|

|

|

|

|||||

|

|

AngioDynamics ANGO has been gaining from its solid prospects with NanoKnife and an increased focus on cancer treatment markets. The optimism, led by a solid fourth-quarter fiscal 2025 performance, positive ongoing studies and a broad product line, bodes well for the stock.

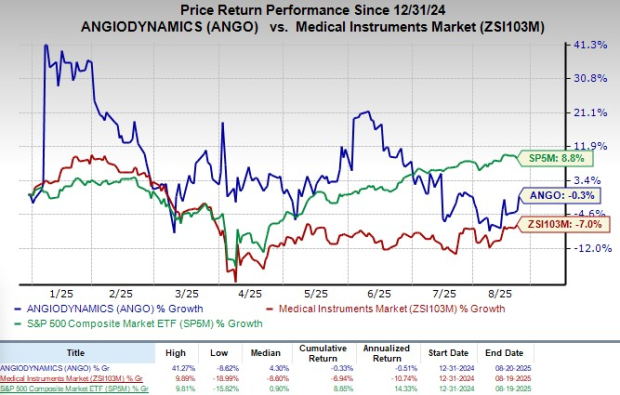

In the year-to-date period, the Zacks Rank #3 (Hold) company’s shares have lost 0.3% compared with the 7% decline of the industry. The S&P 500 has increased 8.8% during the said time frame.

The renowned designer, manufacturer and seller of an extensive range of innovative medical, surgical and diagnostic devices has a market capitalization of $358.8 million. The company projects 50% growth over the next year and expects to witness continued improvements in its business. AngioDynamics’ earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average surprise being 72.58%.

NanoKnife Driving Growth: NanoKnife remains a key product in AngioDynamics’ portfolio, supported by FDA clearance and a Breakthrough Device Designation. Total NanoKnife revenues reached $24.5 million in fiscal 2025, essentially flat from the prior year, with fourth-quarter revenues of $7.2 million reflecting softer capital placements but solid growth in disposables. Management noted that recurring disposable sales, which grew 9.6% for the year, continue to provide a reliable revenue stream and help offset variability in system placements.

Looking ahead, reimbursement milestones are expected to unlock greater potential, with prostate procedures gaining a CPT Category I code in early 2026 and pancreatic procedures following in 2027. Supported by a growing installed base and increasing surgeon adoption, NanoKnife is positioned as a differentiated growth driver capable of contributing sustainably and profitably to AngioDynamics’ Med Tech business.

Clinical Progress and Balanced Portfolio Support Growth: AngioDynamics is reinforcing investor confidence by advancing a broad pipeline of clinical studies while leveraging a diversified product portfolio. The company remains focused on building evidence to support adoption and reimbursement across its Med Tech franchises. Within Auryon, the AMBITION below-the-knee randomized controlled trial and companion registry are progressing, aimed at strengthening the system’s role in treating complex peripheral artery disease, particularly in Europe, following its recent CE Mark.

Meanwhile, the RECOVER-AV trial for AlphaVac in Poland is expected to generate data that bolsters its positioning in large-bore thrombectomy and supports global expansion. NanoKnife also achieved a major milestone with its PRESERVE prostate trial meeting primary endpoints, paving the way for reimbursement catalysts beginning in 2026. Complementary studies, including the AMBITION BTK trial and the APEX-AV pulmonary embolism results, further underscore management’s commitment to building a robust body of clinical validation across its growth platforms.

Alongside its innovation pipeline, AngioDynamics benefits from a well-rounded portfolio that balances high-growth Med Tech introductions with resilient Med Device products. Auryon delivered its 16th straight quarter of double-digit growth, fueled by strong demand for its expanded catheter range. AlphaVac maintained solid traction, while a next-generation version with blood return functionality is progressing through FDA discussions.

The company also saw steady adoption of AngioVac, reinforcing its position in thrombectomy. At the same time, established offerings such as Core Peripheral, EVLT, Ports, and Solero Microwave provided stability and recurring revenue, helping offset fluctuations in newer technologies. This combination of advancing clinical milestones and a diversified product base positions AngioDynamics to deliver sustainable growth and long-term shareholder value.

Decent Q4 Results: AngioDynamics closed the fourth quarter of fiscal 2025 with encouraging signs of progress. The company delivered a narrower-than-expected adjusted loss per share and reported revenues that came in ahead of expectations, highlighting strong execution. Revenue momentum was broad-based, with both overall and geographic sales showing healthy growth on a reported basis and at constant currency. The solid performance across both operating segments further underscores the resilience of the business.

Tariffs Weigh on Margins: AngioDynamics highlighted that tariffs remain a notable drag on profitability, with Med Tech and Med Device margins several points higher when adjusted for these costs. In the fourth quarter of fiscal 2025, Med Tech margins were 59% including tariffs, versus 62.1% excluding them, while Med Device margins were 47.6% versus 48.8% on the same basis.

Management noted that tariff-related expenses are fully embedded in fiscal 2026 guidance, with gross margin projected in the range of 53.5% to 55.5% (or 55.0% to 56.0% excluding tariffs) and adjusted EBITDA in the range of $3.0 million to $8.0 million (or $7.5 million to $10.5 million excluding tariffs). Even so, leadership emphasized that strong commercial execution and efficiency initiatives are helping to cushion the impact and protect long-term growth investments.

AngioDynamics has been witnessing a negative estimate revision trend for fiscal 2026. Over the past 60 days, the Zacks Consensus Estimate for loss has expanded from 6 cents to 30 cents per share.

The Zacks Consensus Estimate for first-quarter fiscal 2026 revenues is pegged at $72.8 million, implying a 7.9% rise from the year-ago reported number. The consensus mark for fiscal first-quarter loss per share is pinned at 13 cents, implying an 18.2% decline year over year.

Some better-ranked stocks in the broader medical space that have announced quarterly results are Medpace Holdings, Inc. MEDP, West Pharmaceutical Services, Inc. WST and Boston Scientific Corporation BSX.

Medpace Holdings, sporting a Zacks Rank of 1 (Strong Buy), reported second-quarter 2025 EPS of $3.10, beating the Zacks Consensus Estimate by 3.3%. Revenues of $603.3 million outpaced the consensus mark by 11.5%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Medpace Holdings has a long-term estimated growth rate of 11.4%. MEDP’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 13.9%.

West Pharmaceutical reported second-quarter 2025 adjusted EPS of $1.84, beating the Zacks Consensus Estimate by 21.9%. Revenues of $766.5 million surpassed the Zacks Consensus Estimate by 5.4%. It currently flaunts a Zacks Rank #1.

West Pharmaceutical has a long-term estimated growth rate of 8.5%. WST’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 16.8%.

Boston Scientific reported second-quarter 2025 adjusted EPS of 75 cents, beating the Zacks Consensus Estimate by 4.2%. Revenues of $5.06 billion surpassed the Zacks Consensus Estimate by 3.5%. It currently carries a Zacks Rank #2 (Buy).

Boston Scientific has a long-term estimated growth rate of 14%. BSX’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 8.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 8 hours | |

| 14 hours | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite