|

|

|

|

|||||

|

|

Pinterest PINS and Meta Platforms, Inc. META are both major players in the evolving social media space. Operating as one of the leaders in the social commerce domain, Pinterest offers its viewers visual recommendations on a variety of subjects like weddings, fashion, or fitness. The company has gained significant popularity among Gen Z and millennials who are more active on immersive mobile platforms. The platforms have been endorsed by advertisers and retailers across multiple domains who are aiming to target this specific customer segment.

Meta Platform is the world’s largest social media platform offering services through multiple popular applications such as Facebook, Instagram and WhatsApp. Owing to its worldwide strong presence and greater reach, it has created a strong foothold in the digital advertising space.

According to a report by Grand View Research, the global social commerce market is expected to reach $17.83 trillion by 2033, witnessing a CAGR of 36.4% from 2025 to 2033. The social media giants like Pinterest and META are intensifying their efforts to gain a firmer footing in this expanding market.

Pinterest is increasingly establishing a unique value proposition to advertisers that could provide a competitive advantage in the long run. Through various innovations, it continues to dramatically improve the advertising platform, which presently appears to be one of the best ad platforms for consumer discretionary brands looking for new ways to reach customers and stretch smaller ad budgets.

The company has witnessed consistent user growth across all regions in the past several quarters. In the second quarter of 2025, global monthly active users (MAUs) reached 578 million, a record high for the company. Pinterest is taking various initiatives to bring more actionable content on the platform from a wide range of sources such as users, creators, publishers and retailers. This has resulted in a solid improvement in engagement metrics like sessions, impressions and saves across all regions.

Pinterest's debt-to-capital ratio stands at 0.0%. Its current ratio stands at 8.76, while its cash ratio is 6.62. As of June 30, 2025, Pinterest had $1.21 billion in cash and cash equivalents and $137.4 million of operating lease liabilities.

However, the company faces fierce competition from other social media giants such as META, SNAP Inc. SNAP and X.com. META and SNAP both have a strong presence in the social ecommerce space. To gain a competitive edge and enhance its global reach, Pinterest has been aggressively expanding into new markets and introducing new AI-powered tools for advertisers. This is increasing user engagement but also driving up expenses. In the second quarter, Total costs and expenses were $1 billion, up from $875.1 million in the year-ago quarter. On a GAAP basis, research and development expenses rose to $359.6 million from $312.8 million. This is straining its margin.

Moreover, Pinterest heavily relies on advertising as its primary source of revenue. Its net sales are affected by seasonality, and despite signs of stabilization, the recovery of the digital ads market remains.

META connects with a large user base worldwide. During the second quarter of 2025, Family Daily Active People or DAP, defined as a registered and logged-in user who visited at least one of the Family products (Facebook, Instagram, Messenger and/or WhatsApp) on a given day, was 3.48 billion, up 6.4% year over year. Access to such a large user base makes META ideal for broad campaigns and global brands.

META is also steadily investing in an AI capability to increase engagement across its platforms. Improvements in AI-powered recommendation systems have led to 5% increase in time spent on Facebook and 6% on Instagram in the second quarter of 2025. Meta Advantage +, which offers a suite of advertising products that optimize campaign performance in Facebook and Instagram, leveraging AI, is gaining strong popularity. META’s Instagram has emerged as one of the primary competitors for Pinterest. Instagram has strong e-commerce integration, enabling users to shop directly from posts.

Meta boasts a robust balance sheet. As of June 30, 2025, cash & cash equivalents and marketable securities were $47.07 billion. Its current ratio stands at 1.97. A current ratio above 1 suggests that a company is well-positioned to meet its short-term obligations. Debt to capital ratio stands at 12.9% compared to the industry’s 15.8%. Meta’s strong liquidity position will enable it to make further investments in product development and acquisitions in the future.

However, macroeconomic challenges and tariff uncertainties remain a concern for the company’s advertising business. META is also facing stiff competition from YouTube, Snap and Pinterest.

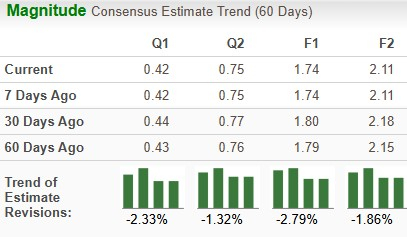

The Zacks Consensus Estimate for Pinterest’s 2025 sales and EPS implies year-over-year growth of 15.62% and 34.88%, respectively. The EPS estimates have declined over the past 60 days.

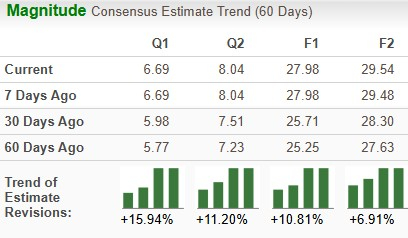

The Zacks Consensus Estimate for META’s 2025 sales implies year-over-year growth of 19.1%, while EPS implies a growth of 17.27% year over year. The EPS estimates have improved over the past 60 days.

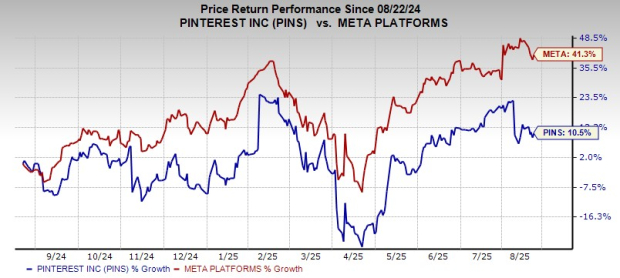

Over the past year, Pinterest has gained 10.5% while Meta has surged 41.3% over the same period.

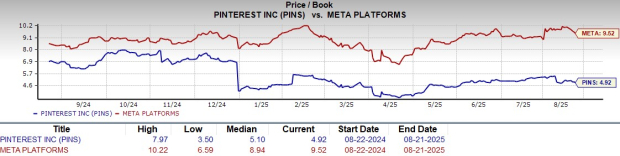

PINS looks more attractive than META from a valuation standpoint. Going by the price/book ratio, PINS’s shares currently trade at 4.92 book value, lower than 9.52 for Meta.

Pinterest and META carry a Zacks Rank #3 (Hold) each at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Both companies are taking several strategic initiatives to drive user engagement across the platform. Upward estimate revisions showcase growing investors' confidence in Meta. With a strong AI focus, improvement in monetization opportunities, and better price performance, Meta appears to be a better investment option.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 |

Mark Zuckerberg Grilled on Usage Goals and Underage Users at California Trial

META

The Wall Street Journal

|

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite