|

|

|

|

|||||

|

|

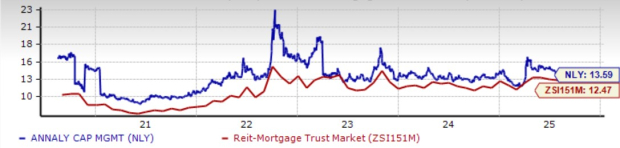

In the first half of 2025, Annaly Capital Management NLY shares have gained 10.3% compared with the industry’s rise of 5.1%. It has also outperformed its peers AGNC Investment AGNC and Arbor Realty Trust ABR over the same time frame. AGNC Investment has grown 7.6%, while Arbor Realty has fallen 17.8%.

Price Performance

Annaly is a mortgage real estate investment trust that primarily owns, manages and finances a portfolio of real estate-related investment securities. The company's diversified approach to capital allocation has been crucial in its ability to navigate market fluctuations and maintain a competitive edge.

Let us delve deeper and analyze other factors to determine the worthiness of the NLY stock.

One of Annaly's main advantages is its well-diversified capital allocation approach. The company's investment portfolio includes residential credit, MSR and agency mortgage-backed securities (MBS). This comprehensive strategy aims to lower volatility and sensitivity to interest rate changes while simultaneously generating appealing risk-adjusted returns. As of June 30, 2025, its investment portfolio aggregated $89.5 billion, including $79.5 billion in a highly liquid Agency portfolio.

Annaly's diversified investment strategy will likely be a key contributor to long-term growth and stability. By diversifying its investments across the mortgage market, the company is better-positioned to capitalize on opportunities as they occur in multiple areas while limiting the risks associated with overexposure to any particular location.

NLY is also focusing on improving its capabilities by acquiring newly originated MSRs from its partner network, which will continue to provide a strong advantage in expanding its MSR business.

The inclusion of MSRs in the portfolio is also notable because these assets tend to increase in value as interest rates rise, offsetting reductions in the value of agency MBS. The MSR portfolio complements Annaly’s Agency MBS strategy by offering an attractive yield while providing a hedge to mortgage basis volatility and slower prepayment speeds on discount dollar-priced MBS. This hedging impact may produce more consistent returns over time and enable Annaly to perform well in a scenario of interest rate change.

Recent capital deployment expanded the Agency MBS portfolio to nearly $5 billion in second-quarter 2025, while residential credit maintained strong origination and securitization activities. The MSR segment remains a significant and stable source of cash flow, with growth supported by acquisitions from Annaly’s partner network.

By maintaining this diversified exposure, NLY is positioned to capitalize on opportunities across housing finance while limiting concentration risk, supporting the company’s ability to deliver stable returns throughout market cycles.

NLY has a record of paying out monthly dividends, currently yielding a staggering 13.6% compared with the industry’s 12.5%. It currently sits at a payout ratio of 99%.

Dividend Yield

In March 2025, Annaly announced a cash dividend of 70 cents per share for the first quarter of 2025, marking a 7.7% hike from the prior payout. This move reflects confidence in the company’s cash flow and growth prospects.

Annaly peer AGNC Investment, and Arbor Realty Trust also pay out quarterly dividends. AGNC Investment has a dividend yield of 15.2%, whereas Arbor Realty Trust has a dividend yield of 9.9%.

Coming back to Annaly, till the end of the second quarter of 2025, the company had $7.4 billion of total assets available for financing, including cash and unencumbered Agency MBS of $4.7 billion, which can readily provide liquidity in times of adverse market conditions. This provides a substantial competitive edge in today's market.

On Dec. 31, 2024, the company’s board of directors authorized a common share repurchase program, which will expire on Dec. 31, 2029. Under the program, the company may repurchase up to $1.5 billion of its outstanding shares of common stock. Though the company has not repurchased shares under this plan since it was announced, its solid liquidity position will support its capital distribution in the future.

The Federal Reserve has lowered the interest rates by 100 basis points in 2024 and has kept rates steady since then. As a result, mortgage rates are range-bound and hovering near 7%. Per a Freddie Mac report, the average rate on a 30-year fixed-rate mortgage was 6.63% as of Aug. 7, 2025, down from 6.72% in the same week a year ago.

Housing affordability challenges are declining with relatively lower mortgage rates. With rates trending lower and balanced supply/affordability playing out in the mortgage market, loan demand is witnessing an increase. This aided NLY’s net interest income (NII) in the first half of 2025. NII increased to $493.2 million in the first six months of 2025 compared with $47.1 million in the same period a year ago.

With improving purchase originations and refinancing activities, NLY will likely witness book value improvement in the coming period as spreads in the Agency market tighten, driving asset prices. This should also boost net interest spread, improving the portfolio's overall yield. This is expected to support Annaly’s financials in the upcoming period.

NLY presents a compelling opportunity for income-focused investors seeking a high dividend yield. With improving interest spreads, a diversified portfolio that mitigates rate volatility and solid liquidity reserves, NLY is well-positioned to deliver stable, risk-adjusted returns even in a mixed economic environment.

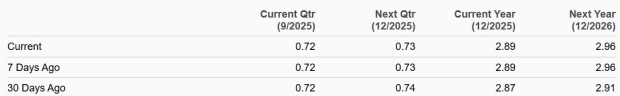

The company’s earnings estimates for 2025 and 2026 indicate year-over-year rallies of 7% and 2.5%, respectively. Earnings estimates for both years have been revised upward over the past 30 days, indicating analysts' bullish outlook toward the company’s growth potential.

Estimates Revision Trend

However, risks remain, including interest rate fluctuations and book value sensitivity. Also, from a valuation standpoint, NLY appears expensive relative to the industry. The company is currently trading at a discount with a forward 12-month price-to-tangible (P/TB) TTM multiple of 1.07X, higher than the industry average of 1.01X. Its peers AGNC Investment and Arbor Realty Trust have a P/TB multiple of 1.18X and 1.06X, respectively.

Price-to-Tangible Book TTM

As such, prospective investors may consider waiting for a more attractive entry point, given the stock’s current premium valuation.

However, existing shareholders may consider holding on to NLY for its income-generating potential and long-term stability.

Annaly currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 11 hours | |

| 12 hours | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-20 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite