|

|

|

|

|||||

|

|

Navitas Semiconductor NVTS and Analog Devices ADI are benefiting from growing semiconductor sales, which are expected to grow double-digit in 2025, per the Semiconductor Industry Association. Second-quarter 2025 sales increased 7.8% sequentially, reflecting strong global chip sales, which are expected to benefit from the rapid adoption of AI servers, GPUs, accelerators and networking chips. This, along with a higher demand for chips in the automotive industry for electric vehicles (EVs), infotainment and power management, bodes well for both NVTS and ADI.

Navitas offers power semiconductor solutions, particularly gallium nitride (GaN) power ICs under GaNFast, GaNSafe and GaNSense brands, along with silicon carbide (SiC) devices. Analog Devices offers analog, mixed-signal, and digital signal processing (DSP) ICs.

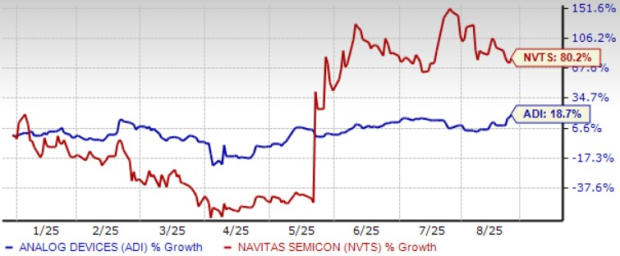

Year to date, Navitas shares have jumped 80.2%, outperforming ADI’s growth of 18.7%. However, over the past month, Analog Devices surged 9.2% significantly outperforming Navitas’ drop of 24.9%.

So, Navitas or Analog Devices, which is a better buy under the current scenario?

Navitas is expected to benefit from growing demand for power that is served by the company’s GaN and SiC technologies. The company believes that the transition toward AI data center and energy infrastructure markets will take multiple quarters. AI data center and related energy infrastructure opportunities represent a very sizable $2.6 billion per year market opportunity for the industry as well as NVTS.

Navitas benefits from a rich partner base that includes the likes of NVIDIA, Powerchip and Xiaomi. NVIDIA has selected Navitas to support next-generation 800V data centers. In stage 1, Solid-State Transformers are expected to replace antiquated Low-Frequency Transformers, leveraging Navitas’ unique Ultra-High Voltage SiC to improve the efficiency and robustness of the power grid. In stage 2, 800V DC/DC can leverage Navitas’ high-voltage GaN and SiC, which, combined with new 80-200V GaN, can support the highest efficiency and density. In stage 3, a 48V DC/DC to power an AI processor can utilize Navitas’ new 80-200V GaN to support the highest efficiency and density.

Navitas inked a partnership deal with Powerchip for manufacturing 200mm (eight-inch) 180nm GaN to support plans for higher levels of integration at a lower cost and greater capacity. Over the next couple of years, NVTS expects high-voltage customers to transition to Powerchip's eight-inch factory, which can produce nearly 80% more chips per wafer compared to existing TSMC’s six-inch for little incremental cost. This is expected to boost Navitas’ gross margin.

However, Navitas’ third-quarter 2025 revenues of $10 million (+/- $0.5 million) reflect adverse impacts from China tariff risks for its SiC business and its strategic decision to deprioritize lower-margin China mobile business.

ADI is benefiting from its strong market position in high-performance analog, especially in the industrial, communications infrastructure and consumer markets. The strong momentum across the industrial and automotive end markets, especially the EV space, is growing on the back of its robust Battery Management System solutions.

Automotive, Analog Devices’ second-largest segment at 30% of revenues, continues to benefit from growing semiconductor content in EVs, advanced driver assistance systems and in-cabin connectivity. The company expects a record level of automotive revenues for 2025.

For the industrial segment, which accounted for 44% of Analog Devices’ third-quarter fiscal 2025 revenues, ADI now expects double-digit year-over-year growth, benefiting from more than $1 billion industrial automation business. The robotics market is expected to see double-digit growth for the foreseeable future that benefits Analog Devices’ prospects.

ADI benefits from strong liquidity with a cash balance of $2.32 billion as of Aug. 2, 2025, and free cash flow of $1.09 billion in the third quarter of fiscal 2025.

The Zacks Consensus Estimate for ADI’s fiscal 2025 earnings is pegged at $7.69 per share, up 4% over the past 30 days, indicating a 20.5% increase over fiscal 2024’s reported figure.

Analog Devices, Inc. price-consensus-chart | Analog Devices, Inc. Quote

The consensus mark for Navitas’ 2025 loss has widened by a couple of cents to 22 cents per share over the past 30 days. NVTS reported a loss of 22 cents per share in 2024.

Navitas Semiconductor Corporation price-consensus-chart | Navitas Semiconductor Corporation Quote

Both Navitas and Analog Devices are overvalued, as suggested by the Value Score of F.

In terms of forward 12-month Price/Sales, Analog Devices shares are trading at 10.5X, higher than Navitas’ 22X.

Navitas’ near-term prospects are expected to suffer from sluggishness in solar, EV and industrial end-markets, negative impact of tariffs and the removal of tax credits for the solar and EV industry. This, along with Navitas’ focus on strengthening its footprint within the mobile and consumer segments, is expected to hurt near-term financial performance.

Meanwhile, Analog Devices’ third-quarter fiscal 2025 results demonstrated broad-based recovery, margin resilience and strong free cash flow generation. Secular growth drivers in automation, AI infrastructure, and automotive electrification provide multi-year tailwinds.

Currently, Analog Devices has a Zacks Rank #2 (Buy), making the stock a stronger pick compared with Navitas, which has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 8 min | |

| 1 hour | |

| 1 hour | |

| 8 hours | |

| 9 hours | |

| 9 hours | |

| 15 hours | |

| 15 hours | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite