|

|

|

|

|||||

|

|

Navitas Semiconductor NVTS and Advanced Micro Devices AMD are both important players in the semiconductor industry, especially as the industry shifts toward artificial intelligence (AI)-driven computing.

While Navitas Semiconductor focuses on Gallium nitride (GaN) and Silicon carbide (SiC) chips used in next-generation AI data centers and energy systems, Advanced Micro Devices is a leading provider of high-performance Central Processing Unit (CPU) and Graphics Processing Unit (GPU) that power AI training, inference, cloud computing and advanced servers.

Both NVTS and AMD are heavily invested in the new generation of semiconductor chips that are used to power AI. However, from an investment point of view, one stock offers a more favorable outlook than the other right now. Let’s break down their fundamentals, growth prospects, market challenges and valuation to determine which stock offers a more compelling investment case.

Navitas Semiconductor is trying to reposition itself around high-power markets, and its inclusion in NVIDIA’s new 800-volt AI factory ecosystem is an important step. The new architecture shifts data center power distribution from traditional AC/DC stages to a high-voltage DC approach that requires faster, more efficient power electronics. This creates an opening for Navitas Semiconductor’s GaN and high-voltage SiC technologies, both of which are now part of the NVIDIA-led ecosystem.

In the third quarter of 2025, Navitas Semiconductor highlighted that it is one of the few companies offering both GaN and SiC solutions, all the way from the grid to graphics processor units. The company has begun sampling mid-voltage GaN devices at 100 volts, which target the last stage of power conversion inside AI servers. NVTS is also sampling 2.3 kV and 3.3 kV SiC modules for grid and energy storage applications that support these new data center designs.

The company’s decision to deprioritize its lower-margin China mobile business weighs on its near-term prospects. The company is walking away from low-margin mobile products to focus its resources on high-power business. In the third quarter of 2025, revenues were about $10.1 million, down more than 50% from last year due to weak demand and strong pricing pressure in the mobile business, especially in China.

For the fourth quarter of 2025, management projects revenues to be around $7 million, which represents another sequential decline. The company is reducing exposure to low-margin mobile and consumer customers, cutting channel inventory, and consolidating distributors, all of which reduce near-term revenues. The Zacks Consensus Estimate for Navitas Semiconductor’s projected 2026 revenues is pegged at $38.36 million, indicating a year-over-year decline of 15.6%.

Advanced Micro Devices is seeing strong growth in its data center business. In the fourth quarter of fiscal 2025, AMD’s Data Center revenues increased 39% year over year to $5.4 billion. In fiscal 2025, AMD's revenues from the Data Center segment grew 32% on a year-over-year basis.

Growth is coming mainly from EPYC server CPUs. In fiscal 2025, hyperscalers launched more than 500 new AMD-based instances, taking the total number of EPYC-powered instances to nearly 1,600, up more than 50% year over year. In the fourth quarter of fiscal 2025, fifth-generation EPYC CPUs made up more than half of total server CPU revenues. AMD also said that the number of large enterprises deploying EPYC on-premise more than doubled during fiscal 2025.

AMD’s AI GPU business is witnessing strong growth. In the fourth quarter of fiscal 2025, Instinct GPU revenues reached a record level, helped by higher shipments of the MI350 series and the next-generation MI450 platform, which is planned for launch in the second half of fiscal 2026. Management expects this platform to support large-scale AI systems. Over time, AMD expects its Data Center AI business to reach tens of billions of dollars in yearly revenues by 2027.

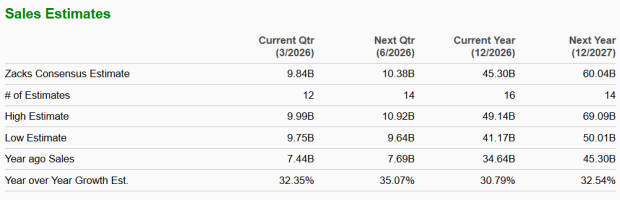

Looking ahead, AMD projects revenues for the first quarter of fiscal 2026 to be around $9.8 billion, implying year-over-year growth of 32%. Management expects Data Center revenues to grow sequentially in the first quarter of fiscal 2026, supported by strong demand for EPYC CPUs and AI GPUs. The Zacks Consensus Estimate for AMD’s fiscal 2026 revenues is pegged at $45.30 billion, indicating a year-over-year increase of 30.8%.

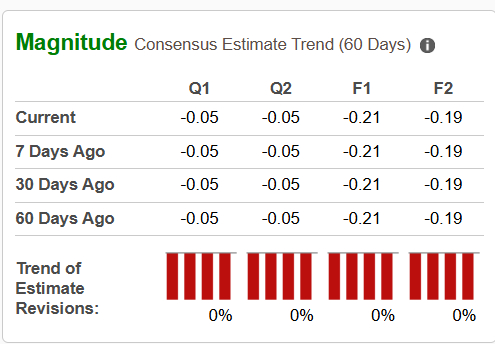

The earnings estimate revision trend for the two companies reflects that analysts are turning more bullish toward Advanced Micro Devices.

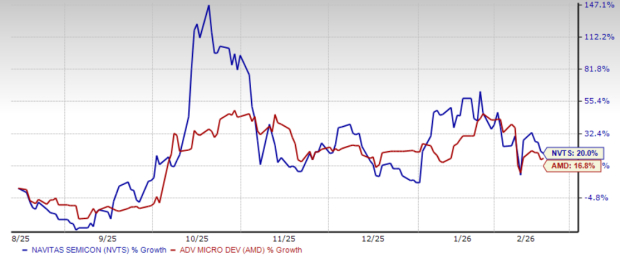

In the past six months, Advanced Micro Devices’ shares have surged 16.8%, and shares of Navitas Semiconductor have risen 20%.

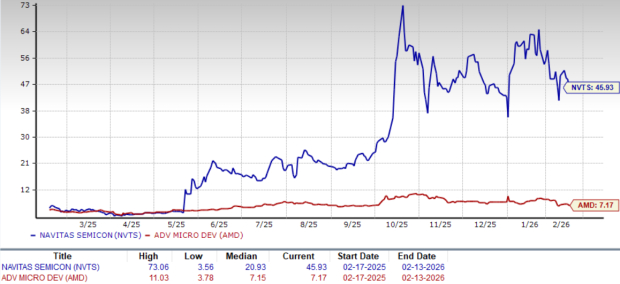

Currently, Advanced Micro Devices is trading at a forward sales multiple of 7.197X, lower than Navitas Semiconductor’s forward sales multiple of 45.93X. Advanced Micro Devices’ reasonable valuation makes it more attractive for investors looking for value and stability.

Navitas Semiconductor and Advanced Micro Devices are both set to ride the long-term growth in AI and data center markets, but their current positions are very different. Currently, Navitas Semiconductor is facing risks of lower revenues and near-term uncertainty as it shifts away from the lower-margin mobile business.

In contrast, Advanced Micro Devices is witnessing strong growth. Its Data Center business is expanding rapidly, driven by EPYC CPUs and growing AI GPU adoption. AMD’s reasonable valuation offers downside protection as well, making it a better choice for investors looking for stability and steady upside.

Currently, Navitas Semiconductor and Advanced Micro Devices carry a Zacks Rank #3 (Hold) each. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 3 hours | |

| 5 hours | |

| 5 hours | |

| 11 hours | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-14 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite