|

|

|

|

|||||

|

|

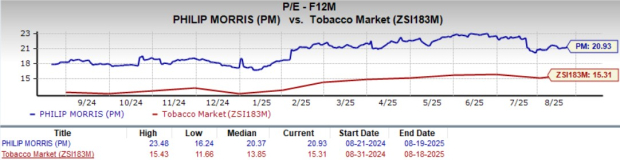

Philip Morris International Inc. (PM) is currently trading at a forward 12-month price-to-earnings (P/E) multiple of 20.93X, representing a significant premium compared with the Zacks Tobacco industry average of 15.31X and the broader Consumer Staples sector of 17.14X. This level is slightly below the S&P 500’s multiple of 22.85X.

Such a high multiple raises a key question: Does PM offer enough growth to justify this premium, or is the stock moving into overvalued territory?

Performance among major tobacco players, Altria Group Inc. (MO), Turning Point Brands, Inc. (TPB) and British American Tobacco p.l.c. (BTI), has been mixed. Altria and British American Tobacco currently trade at lower forward P/E ratios of 12.12X and 11.88X, respectively. In contrast, Turning Point Brands trades at a notably higher multiple of 24.02X.

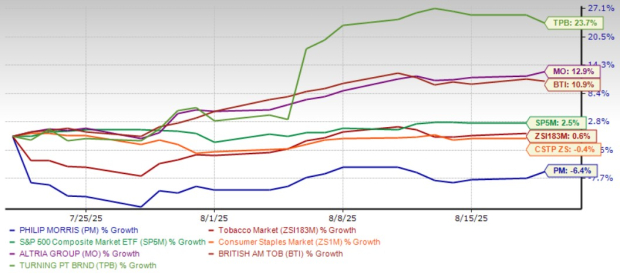

In recent weeks, Philip Morris has trailed both the market and its peers. In the past month, PM shares fell 6.4% compared with a 0.4% dip in the Consumer Staples sector, while the Zacks Tobacco industry and the S&P 500 advanced 0.6% and 2.5%, respectively. Peers, meanwhile, posted strong gains. Altria, British American Tobacco and Turning Point Brands jumped 12.9%, 10.9% and 23.7%, respectively. This sharp contrast underscores investor caution toward PM, even as the stock continues to command a premium multiple.

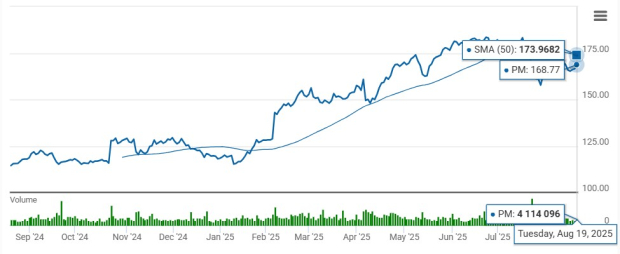

Closing yesterday’s trading session at $168.77, shares of Philip Morris are currently trading below the 50-day simple moving average of $173.97. The moving average is a key indicator for gauging market trends and momentum. The breach of this threshold heightens investor concerns about the stock’s short-term outlook and signals the potential for downside if these levels are not reclaimed.

With PM’s recent underperformance, investors may be questioning whether the pullback reflects short-term volatility or signals deeper concerns. Before making any decision, it is important to assess the factors behind the decline. Are these challenges temporary, or could they pose more lasting headwinds? Let us take a closer look.

Philip Morris faced notable volume declines in traditional cigarettes, particularly in Turkey and Indonesia. Cigarette shipment volumes fell 1.5% year over year to 155.2 billion units in the second quarter of 2025. In Turkey, regulatory changes disrupted supply chains, causing temporary losses and inventory write-downs. In Indonesia, the legal cigarette market contracted further as illicit trade gained share, a trend expected to persist.

Management projects a 2% full-year cigarette volume decline, with a sharper 3-4% drop in the second half.

In the United States, ZYN continued to show strong consumer demand, but management highlighted in its last reported quarter’s earnings call that restocking volumes came in slightly below expectations, leading to some shipment volatility. While underlying trends remain favorable, this inconsistency between demand and reported shipments has raised questions about the near-term visibility of ZYN’s growth trajectory.

Philip Morris reported adjusted earnings per share of $1.91, up 20% year over year, but results were impacted by currency volatility. While the quarter included a favorable currency variance of 2 cents per share, this was 4 cents lower than management’s prior guidance due to intercompany transactional impacts tied to Swiss franc fluctuations. This shortfall highlights how foreign exchange fluctuations affect reported earnings.

Philip Morris’ long-term growth story continues to be anchored by its smoke-free transformation. In the second quarter of 2025, smoke-free products accounted for 41% of total net revenues, improving 15.2% year over year organically, with strong contributions from IQOS, ZYN and VEEV. This segment has become an increasingly important contributor to earnings, positioning PM for sustainable growth and long-term value creation.

Despite volume declines, PM’s traditional cigarette business remains resilient, supported by its premium brands and pricing power. Combustible net revenues grew 2.1% in the second quarter, driven by price increases, while gross profit advanced 5%. Marlboro also reached its highest quarterly market share since the 2008 spin-off, reinforcing PM’s brand strength and pricing leadership.

Philip Morris made solid progress on its cost and productivity initiatives. The company achieved more than $500 million in gross cost savings in the first half of the year through manufacturing and back-office optimization initiatives. The company aims to deliver $2 billion in gross cost efficiencies between 2024 and 2026, and by mid-2025, it has already realized more than $1.2 billion. The margin expansion achieved in the quarter reflects the impacts of these efficiencies.

On its last reported quarter’s earnings call, management lifted its full-year adjusted EPS guidance to $7.43-$7.56 (indicating 13-15% growth) from the prior stated $7.36-$7.49 (implying 12-14% growth). This guidance reflects confidence in sustaining double-digit earnings growth, although regulatory and currency challenges persist.

Reflecting positive sentiment around Philip Morris, the Zacks Consensus Estimate for earnings per share has seen upward revisions. In the past 30 days, the consensus estimate has moved up by a penny each to $7.50 per share for the current year and $8.39 for the next year. These estimates indicate year-over-year growth rates of 14.2% and 11.9%, respectively.

Philip Morris offers solid long-term potential, supported by its smoke-free transformation, resilient premium cigarette brands and ongoing cost-efficiency initiatives. While volume declines in key markets, ZYN shipment volatility and currency headwinds remain challenges, the company’s raised EPS outlook and upward estimate revisions reflect confidence in sustained earnings growth.

However, PM’s premium valuation and recent stock underperformance suggest a cautious stance, making it reasonable for investors to maintain positions. Philip Morris currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-22 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite