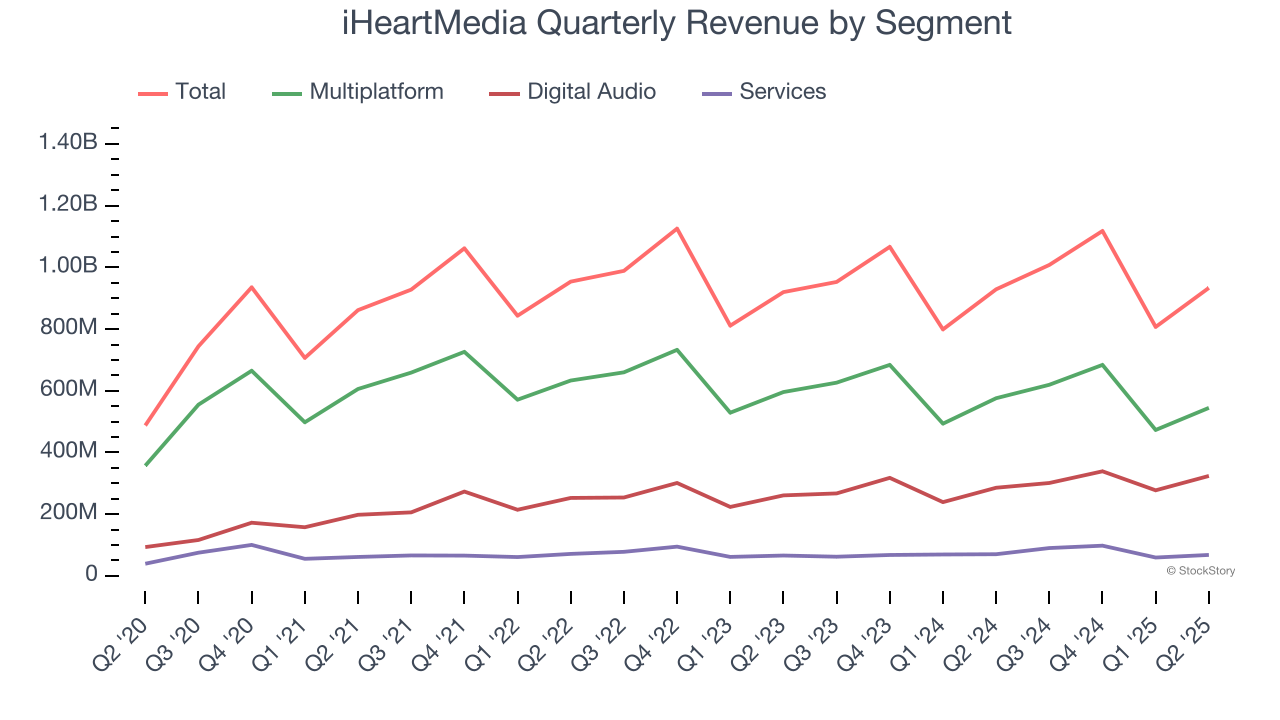

iHeartMedia also breaks out the revenue for its three most important segments: Multiplatform, Digital Audio, and Services, which are 58.3%, 34.7%, and 7.3% of revenue. Over the last two years, iHeartMedia’s Multiplatform revenue (broadcasting, networks, events) averaged 4.1% year-on-year declines, but its Digital Audio (podcasting) and Services (media representation) revenues averaged 9.5% and 5.3% growth.

This quarter, iHeartMedia’s $933.7 million of revenue was flat year on year but beat Wall Street’s estimates by 2.4%. Company management is currently guiding for a 2.5% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to remain flat over the next 12 months. This projection is underwhelming and suggests its newer products and services will not lead to better top-line performance yet.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

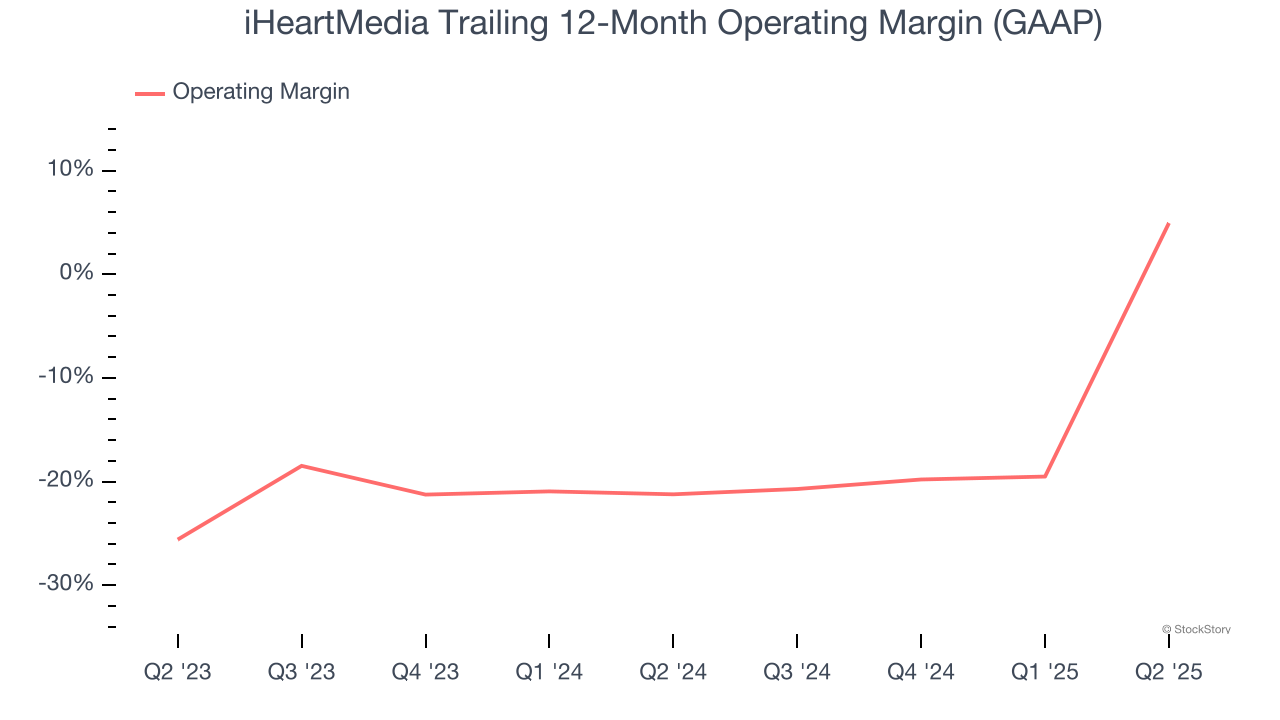

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

iHeartMedia’s operating margin has been trending up over the last 12 months, but it still averaged negative 7.9% over the last two years. This is due to its large expense base and inefficient cost structure.

In Q2, iHeartMedia generated an operating margin profit margin of 3.8%, up 101.7 percentage points year on year. This increase was a welcome development and shows it was more efficient.

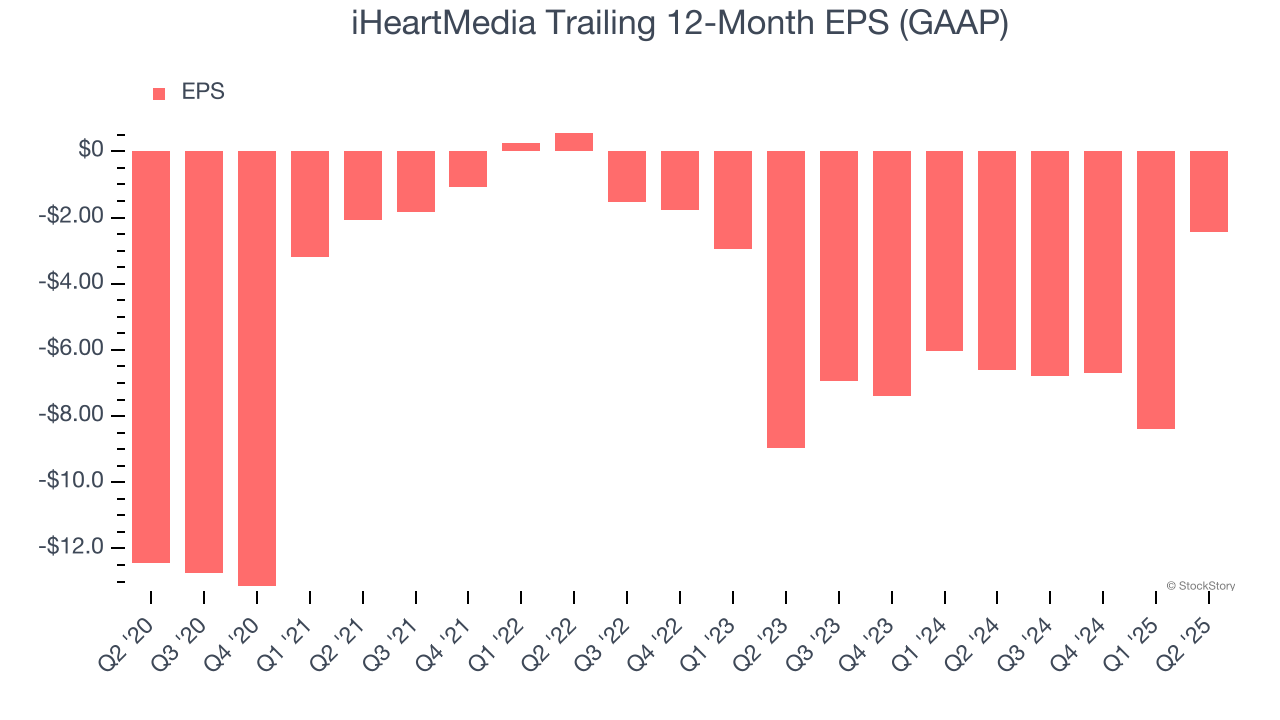

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Although iHeartMedia’s full-year earnings are still negative, it reduced its losses and improved its EPS by 27.8% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability.

In Q2, iHeartMedia reported EPS at negative $0.54, up from negative $6.50 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

It was encouraging to see iHeartMedia beat analysts’ revenue expectations this quarter. We were also happy its EBITDA outperformed Wall Street’s estimates. On the other hand, its EPS missed and its EBITDA guidance for next quarter fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 2.5% to $1.56 immediately following the results.

iHeartMedia underperformed this quarter, but does that create an opportunity to invest right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.

| Feb-16 | |

| Feb-12 | |

| Jan-30 | |

| Jan-29 | |

| Jan-14 | |

| Jan-13 | |

| Jan-08 | |

| Jan-08 | |

| Jan-01 | |

| Dec-22 | |

| Dec-22 | |

| Dec-19 | |

| Dec-18 | |

| Dec-17 | |

| Dec-16 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite