|

|

|

|

|||||

|

|

United Parcel Service UPS and Expeditors International of Washington EXPD are two prominent names in the Zacks Transportation sector. Both companies have announced dividend hikes this year despite the prevalent economic uncertainties, reflecting their shareholder-friendly approach.

Dividend-paying stocks provide a solid income stream and have fewer chances of experiencing wild price swings. Dividend stocks are safe bets for creating wealth, as the payouts generally act as a hedge against economic uncertainty, like the current scenario.

In February, UPS’ board of directors approved a dividend hike, thereby raising its quarterly cash dividend to $1.64 per share ($6.56 annualized) from $1.63 ($6.52 annualized). Expeditors’ board of directors approved a dividend hike of 5.5%, raising its quarterly semi-annual cash dividend from 73 cents per share to 77 cents, in May. The company’s payout ratio is 25%, with a five-year dividend growth rate of 8.4%.

Expeditors International of Washington, Inc. dividend-yield-ttm | Expeditors International of Washington, Inc. Quote

United Parcel Service dividend-yield-ttm | United Parcel Service Quote

No doubt UPS’ most recent dividend hike reflects its shareholder-friendly approach, but questions about the sustainability of its dividend arise. United Parcel Service’s elevated dividend payout ratio (the percentage of net income paid out as dividends) highlights the concerns associated with its ability to maintain dividend payouts over the long term.

We remind investors that in the early 2020s, when UPS’ business was flourishing, driven by exponential e-commerce growth during the peak pandemic period, the company made huge dividend payments. Free cash flow has been on a decline since touching a high of $9 billion in 2022.

Currently, UPS' elevated dividend payout is hurting its operational flexibility, with free cash flow barely covering the dividend. At 2024-end, free cash flow was $6.3 billion, not much above its dividend payments of $5.4 billion. United Parcel Service expects to make dividend payments of around $5.5 billion in 2025. On the other hand, EXPD’s much lower dividend payout ratio implies that concerns associated with its ability to maintain dividend payouts over the long term are absent.

While we have considered the dividend-paying abilities of both the transportation stocks, let’s delve deep to compare other relevant metrics to determine which of EXPD and UPS is a better investment now.

EXPD has navigated the recent tariff-induced stock market volatility well, registering an 8.3% year-to-date gain, while UPS stock has performed miserably in 2025 so far, declining in double digits.

UPS’ lackluster price performance is mainly due to the revenue weakness as geopolitical uncertainty and high inflation continue to hurt consumer sentiment and growth expectations. The weak demand scenario has led to a decline in the volume of packages shipped.

On the other hand, EXPD’s recent strength is driven by the improving scenario concerning airfreight tonnage, which increased 7% year over year during the June quarter, and ocean container volume (also up 7%), apart from its cost-cutting initiatives. Expeditors is being served well by the growth of e-commerce and technology sectors, indicating strong underlying business fundamentals.

The Zacks Consensus Estimate for EXPD’s 2025 sales estimate implies a 0.3% year-over-year increase, while the same for 2026 implies a 0.8% year-over-year decrease. The consensus mark for EXPD’s 2025 EPS estimate highlights a 4% year-over-year decrease. The same for 2026 implies a 1.8% year-over-year increase.

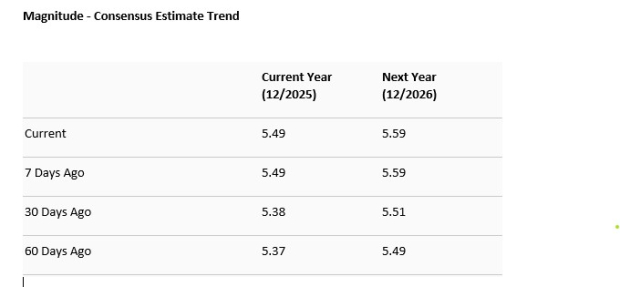

The Zacks Consensus Estimate for UPS’ 2025 sales estimate implies a 3.9% year-over-year decrease, while the same for 2026 implies a 0.6% year-over-year increase. The consensus mark for UPS’ 2025 EPS estimate highlights a 14.4% year-over-year decrease. The same for 2026 implies a 13.4% year-over-year increase. The EPS estimates for 2025 and 2026 have been trending southward over the past 60 days, unlike EXPD.

EXPD is trading at a forward sales multiple of 1.54X. EXPD has a Value Score of D. Meanwhile, UPS has a Value Score of B, with its forward sales multiple at 0.84X.

EXPD’s expensive valuation (compared to UPS) seems to suggest that investors are to pay a premium for this key player in the transportation sector. Agreed that both stocks focus on paying dividends, but EXPD’s lower dividend payout ratio puts to rest concerns about dividend sustainability, unlike UPS.

EXPD’s better price performance and northward earnings estimate revisions highlight the fact that the improving air freight tonnage and ocean container volume scenario, apart from its cost-cutting actions, is working well.

Given its better prospects, EXPD seems a better pick than UPS now.

While EXPD carries a Zacks Rank #3 (Hold), UPS has a Zacks Rank #4 (Sell) at present.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 7 hours | |

| 7 hours | |

| 10 hours | |

| 11 hours | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite