|

|

|

|

|||||

|

|

Howmet Aerospace Inc. HWM and L3Harris Technologies, Inc. LHX are two prominent names operating in the aerospace and defense industry. While Howmet is a leading manufacturer of components and systems for jet engines and airframes, L3Harris offers integrated technologies, including avionics, electronic systems, and command and control systems, in the United States and internationally.

Both companies have been enjoying significant growth opportunities in the aerospace and defense space on account of the improving air traffic trend and the expansionary U.S. budgetary policy. But which one is a better investment today? Let’s take a closer look at their fundamentals, growth prospects and challenges to make an informed choice.

The strongest driver of Howmet’s business at the moment is the commercial aerospace market. The persistent strength in air travel has been driving demand for wide-body aircraft, in turn, supporting continued OEM spending. Pickup in air travel has been favorable for the company as the increased usage of aircraft spurs spending on parts and products that it provides.

Revenues from the commercial aerospace market increased 8% year over year in the second quarter of 2025, constituting 52% of its business. The sustained strength was attributed to new, more fuel-efficient aircraft with reduced carbon emissions and increased spare demand for engines. The Boeing Company BA is also anticipated to witness a gradual production recovery, particularly in the Boeing 737 MAX aircraft, which is likely to boost demand for Howmet’s products in the market.

Howmet is also benefiting from solid momentum in the defense business, cushioned by steady government support. HWM continues to witness robust orders for its engine spares for the F-35 program and other legacy fighters. Revenues from the defense aerospace market surged 21% year over year in the second quarter, constituting 17% of the company’s business.

It's worth noting that in July 2025, the House of Representatives passed the fiscal year 2026 Defense Appropriations Act, providing a total discretionary allocation of $831.5 billion. Such robust budgetary provisions set the stage for Howmet, which remains focused on its defense business to win more contracts, which is likely to boost its top line.

HWM’s commitment to rewarding its shareholders through dividend payouts and share buybacks is also encouraging. In the first half of 2025, it paid dividends worth $83 million and repurchased shares for $300 million. In January 2025, the company hiked its quarterly dividend by 25% to 10 cents per share.

Also, in July 2024, Howmet’s board approved an increase in the share repurchase program by $2 billion to $2.487 billion of its common stock. As of July 2025, HWM’s total share repurchase authorization available was $1.8 billion.

The company’s shareholder-friendly policies are supported by its healthy liquidity position. Exiting the second quarter, Howmet’s cash equivalents and receivables were $545 million, much higher than its short-term maturities of $5 million. In the first six months of the year, HWM generated net cash of $699 million from operating activities, while its free cash flow totaled $478 million.

L3Harris is well-positioned to benefit from solid U.S. budget funding provisions. The company claims that its Hypersonic and Ballistic Tracking Space Sensor satellite, known as HBTSS, launched in February 2024, is the only proven on-orbit system capable of tracking the new-range hypersonic missiles. This should provide it with a competitive edge in becoming the primary contractor for the Golden Dome program.

Notably, the company completed a $125 million expansion at its space manufacturing facility in Fort Wayne, IN, in April 2025, to support the Department of Defense’s urgent need for on-orbit technology to defend the homeland by building the “Golden Dome.”

While the company boasts a solid position in the U.S. defense space, its international presence also remains significant. Evidently, during the second quarter of 2025, the company’s international revenues accounted for approximately 20.7% of its total revenues. L3Harris continues to witness strong demand for its defensive solutions from Asia-Pacific, Latin America and South America, as well as the NATO allies of the United States.

During second-quarter 2025, L3Harris secured software-defined radio awards worth $181 million and $214 million, respectively, from the German and Czech armed forces. The company also signed a memorandum of understanding with Thales UK to develop an integrated short-range air defense (SHORAD) command and control capability.

However, the company’s highly leveraged balance sheet remains a major concern. Exiting second-quarter 2025, L3Harris’ cash and cash equivalents amounted to $0.48 billion. On the other hand, its long-term debt of $10.98 billion remained much above the cash balance. Its current debt of $1.13 billion also came in higher than its cash reserve.

Persistent shortage of labor in the aerospace-defense industry continues to pose a threat. Due to such labor shortages, manufacturing companies like L3Harris, which supply critical components for the aerospace and defense industry, might be unable to deliver the finished products within the stipulated timeline, which may impact their performance.

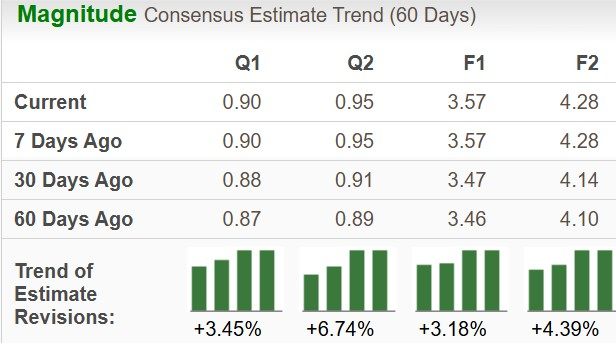

The Zacks Consensus Estimate for HWM’s 2025 sales and earnings per share (EPS) implies year-over-year growth of 9.4% and 32.7%, respectively. HWM’s EPS estimates for both 2025 and 2026 have increased over the past 60 days.

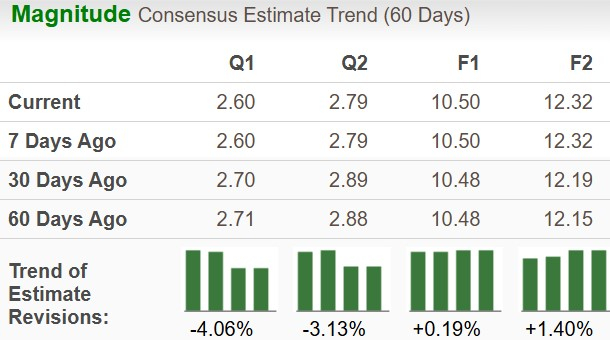

While the Zacks Consensus Estimate for LHX’s 2025 sales indicates year-over-year growth of 2%, the EPS estimate implies a decline of 19.9%. LHX’s EPS estimates have been trending northward over the past 60 days for both 2025 and 2026.

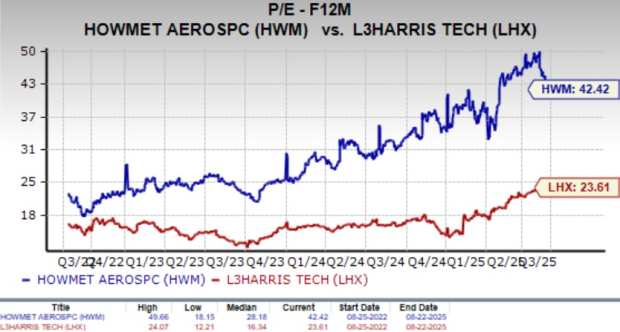

In the past year, Howmet shares have soared 76.9%, while L3Harris stock has gained 20.4%.

HWM is trading at a forward 12-month price-to-earnings ratio of 42.42X, above its median of 28.18X over the last three years. LHX’s forward earnings multiple sits at 23.61X, above its median of 16.34X over the same time frame.

L3Harris’ strength in the aerospace and defense markets has been dented by the continued supply-chain challenges and labor shortages. The company’s solid momentum in domestic and international markets adds to its strength. However, its high debt profile remains a major constraint.

In contrast, Howmet’s market leadership position and strength in both commercial and defense aerospace markets provide it with a competitive advantage to leverage the long-term demand prospects in the aerospace market. Despite its steeper valuation, HWM holds robust prospects due to strong estimates, stock price appreciation and better prospects for sales and profit growth.

Given these factors, HWM seems to be a better pick for investors than LHX currently. While HWM currently carries a Zacks Rank #2 (Buy), LHX has a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 13 min | |

| 13 min | |

| 14 min | |

| 1 hour | |

| 2 hours | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite