|

|

|

|

|||||

|

|

The semiconductor companies are at the core of the AI revolution as they offer solutions that enable improved processing power and efficiency to manage AI workloads. Amid rapid AI proliferation, investors are increasingly focusing on companies that offer the infrastructure behind it. Both Credo Technology Group Holding Ltd CRDO and Broadcom AVGO are key players in this domain, but operate from very different positions of scale and maturity.

Credo represents an emerging growth story, while Broadcom is a semiconductor giant. Credo lies at the intersection of AI and data center build-outs with its active electrical cables (AECs), optical Digital Signal Processors (DSPs), and PCIe retimers solutions that address the growing need for high-speed, low-power connectivity in the data center space. On the other hand, Broadcom boasts a highly diversified business with a strong presence in the AI chip development space.

Both companies bring to the table unique strengths, which makes this an intriguing comparison for investors.

So, now the question arises: Which stock makes a better investment pick at present? Let’s dive into the fundamentals, valuations, growth outlook and risks for each company.

Credo is positioned to gain from the increasing demand for high-speed connectivity solutions in AI and cloud data centers. Moreover, the system-level approach provides it with a strong competitive moat. It owns the entire stack of SerDes IP, Retimer ICs, system-level design, qualification and production. This integrated approach allows faster innovation cycles and strong cost efficiency.

CRDO’s growth is fueled by the strength of its AEC business. The demand for AECs is increasing as ZeroFlap AECs offer more than 100 times improved reliability than laser-based optical solutions. This made AECs an increasingly attractive option for data center applications, contributing to the new expansion of AEC usage and further solidifying Credo Technology’s position in the market. With demonstration of PCIe Gen6 AECs and increasing hyperscaler interest, this product line is expected to remain a growth engine going forward.

Strength in the optical business, particularly DSPs, and PCIe retimers and Ethernet retimers business is another tailwind. On the last earnings call, CRDO announced that it achieved a key 800-gig transceiver DSP design win and unveiled ultra-low-power 100-gig per lane optical DSPs built on 5-nanometer technology. CRDO highlighted that this particular suite, including full DSP and linear receive optics or LRO variants, sets “new industry benchmarks for power efficiency.” CRDO expects its 3-nanometer 200-gig-per-lane optical DSP (port speeds up to 1.6 terabits per second) to boost the industry’s transition to 200-gig lane speeds. Shift to 100 gig per lane solutions and higher demand for system-level expertise and software capabilities for dealing with AI-optimized architectures bode well for CRDO’s retimer business.

Credo ended fiscal 2025 with a fortified balance sheet boasting a cash position of $431.3 million and no debt. For a company riding the AI infrastructure wave, this liquidity is a potential accelerator to seize revenue opportunities. For fiscal 2026, Credo anticipates revenues to surpass $800 million, implying more than 85% year-over-year growth. Non-GAAP operating expenses are expected to grow at less than half the revenue growth rate, driving non-GAAP net margin to nearly 40%.

However, the fierce competitive landscape and global macroeconomic uncertainties amid tariff troubles remain overhangs. Credo operates at a much lower scale, exposing it to customer concentration risk. In the fiscal fourth quarter, three customers contributed more than 10% of revenues each, and management expects this pattern to persist. A change in spending or in-house solution from one of these customers could materially affect revenue numbers. Also, two new hyperscaler ramps, a key part of fiscal 2026 guidance, are not expected until the year's second half. This leaves the first half dependent on existing customers, raising the risk that delays in the ramps could lead to a guidance miss.

AI semiconductor revenue growth and VMware’s continued traction are the two long-term tailwinds for AVGO. Semiconductor revenues came in at $8.4 billion in the second quarter of fiscal 2025, increasing 17% year over year. Within this, AI semiconductor revenues hit $4.4 billion, a 46% year-over-year increase. Management guided that AI semiconductor revenues in the third quarter will rise to $5.1 billion, up 60% year over year.

Custom AI accelerators' or XPUs revenues rose by double digits year over year. AVGO sees massive opportunities in the AI space as its three hyperscaler customers have started to develop their own XPUs. These hyperscalers are significantly ramping up investment in their next-generation frontier models, which do require high-performance accelerators and AI data centers with larger clusters. Management reaffirmed expectations that at least three customers will each deploy one million AI accelerator clusters by 2027, with a significant percentage being custom XPUs. AVGO expects a surge in XPU demand in the second half of 2026 as hyperscalers double down on inference workloads.

AI networking, based on Ethernet, represented 40% of AI revenues and was up more than 170% year over year. Broadcom’s Tomahawk switches, Jericho routers, and NICs are at the center of hyperscale AI cluster deployments. It recently started shipping the Jericho4 Ethernet fabric router, which is designed to interconnect over one million XPUs across several data centers. This offers unmatched bandwidth, security, and lossless performance. Tomahawk 6 switch (102.4 Tbps capacity) is a breakthrough solution, enabling hyperscalers to build clusters of more than 100,000 AI accelerators in two tiers instead of three. This translates to better performance, lower latency, higher bandwidth, and reduced power consumption, which are required for training frontier AI models.

Broadcom’s product portfolio spans networking, wireless, broadband, storage, and enterprise software, acting as an absorber for any cyclical shocks. Strong cash flow generation and a robust partner ecosystem give it an extra edge against rivals.

Broadcom expects third-quarter 2025 revenues of $15.8 billion, up 21% year over year. Gross margin is expected to contract nearly 130 basis points sequentially, owing to a higher mix of XPUs within AI revenues. Management reiterated that consolidated gross margins for fiscal 2025 will continue to be influenced by the revenue mix between infrastructure software and semiconductors.

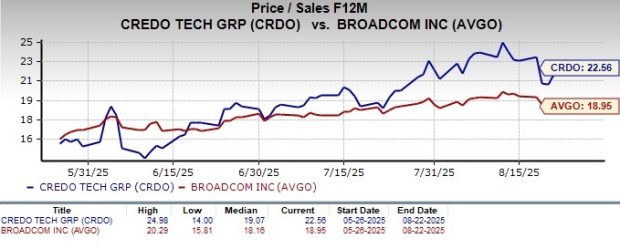

Over the past three months, CRDO and AVGO have registered gains of 84.6% and 28.6%, respectively.

In terms of the forward 12-month price/sales ratio, CRDO is trading at 22.56X, lower than AVGO’s 18.95X.

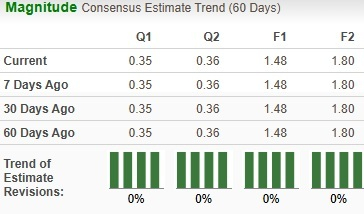

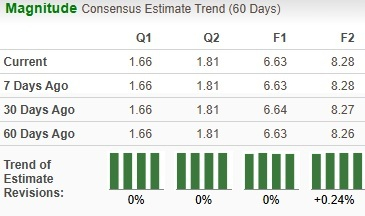

Analysts have kept their earnings estimates unchanged for CRDO and AVGO’s bottom line for the current fiscal in the past 60 days.

Both CRDO and MRVL are well-positioned to gain from the rapidly growing AI-driven data center market.

AVGO at present carries a Zacks Rank #2 (Buy), while CRDO has a Zacks Rank #3 (Hold). Consequently, in terms of Zacks Rank, AVGO seems to be a better pick at the moment.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 44 min | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite