|

|

|

|

|||||

|

|

Hims & Hers Health, Inc.’s HIMS investors have been experiencing some short-term losses from the stock lately, following its bumpy ride over recent months. The San Francisco, CA-based health and wellness platform’s stock lost 21.3% against the industry’s 1.7% rise in the same time frame. It has also underperformed the sector and the S&P 500’s growth of 2.4% and 10.1%, respectively.

A major development of HIMS this month has included the announcement of its second-quarter 2025 results.

Hims & Hers had recorded a robust improvement in the top and bottom lines and strength in its Online revenue channel in second-quarter 2025. The increase in subscribers and monthly online revenue per average subscriber during the quarter was encouraging. The expansion of the operating margin during the quarter was also seen. However, HIMS’ lower Wholesale revenues in the quarter were disappointing. The gross margin contracted due to rising product costs, which do not bode well for the stock.

Over the past three months, the stock’s performance has remained bleak, underperforming its peers like Teladoc Health, Inc. TDOC and American Well Corporation AMWL, popularly known as Amwell. Teladoc Health’s and Amwell’s shares have lost 1.9% and 0.8%, respectively, in the same time frame.

HIMS expects revenues for the third quarter of 2025 and the full year in the bands of $570 million to $590 million (reflecting an uptick of 42-47% year over year) and $2.3 billion to $2.4 billion (representing growth of 56-63% from 2024 levels), respectively. The Zacks Consensus Estimate for revenues for the third quarter and the full year is currently pegged at $582.5 million and $2.35 billion, respectively, while the same for earnings per share is currently pegged at 12 cents and 64 cents.

Hims & Hers is seeing strong momentum in its personalized healthcare platform, with second-quarter 2025 subscribers up 30.8% year over year to 2.4 million, and monthly online revenue per average subscriber rising 29.8% to $74. This growth reflects high engagement with its telehealth-driven, vertically integrated model, which combines provider consultations, pharmacy fulfillment and digital care management. HIMS is actively expanding into new high-impact specialties such as hormonal health and longevity, supported by its in-house lab capabilities, enabling more precise and proactive care. These offerings deepen customer relationships and broaden lifetime value potential.

A substantial portion of Hims & Hers’ revenue is driven by its flexible subscription-based model, which offers recurring deliveries across sexual health, dermatology, mental health, weight loss and other categories. Customers can choose billing cadences from 30 to 360 days, with options to cancel, snooze or reactivate, enhancing retention and predictability while supporting cost efficiencies through integrated operations. This model underpins HIMS’ profitability and scalability, as reflected in its reaffirmed full-year 2025 revenue guidance of $2.3–$2.4 billion and raised EBITDA outlook of $295 million-$335 million.

In May 2025, Hims & Hers completed an upsized $870 million convertible senior notes offering to accelerate its global expansion, strategic acquisitions and AI-led innovation. The appointment of Mo Elshenawy as chief technology officer signals HIMS’ intent to embed AI into diagnostics, personalized treatment plans and operational efficiency. This move aligns with management’s vision to build a next-generation healthcare platform that delivers intelligent, personalized and scalable care to millions.

In July 2025, Hims & Hers announced plans to launch its affordable, holistic weight loss program in Canada in 2026, coinciding with the anticipated first global availability of generic semaglutide. By combining significantly lower-cost treatment with 24/7 access to licensed providers and clinically backed care plans, HIMS aims to expand access to effective GLP-1 therapies in a market where branded options have been cost-prohibitive. This initiative positions Hims & Hers to capture share in Canada’s large and underserved weight loss segment.

Earlier, the company finalized the acquisition of ZAVA, a European digital health platform with operations in the U.K., Germany, France and Ireland. This deal expands Hims & Hers’ geographic footprint and allows it to offer localized, specialty-driven care across dermatology, weight loss, sexual health and mental health, tailored in local languages and supported by native healthcare providers. By leveraging ZAVA’s existing infrastructure, Hims & Hers is accelerating its vision of delivering personalized, high-quality care globally, while tapping into new revenue streams from major international markets.

In the second quarter of 2025, Hims & Hers’ gross margin contracted 491 basis points (bps) due to a surge in the cost of revenues. This poses a challenge for the company if it is unable to control its costs in the future.

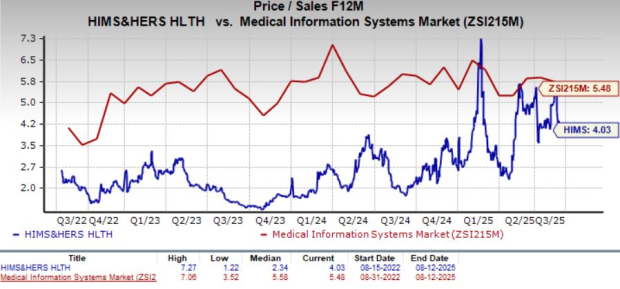

HIMS’ forward 12-month P/S of 4X is lower than the industry’s average of 5.5X but is higher than its three-year median of 2.3X.

Teladoc Health and Amwell’s forward 12-month P/S currently stand at 0.5X and 0.4X, respectively, in the same time frame.

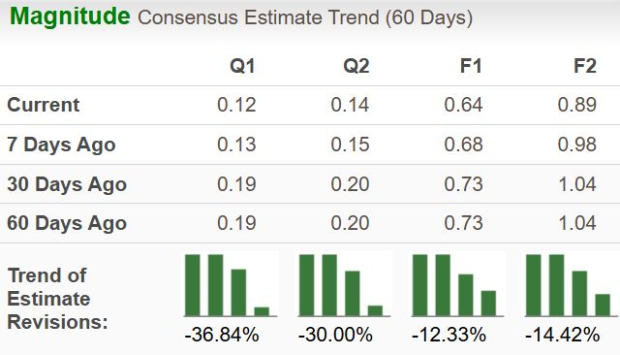

Estimates for Hims & Hers’ 2025 earnings have moved 12.3% south to 64 cents in the past 60 days.

There is no denying that Hims & Hers is poised favorably in terms of core business strength, earnings prowess, robust financial footing and global opportunities. The Zacks Rank #3 (Hold) company’s strong growth prospects present a good reason for existing investors to retain shares for potential future gains. However, new investors are unlikely to be motivated to add the stock following the current plunge in share prices. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

For those exploring to make new additions to their portfolios, the valuation indicates superior performance expectations compared with its industry peers. It is still valued lower than the industry, which suggests potential room for growth if it can align more closely with overall market performance. The favorable Zacks Style Score with a Growth Score of A suggests continued uptrend potential for HIMS.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite