|

|

|

|

|||||

|

|

Industrial products distributor Applied Industrial (NYSE:AIT) reported revenue ahead of Wall Street’s expectations in Q2 CY2025, with sales up 5.5% year on year to $1.22 billion. Its GAAP profit of $2.80 per share was 6.4% above analysts’ consensus estimates.

Is now the time to buy Applied Industrial? Find out by accessing our full research report, it’s free.

Neil A. Schrimsher, Applied’s President & Chief Executive Officer, commented, “We ended fiscal 2025 on an encouraging note with fourth quarter sales and EPS exceeding our expectations. Sales returned to positive organic growth with underlying trends improving as the quarter progressed. This was driven by stronger than expected Engineered Solutions segment sales where our teams executed exceptionally well, including capitalizing on recent order strength and firming demand across several verticals. Service Center segment sales held steady against the muted end-market backdrop with sequential trends seasonally strong. M&A contribution was also encouraging with solid progress continuing to develop at Hydradyne. Lastly, we delivered another solid quarter of cash generation, culminating in record free cash flow in fiscal 2025 that enabled meaningful capital deployment throughout the year. Overall, I am extremely proud of what we accomplished within a challenging demand landscape. Our consistent outperformance reflects our commitment to excellence and ability to create value for all stakeholders in any environment.”

Formerly called The Ohio Ball Bearing Company, Applied Industrial (NYSE:AIT) distributes industrial products–everything from power tools to industrial valves–and services to a wide variety of industries.

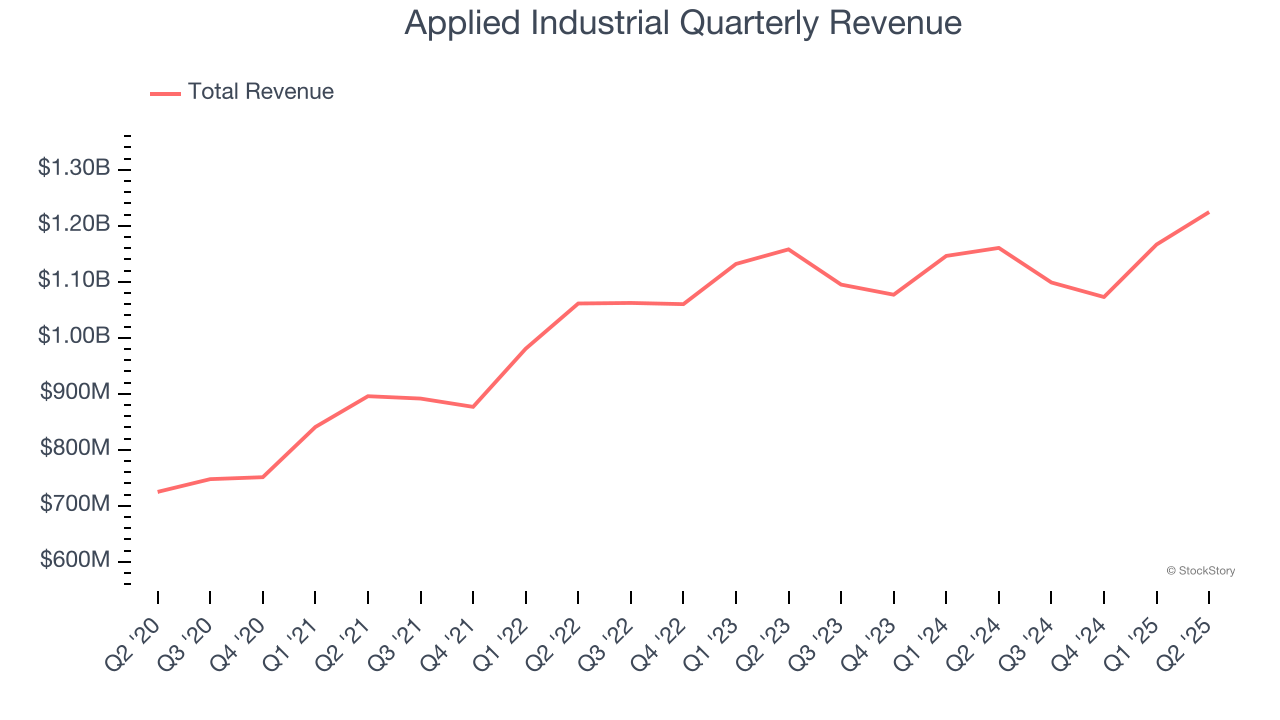

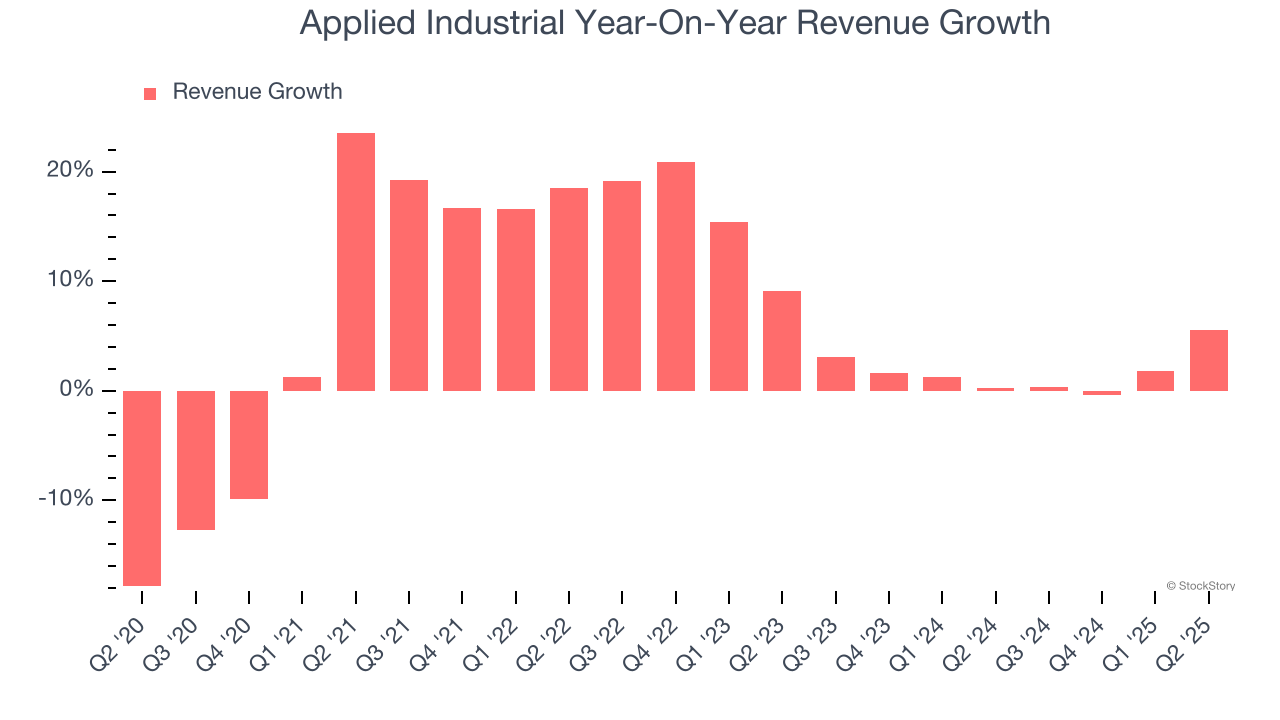

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Applied Industrial’s 7.1% annualized revenue growth over the last five years was mediocre. This fell short of our benchmark for the industrials sector and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Applied Industrial’s recent performance shows its demand has slowed as its annualized revenue growth of 1.7% over the last two years was below its five-year trend.

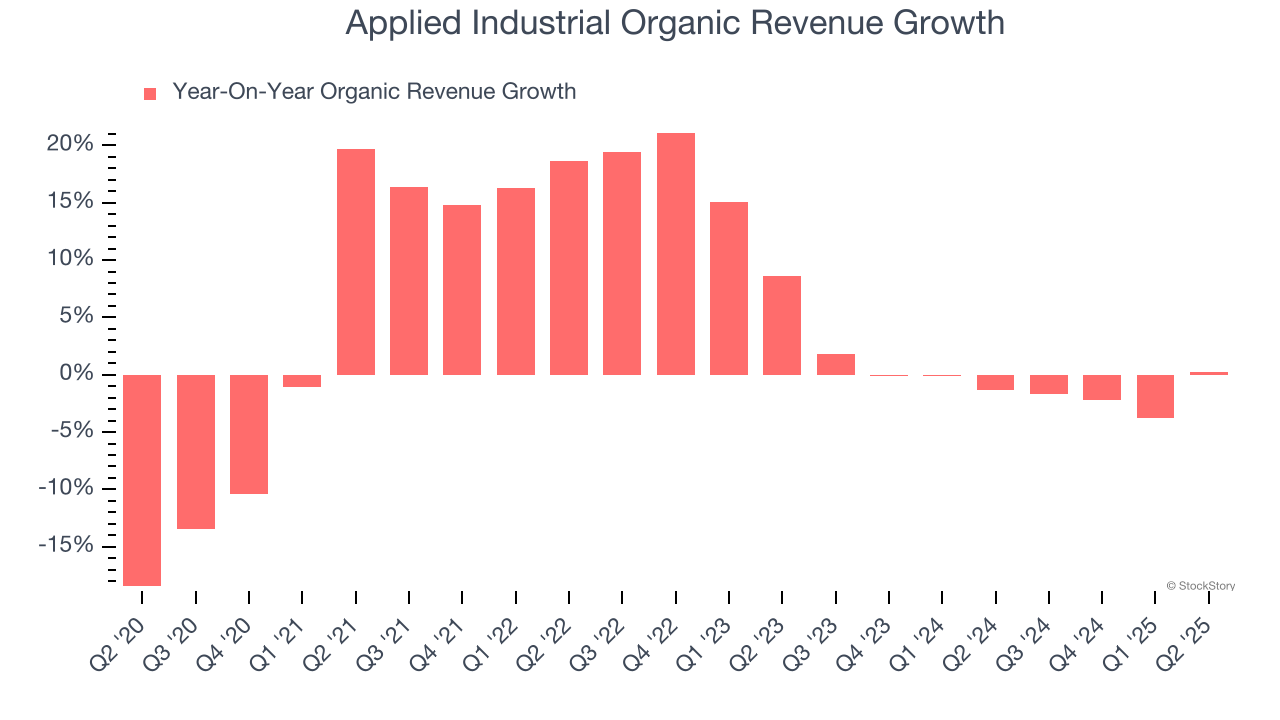

Applied Industrial also reports organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Applied Industrial’s organic revenue was flat. Because this number is lower than its two-year revenue growth, we can see that some mixture of acquisitions and foreign exchange rates boosted its headline results.

This quarter, Applied Industrial reported year-on-year revenue growth of 5.5%, and its $1.22 billion of revenue exceeded Wall Street’s estimates by 3.5%.

Looking ahead, sell-side analysts expect revenue to grow 4.8% over the next 12 months. Although this projection implies its newer products and services will fuel better top-line performance, it is still below average for the sector.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

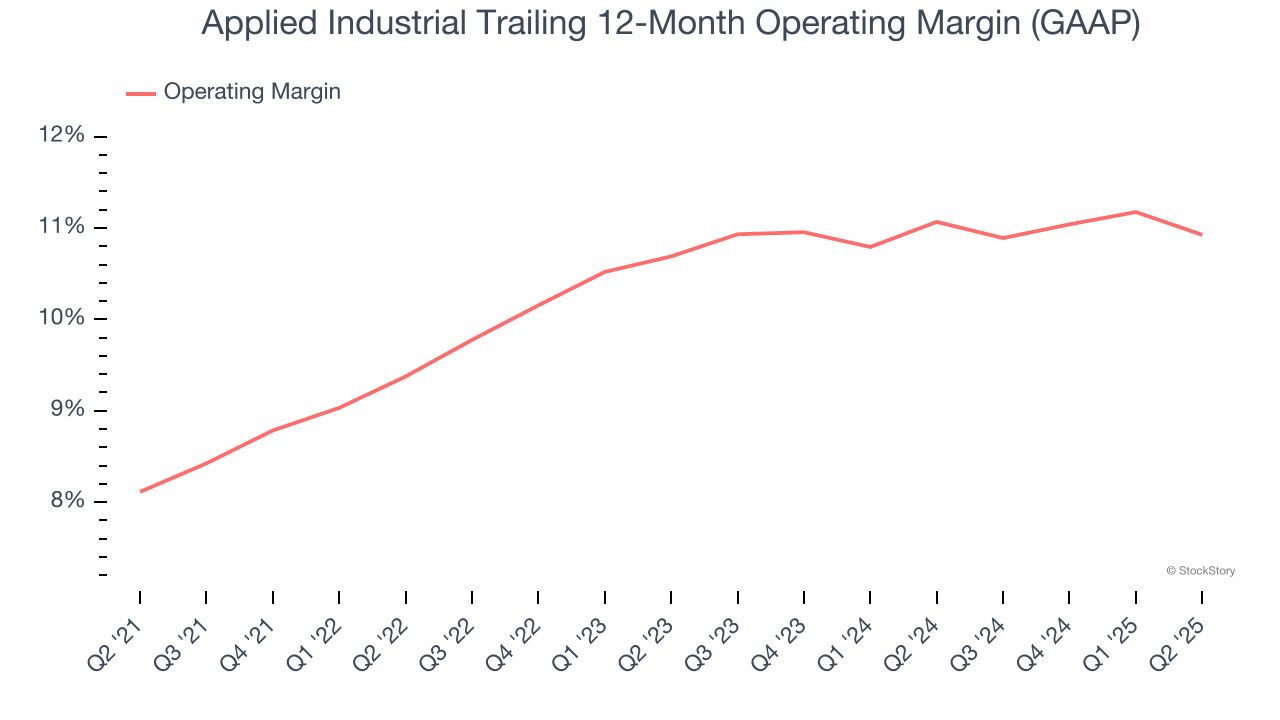

Applied Industrial has managed its cost base well over the last five years. It demonstrated solid profitability for an industrials business, producing an average operating margin of 10.2%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Analyzing the trend in its profitability, Applied Industrial’s operating margin rose by 2.8 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Applied Industrial generated an operating margin profit margin of 11%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

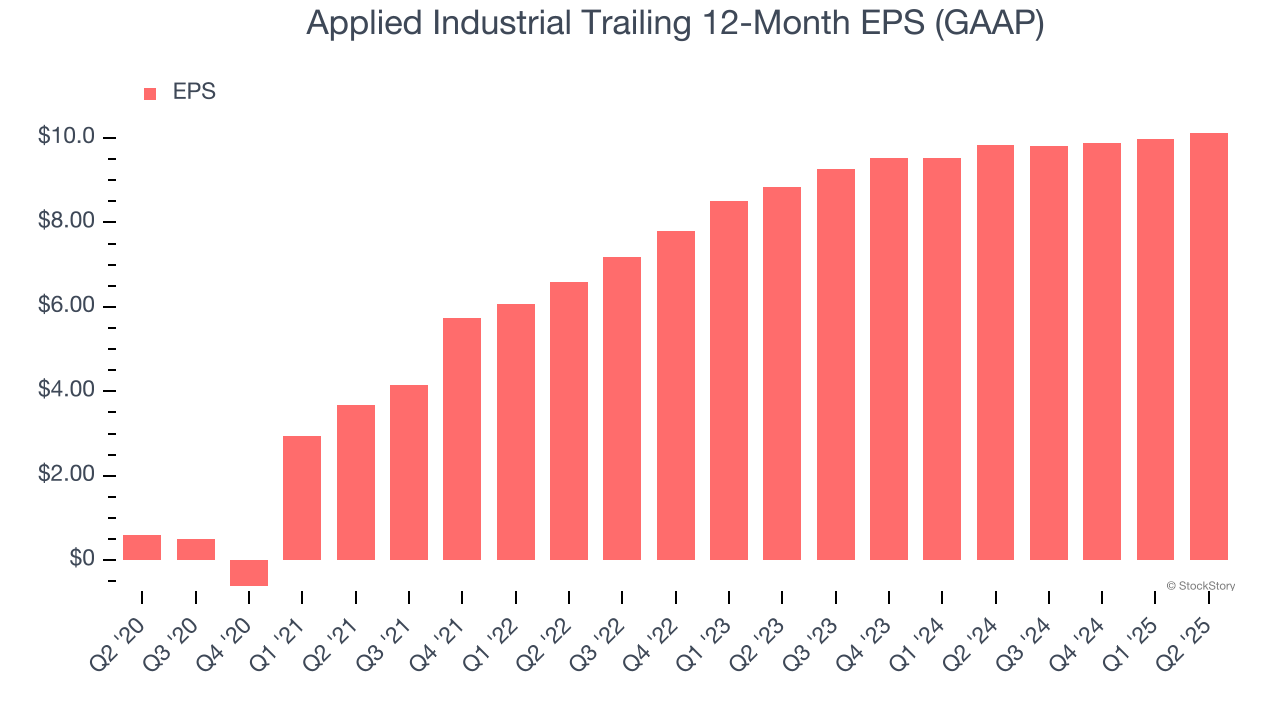

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Applied Industrial’s EPS grew at an astounding 76% compounded annual growth rate over the last five years, higher than its 7.1% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

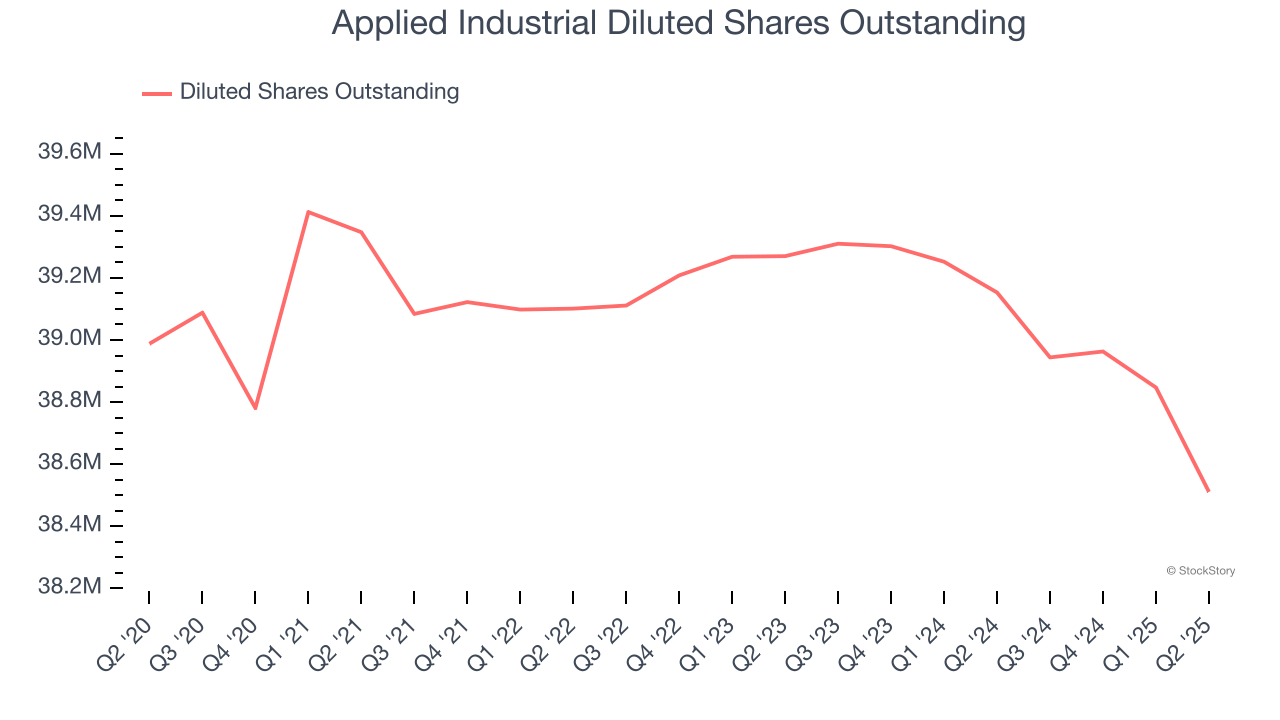

Diving into Applied Industrial’s quality of earnings can give us a better understanding of its performance. As we mentioned earlier, Applied Industrial’s operating margin was flat this quarter but expanded by 2.8 percentage points over the last five years. On top of that, its share count shrank by 1.2%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Applied Industrial, its two-year annual EPS growth of 7% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q2, Applied Industrial reported EPS of $2.80, up from $2.64 in the same quarter last year. This print beat analysts’ estimates by 6.4%. Over the next 12 months, Wall Street expects Applied Industrial’s full-year EPS of $10.13 to grow 5.2%.

We were impressed by how significantly Applied Industrial blew past analysts’ organic revenue expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. On the other hand, its full-year EPS guidance missed. Overall, we think this was a mixed quarter. The stock remained flat at $273 immediately following the results.

Big picture, is Applied Industrial a buy here and now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.

| Feb-09 | |

| Feb-03 | |

| Feb-03 | |

| Feb-02 | |

| Feb-01 | |

| Jan-30 | |

| Jan-29 | |

| Jan-29 | |

| Jan-28 | |

| Jan-28 | |

| Jan-28 | |

| Jan-27 | |

| Jan-27 | |

| Jan-27 | |

| Jan-27 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite