|

|

|

|

|||||

|

|

Eli Lilly and Company LLY is a key player in the diabetes and obesity drug market, mainly due to the significant popularity and success of its GLP-1 therapies — Mounjaro for diabetes and Zepbound for weight loss.

Mounjaro and Zepbound face strong competition from Novo Nordisk’s NVO semaglutide medicines, Ozempic for diabetes and Wegovy for obesity. Despite being on the market for only around three years, Mounjaro and Zepbound have become key top-line drivers for Lilly, with demand rising rapidly.

The obesity market is expected to expand to $100 billion by 2030, according to data from Goldman Sachs, which means fierce competition is inevitable. Though Lilly and Novo Nordisk presently dominate the market, they are making rapid progress in the development of more potent and convenient GLP-1-based candidates in their clinical pipeline to beat future competition.

Lilly is investing broadly in obesity and has several new molecules currently in clinical development. This includes two late-stage candidates, orforglipron, a once-daily oral GLP-1 small molecule, and retatrutide, a GGG tri-agonist and some mid-stage candidates, bimagrumab, eloralintide and mazdutide.

Lilly has already announced positive data from two out of the seven phase III studies on orforglipron in patients with type II diabetes and obesity involving over 3,600 participants. In the first study, called ACHIEVE-1, in type II diabetes patients, orforglipron lowered A1C by an average of 1.3%-1.6% across doses and also reduced weight by an average of 16lb (7.9%) at the highest dose. Top-line data from the second study called ATTAIN-1 in people with obesity (but without type II diabetes), announced in August, showed that patients taking the highest dose of orforglipron lost more than 27 pounds or 12.4% of their body weight.

However, the 12.4% weight loss achieved with the highest 36 mg dose of Lilly’s oral GLP-1 candidate, orforglipron in the ATTAIN-1 study fell short of investor expectations. Investors were probably expecting orforglipron to match Wegovy’s average weight loss in a range of 13-15% or even exceed that percentage. Patient discontinuation rates in the study were also considered high, with as high as 24.4% of patients in the 36 mg dose arm discontinuing treatment. Orforglipron is being viewed as a key candidate in Lilly's obesity pipeline, which has the potential to transform the obesity treatment space as both Zepbound and Wegovy are weekly injections.

No doubt, the weight-loss pill data was a disappointment. Many investors feel that the potential market for orforglipron is now less than previously expected. However, some investors feel the market reaction to the data was overblown and perceive that orforglipron may be used for maintenance therapy after patients lose weight with injectable products like Zepbound or Wegovy. Orforglipron has the potential to be approved as it has shown efficacy and safety consistent with injectable GLP-1 therapies while offering the convenience of a once-daily pill. There is significant demand for single oral pills for weight loss that can be manufactured at scale to meet global demand.

Lilly plans to report data from four additional orforglipron phase III studies in diabetes and obesity over the next five months. Lilly plans to file regulatory applications for orforglipron in obesity in the fourth quarter of 2025 and for type II diabetes in the first half of 2026.

It is also evaluating orforglipron in late-stage studies in other disease areas like obstructive sleep apnea and hypertension and also plans to initiate a new phase III study in people with knee osteoarthritis pain in overweight or obesity later this year.

Lilly is conducting late-stage studies on its other key candidate, retatrutide, a GGG tri-agonist, in obesity, obstructive sleep apnea, knee osteoarthritis, chronic low back pain and type II diabetes. It expects the first data readout from a phase III study on retatrutide in osteoarthritis of the knees later in 2025.

In conclusion, Lilly has a deep pipeline in obesity and diabetes with a range of oral and injectable medications with different mechanisms of action. We believe the orforglipron setback, though quite big, is not the end of the road for Lilly’s obesity pipeline plans.

Several other companies, like Amgen AMGN and Viking Therapeutics VKTX, are also making rapid progress in the development of more potent and convenient GLP-1-based candidates in their clinical pipeline.

Amgen is developing MariTide, a GIPR/GLP-1 receptor, as a single dose in a convenient autoinjector device with a monthly and maybe less frequent dosing. In March, Amgen initiated two phase III studies on MariTide in obesity as part of its comprehensive MARITIME phase III program. Since June, Amgen has initiated two more phase III studies in other obesity related conditions.

Viking Therapeutics’ dual GIPR/GLP-1 receptor agonist, VK2735, is being developed both as oral and subcutaneous formulations for the treatment of obesity. The company recently announced mixed top-line results from a mid-stage study evaluating the safety and efficacy of the oral formulation of VK2735. Though patients on the highest drug dose lost up to 12.2% of their body weight after 13 weeks of daily dosing compared with 1.3% in the placebo group, a significant number of patients also dropped out of the study.

Phase III obesity studies with the subcutaneous formulation of VK2735 were recently initiated.

NVO, LLY and VKTX are racing to introduce oral weight-loss pills, as Wegovy and Zepbound are both injectable drugs. Novo Nordisk has already filed a new drug application (NDA) for an oral version of Wegovy and also has several next-generation candidates in its obesity pipeline, like CagriSema (a combination of semaglutide and cagrilintide) and an oral pill, amycretin (a dual GLP-1 and amylin receptor agonist). The FDA is expected to decide on the Wegovy oral formulation NDA in the fourth quarter.

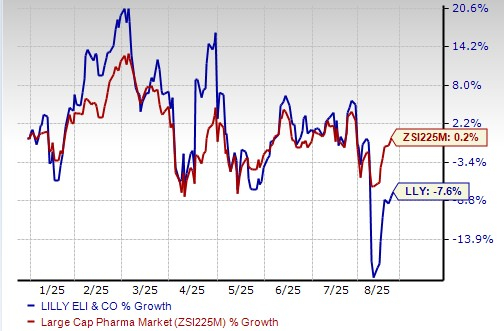

Lilly’s stock has declined 7.6% so far this year against the industry’s increase of 0.2%.

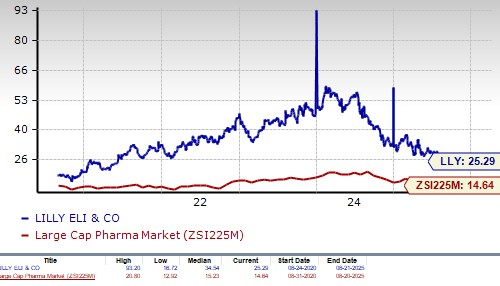

From a valuation standpoint, Lilly’s stock is expensive. Going by the price/earnings ratio, the company’s shares currently trade at 25.29 forward earnings, higher than 14.64 for the industry. However, the stock is trading below its 5-year mean of 34.54.

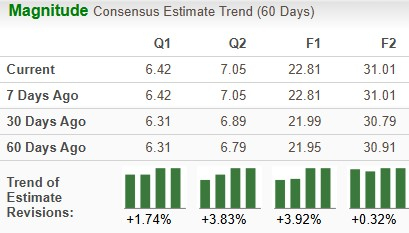

Estimates for Lilly’s 2025 earnings have risen from $21.99 to $22.81 per share in the past 30 days, while those for 2026 have risen from $30.79 to $31.01 over the same timeframe.

Lilly has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-23 | |

| Feb-23 | |

| Feb-23 |

Hims & Hers Health Fourth-Quarter Sales Rise, Gives Soft First-Quarter Guidance

NVO -16.43%

The Wall Street Journal

|

| Feb-23 |

Stocks to Watch Monday Recap: Diamondback, Netflix, Novo Nordisk, Lilly

NVO -16.43% LLY

The Wall Street Journal

|

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 |

Novo Nordisk Dives As Next-Gen Obesity Drug Lags Eli Lilly's Kingpin

NVO -16.43% VKTX +11.05% LLY

Investor's Business Daily

|

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite