|

|

|

|

|||||

|

|

CONMED Corporation CNMD is well poised for growth in the coming quarters, courtesy of its broad product spectrum. The optimism, led by the solid recurring revenue base and potential in General Surgery, is expected to contribute further. However, headwinds from supply-chain constraints and data security threats persist.

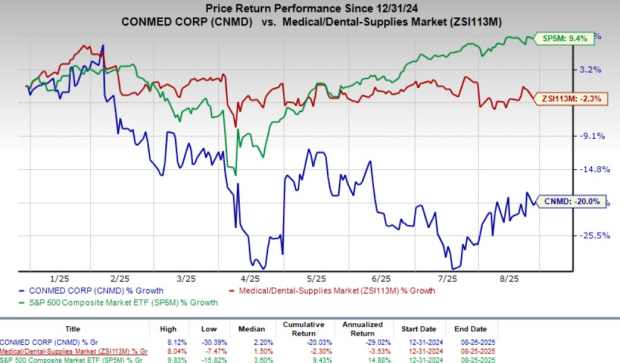

Shares of this Zacks Rank #3 (Hold) company have lost 20% so far this year compared with the industry’s 2.3% decline. The S&P 500 Index has increased 9.4% in the same time frame.

CONMED, a renowned global medical products manufacturer specializing in surgical instruments and devices, has a market capitalization of $1.68 billion. The company projects 7% earnings growth for fiscal 2025 and expects to maintain its strong performance going forward.

Its earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 9.20%.

Revenues Likely to Ride on Macro Tailwinds: CONMED posted revenues of $342.3M (up nearly3% Y/Y) and adjusted EPS of $1.15, both above the guidance, as General Surgery outgrew Orthopedics. Management reiterated a medium to high-single-digit long-term revenue ambition, underpinned by hospital priority for minimally invasive laparoscopy and arthroscopy — key spots for AirSeal, Buffalo Filter, BioBrace and Foot & Ankle.

AirSeal remains the largest single contributor to General Surgery sales growth, primarily due to its usage on nearly 35-40% of procedures done by Intuitive Surgical’s (ISRG) advanced robotic surgical system, da Vinci Xi. AirSeal is already used in 10-20% of procedure done by Intuitive Surgical’s latest robotic surgery system, da Vinci 5. Intuitive Surgical’s da Vici robotic surgery portfolio is one of the leading systems in the world, representing significant prospect for CONMED’s AirSeal. Buffalo Filter continued double-digit growth, aided by “smoke-free OR” legislation — North Carolina became the 19th state, with compliance due by Jan. 1, 2026. In Orthopedics, BioBrace demand stayed double-digit and now spans 52 procedures. The BioBrace RC device for rotator cuff repair moved into full U.S. market release following favorable surgeon feedback. Foot & Ankle posted its third straight quarter of double-digit growth as supply stabilized.

Supply-chain friction that hurt U.S. Orthopedics is easing, with SKUs on backorder declining. Meanwhile, a top-tier ops program targets over $20 million in annual savings and aims to turn the supply chain into a competitive asset. Management struck a constructive tone on the rest of 2025, supported by narrowing FY25 revenue guidance ($1.356-$1.378 billion) and expectations of steady back-half improvement.

Expanding Margins Look Promising:Second-quarter adjusted gross margin rose 120 bps year over year to 56.5% on better product mix and efficiency, with the company mapping a path toward nearly 57% in the fourth quarter on an ex-tariff basis (mid-55s including tariffs). Adjusted SG&A was 37.1% of sales, and R&D was 4.1%. The margin is likely to be affected by procurement, planning, production discipline, and portfolio mix, with tariffs and FX explicitly included in guidance. The adjusted EPS guidance was raised by 9 cents versus last quarter, evenly split across FX, tariffs, and operational outperformance. Leverage improved to nearly 3.1x, with a sub-3.0x target by full-year 2025.

Solid Recurring Revenue Base: CNMD’s revenues are heavily driven by disposables, which hospitals favor for infection control and workflow economics. Within General Surgery, AirSeal carries a nearly 92% recurring revenue profile, and Buffalo Filter’s installed base plus tightening smoke-evacuation standards reinforce the annuity stream. Capital placements was softer on tough comps (a prior insufflation market recall, distributor ramp last year) and some residual supply constraints — ironically a setup that tends to seed future disposable pull-through as availability normalizes.

Regulatory & Tariff Pressures: As a Class II device manufacturer, CNMD is subject to periodic FDA and international inspections, which can introduce cost and operational risk. The more quantifiable headwind this year is tariffs — management now expects unfavorable impact of nearly 2 cents EPS in third-quarter and 7 cents in fourth-quarter, which also tempers the gross-margin cadence (third-quarter mid-55s; fourth-quarter mid-55s, including tariffs). While FX modestly improved versus prior assumptions, tariffs remain a tangible drag for the second half of 2025.

Data Security Threats: Like peers, CNMD’s reliance on enterprise IT and connected devices leaves it exposed to cybersecurity risks that could disrupt operations or compromise sensitive data. While no new incident was disclosed, management’s standard risk framing reminds that cyber events can have financial and reputational consequences — an evergreen consideration for med-tech investors.

CONMED Corporation price | CONMED Corporation Quote

CONMED is witnessing a rising estimate revision trend for 2025. In the past 30 days, the Zacks Consensus Estimate for earnings has moved north 4 cents to $4.46 per share.

The Zacks Consensus Estimate for third-quarter 2025 revenues and EPS is pegged at $335.6 million and $1.06, respectively, suggesting 5.6% and 1% growth from the year-ago reported numbers.

Some better-ranked stocks in the broader medical space that have announced quarterly results are Medpace Holdings, Inc. MEDP, West Pharmaceutical Services, Inc. WST and Boston Scientific Corporation BSX.

Medpace Holdings, sporting a Zacks Rank of 1 (Strong Buy), reported second-quarter 2025 EPS of $3.10, beating the Zacks Consensus Estimate by 3.3%. Revenues of $603.3 million outpaced the consensus mark by 11.5%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Medpace Holdings has a long-term estimated growth rate of 11.4%. MEDP’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 13.9%.

West Pharmaceutical reported second-quarter 2025 adjusted EPS of $1.84, beating the Zacks Consensus Estimate by 21.9%. Revenues of $766.5 million surpassed the Zacks Consensus Estimate by 5.4%. It currently flaunts a Zacks Rank #1.

West Pharmaceutical has a long-term estimated growth rate of 8.5%. WST’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 16.8%.

Boston Scientific reported second-quarter 2025 adjusted EPS of 75 cents, beating the Zacks Consensus Estimate by 4.2%. Revenues of $5.06 billion surpassed the Zacks Consensus Estimate by 3.5%. It currently carries a Zacks Rank #2 (Buy).

Boston Scientific has a long-term estimated growth rate of 14%. BSX’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 8.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite