|

|

|

|

|||||

|

|

Technology investors have become intrigued by the potential of the quantum era as the artificial intelligence (AI) revolution unfolds.

Quantum Computing, or QCi, is exploring photonic qubits -- a technology that's garnered the interest of academic research institutions and government agencies.

While QCi looks promising to the casual viewer, savvy investors understand the bigger issues surrounding the company's popularity.

Over the last three years, some of the biggest gains from the artificial intelligence (AI) megatrend have centered on semiconductors, data centers, cloud computing infrastructure, and enterprise software. But like all maturing themes, investors are craving a new wave of opportunity.

Enter quantum computing, an emerging technology that is projected to have over $1 trillion in economic value by next decade, according to global management consulting firm McKinsey & Company.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Unlike traditional AI applications, investors seem infatuated with speculative opportunities when it comes to investing in quantum computing stocks. Rather than traditional power players such as Nvidia, Alphabet, Microsoft, or Amazon, one of the most talked-about names in the quantum era is Quantum Computing Inc. (NASDAQ: QUBT), or QCi for short.

Quantum Computing (the company) just reported earnings for the second calendar quarter of 2025 -- and let me tell you, there is a lot to unpack. Is Quantum Computing stock a buy after its Q2 report?

QCi's second-quarter earnings report highlighted several updates -- including mentions of a partnership with NASA, its addition to the Russell 2000 index, and incremental progress on its photonic qubit technology.

While these details make for exciting headline content, how have they translated into measurable business results?

QUBT Revenue (Quarterly) data by YCharts

In Q2, the company generated just $61,000 in sales while posting a net loss of $36.5 million. In other words, QCi essentially remains a pre-revenue business with no proven path to a turnaround or sustained positive unit economics.

While quantum computing (the technology) is increasingly hailed as the next frontier of AI, prudent investors should remain cautious. At present, the field is still dominated by research and development (R&D) rather than practical utility.

Quantum Computing (the company) is not signing Fortune 500 clients at a record pace because of any groundbreaking innovations it has achieved -- far from it.

Frankly, I see QCi more as a hype-driven branding story -- perhaps deliberately spinning an exciting narrative while the core business fundamentals tell a very different story.

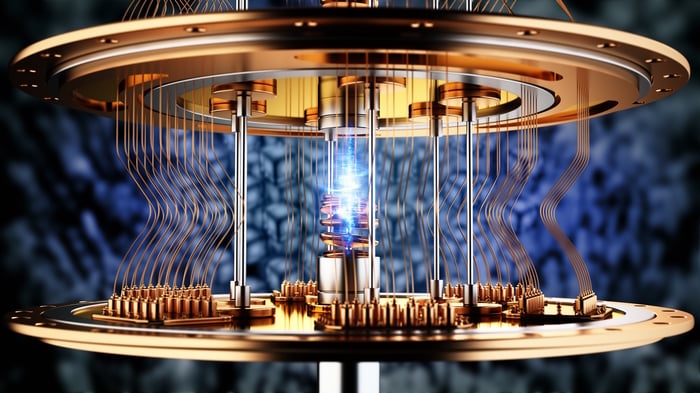

Image source: Getty Images.

With such minimal traction and mounting losses, Quantum Computing looks more aspirational than investable -- focused on conceptual breakthroughs rather than tangible applications adopted by enterprise customers at scale.

Where bullish investors might push back is on the company's balance sheet. Despite QCi's tiny revenue base and recurring burn, the company ended Q2 with $349 million of cash and equivalents.

Investors should not be fooled by this. Quantum Computing's balance sheet strength comes from stock issuances as opposed to organic cash generation. This brings up the heart of the bear storyline: valuation.

As of market close on Aug. 15, QCi boasted a market cap of $2.4 billion -- equating to a price-to-sales (P/S) multiple of more than 7,000. For perspective, this is orders of magnitude higher than established AI leaders with proven disruption.

QUBT PS Ratio data by YCharts

I think it's clear that Quantum Computing's management understands the disconnect between the company's valuation and business fundamentals. Issuing shares during a frothy stock market environment suggests that the company is capitalizing on enthusiasm driven largely by speculation and unsuspecting buyers before a valuation reset could -- and likely will -- occur.

The key takeaway here is that QCi stock may look like a bargain for "just $15" per share, but smart investors understand that the absolute share price does not solely determine the value of a business.

Quantum Computing (the company) is historically pricey and trading at levels reminiscent of the stock market bubble of the late 1990s driven by euphoria around the internet. With nearly no revenue, widening losses, and a dependence on equity raises, I think QCi is facing a looming liquidity crunch.

At best, QCi is a moonshot gamble. Unless you are an investor comfortable with extreme volatility and abnormally outsize risk, Quantum Computing stock is best avoided for the time being.

Before you buy stock in Quantum Computing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Quantum Computing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $668,155!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,106,071!*

Now, it’s worth noting Stock Advisor’s total average return is 1,070% — a market-crushing outperformance compared to 184% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of August 13, 2025

Adam Spatacco has positions in Alphabet, Amazon, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Amazon, International Business Machines, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-07 | |

| Feb-03 | |

| Feb-02 | |

| Jan-29 | |

| Jan-28 | |

| Jan-27 | |

| Jan-27 | |

| Jan-27 | |

| Jan-25 | |

| Jan-25 | |

| Jan-23 | |

| Jan-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite