|

|

|

|

|||||

|

|

Apollo Global Management APO and KKR & Co. Inc. KKR are two of the most well-known players in the asset management industry, each with strong track records in private equity, credit, and infrastructure investing. Both firms have benefited from rising asset under management (AUM) and revenue growth. Yet, their business models, growth strategies, and market positioning differ in ways that could impact their future upside.

Let’s closely examine other factors at play for KKR and APO to determine which stock has more upside potential.

The Case for Apollo

Apollo’s diverse business model ensures sustainable earnings. The company’s diversified AUM across various asset classes, client bases, and geographies offers support. Its AUM balance witnessed a CAGR of 7.8% over the past three years (2021-2024). The increase in AUM is primarily driven by the growth of its retirement services client assets, subscriptions across the platform, and new financing facilities. The momentum continued in the first half of 2025. By 2029, Apollo expects its total AUM to reach almost $1.5 trillion by scaling its private equity business.

Growth is being reinforced through acquisitions and partnerships. In early 2025, Apollo struck deals to acquire Bridge Investment Group and Argo Infrastructure Partners, enhancing real estate and infrastructure capabilities. It also extended a multi-billion-dollar partnership with Mubadala, launched a $25 billion private credit program with Citigroup, and partnered with State Street Global Advisors to broaden retail access to private markets.

On the financial side, Apollo has demonstrated robust organic growth. Revenues expanded at a 63.7% CAGR (2021–2024), though growth moderated in the first half of 2025. The expansion of retail channels through Athene, alongside strong inflows, positions Apollo for continued revenue gains across Asset Management and Retirement Services.

KKR & Co.’s total AUM has been witnessing improvement over the years. The metric saw a five-year (2019-2024) compound annual growth rate (CAGR) of 23.9%, with the rising trend continuing in the first half of 2025. Going forward, the company’s efforts to improve and add investment strategies continue to support AUM growth. In July 2025, KKR & Co. closed a majority stake in HealthCare Royalty Partners, a middle-market biopharma royalty acquisition company, adding nearly $3 billion to its AUM. At its 2024 investor day held in April, the company laid out a plan to scale its core businesses as it aims to reach at least $1 trillion in AUM by 2030. The company intends to build on its existing asset management, insurance, and strategic holding units to reach the milestone.

On the revenue side, KKR has maintained steady organic growth, with total segment revenues increasing at a 16.3% CAGR (2019–2024), with the rising trend continuing in the first half of 2025. This was supported by its expansion in traditional private equity as well as diversification into infrastructure, real estate, growth equity, and core investing. These moves have broadened KKR’s opportunity set, boosted deal activity, and strengthened its revenue base.

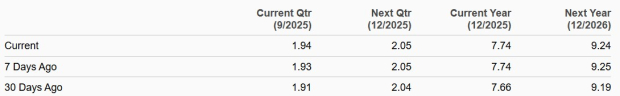

The Zacks Consensus Estimate for APO’s 2025 and 2026 earnings implies a year-over-year rise of 4.2% and 19.4%, respectively. Earnings estimates for both years have been revised upward over the past month.

APO Estimates Revision Trend

The Zacks Consensus Estimate for KKR’s 2025 and 2026 earnings implies a year-over-year rise of 9.4% and 30.9%, respectively. Earnings estimates for both years have been revised upward over the past month.

KKR Estimates Revision Trend

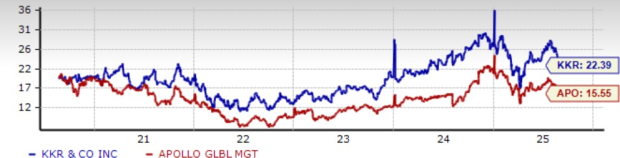

Over the past year, APO outperformed the industry while KKR lagged. APO has gained 26.4% while KKR has risen 16.9% compared with the industry’s growth of 20.9%.

Price Performance

From a valuation standpoint, APO is currently trading at a forward 12-month price-to-earnings (P/E) multiple of 15.55X, while KKR is currently trading at a forward 12-month P/E multiple of 22.39X. APO is lower than the industry average of 17.38X, while KKR stock is trading at a premium.

Price-to-Earnings F12M

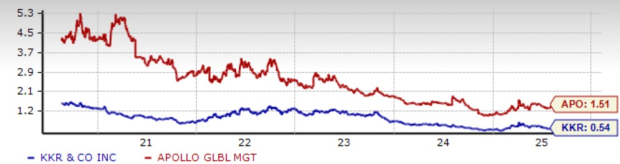

Additionally, both Apollo and KKR & Co. reward their shareholders handsomely. In May 2025, Apollo raised its quarterly dividend by 10.9% to 51 cents per share. It has a dividend yield of 1.5%. Similarly, KKR raised its quarterly dividend by 5.6% to 19 cents per share in May 2025. It has a dividend yield of 0.5%.

Dividend Yield

Also, both companies have a share repurchase plan. Apollo’s board authorized up to $3 billion in buybacks in February 2024, with $1.05 billion still available as of March 2025. Likewise, KKR's repurchase plan had $459 million worth of shares remaining available as of June 30, 2025

While both Apollo and KKR & Co. stand out as asset management powerhouses with impressive growth trajectories, APO’s diversified business model, strong inflows from retirement services, and strategic partnerships provide a clear path to sustained AUM growth. The firm also maintains robust capital return policies with meaningful dividend hikes, buybacks, and higher dividend yield.

While KKR boasts higher projected earnings growth, much of that optimism appears priced in at its premium valuation.

Hence, Apollo currently offers investors a better mix of growth potential, value, and capital return strength, making it the more compelling upside play.

KKR and APO currently carry a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 6 hours | |

| 12 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-15 | |

| Feb-15 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite