|

|

|

|

|||||

|

|

Supportive government policies, rapidly rising electricity demand, offshore wind expansion, and the improving economics of wind technology are fueling unprecedented investment in the wind industry amid the relentless global shift toward clean energy. GE Vernova (GEV) and Vestas Wind Systems (VWDRY), two prominent wind turbine manufacturers, are capitalizing on this investment trend by advancing the scale and efficiency of their turbines while expanding their geographic reach.

GE Vernova stands out as a U.S.-based energy leader, offering a broad portfolio that spans onshore and offshore wind, grid and storage solutions, as well as next-generation power technology ranging from hydro to nuclear. On the other hand, Vestas Wind Systems, a Danish wind power giant, focuses singularly on the design, manufacturing, installation and service of wind turbines.

Against this backdrop, both GEV and VWDRY offer access to the core of the green energy transition. To see which one offers better prospects right now, we need to look at their strengths and weaknesses, outlined below.

GE Vernova’s cash and cash equivalents as of June 30, 2025, totaled $7.89 billion, while both the current and long-term debt values were nil. A comparative analysis of these figures reflects that GE Vernova boasts a strong solvency position, which, in turn, should enable the company to duly meet its commitment to invest $9 billion in cumulative research and development (R&D) and capital expenditure through 2028.

As part of this plan, GE Vernova’s Wind segment aims to invest nearly $100 million in its manufacturing facilities in Pensacola, FL; Schenectady, NY; and Grand Forks, ND, as well as in its remanufacturing facility in Amarillo, TX. GEV also has plans to invest a total of nearly $20 million to expand capacity at its Grid Solutions facilities in Charleroi, PA, which should duly support the smooth integration of renewable electricity across the United States.

On the other hand, Vestas Wind Systems had cash and cash equivalents of approximately $3.54 billion as of June 30, 2025. As of the same date, the company’s long-term debt totaled approximately $3.03 billion, while its current debt was nearly $0.87 billion. A comparative analysis of these figures implies that VWDRY also boasts a solid solvency position, which should enable it to invest in product innovation and ramp up its manufacturing capacity for existing products, such as the V236-15.0 megawatt (MW) platform, to seize expanding market opportunities.

In terms of growth drivers, increasing demand for both offshore and onshore wind is boosting the overall prospect for the wind industry, as renewables are steadily outperforming fossil-fuel-based electricity in terms of cost-effectiveness. This demand trend should benefit both GEV and VWDRY as both are making notable efforts to expand their business reach in the wind industry.

In May 2025, it was announced that Vestas will acquire a blade factory from GEV’s LM Wind Power business in Goleniów, Poland. While this deal will strengthen VWDRY’s European manufacturing capacity to meet rising wind energy demand, for GE Vernova, it streamlines operations and frees up capital to reinvest in core EU facilities, enhancing focus on producing wind products for European customers.

Apart from the growth traits of the wind energy industry, increasing demand for efficient grid and storage solutions, along with rising use of non-fossil energy sources like hydro and nuclear, has been playing the role of an additional growth catalyst for GEV. VWDRY lags behind as it remains solely focused on wind turbine development and associated services.

Since both GEV and VWDRY operate in the wind industry, they share some common risks. Notably, the offshore wind segment has been witnessing rising material costs, persistent supply-chain issues, and regulatory delays, thereby impacting project viability and causing delays in hitting ambitious deployment targets. This remains a major risk for wind stocks like GEV and VWDRY.

Further, the already disruptive supply chain of the industry has been exacerbated by the increased import tariffs imposed by the U.S. government in early 2025, which bears every possibility of further pushing up the costs of raw materials, installation as well as delay in project completion.

Apart from these shared risks, GEV faces some unique threats on account of its diversified portfolio, particularly from its nuclear exposure. Since GEV’s operations involve the handling, use, transportation, and disposal of radioactive and hazardous materials, including nuclear fuel, nuclear power devices and their components, the company is subject to international, federal, state, and local regulations governing the usage and disposal of such materials. If GEV fails to follow any of these regulations, or if damage occurs during the transport or disposal of these materials, the company may face significant costs.

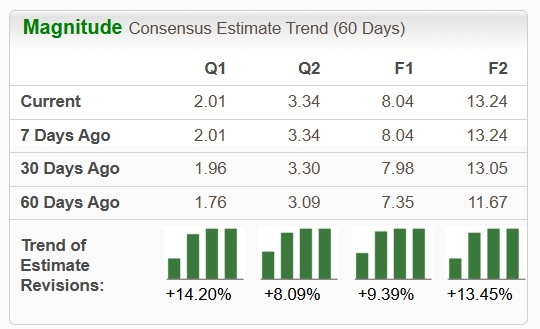

The Zacks Consensus Estimate for GE Vernova’s 2025 sales and earnings per share (EPS) implies an improvement of 6.7% and 44.1%, respectively, from the year-ago quarter’s reported figures. The stock’s near-term EPS estimates have also moved north over the past 60 days.

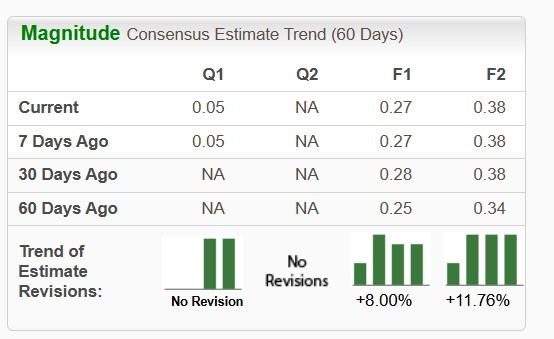

The Zacks Consensus Estimate for Vestas Wind Systems' 2025 sales implies a year-over-year improvement of 20.5%, while that for earnings suggests a rise of 50%. The stock’s bottom-line estimates for 2025 and 2026 have moved north over the past 60 days.

GEV (up 8.9%) has underperformed VWDRY (up 31.1%) over the past three months but has outperformed the same in the past year. Shares of GEV have surged 18.4%, while those for VWDRY have lost 8.8% over the said period.

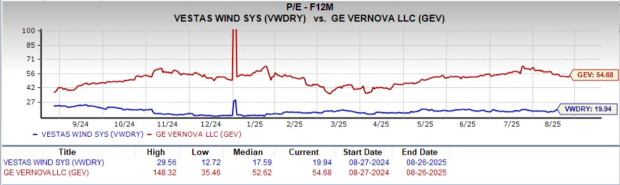

VWDRY is trading at a forward earnings multiple of 19.94, much below GE Vernova’s forward earnings multiple of 54.68.

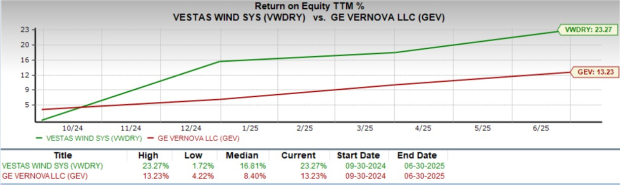

A comparative analysis of both these stocks’ Return on Equity (ROE) suggests that VWDRY is more efficient at generating profits from its equity base compared to GEV.

Both GE Vernova and Vestas Wind Systems remain central players in the clean energy transition, yet their appeal differs across key metrics.

GE Vernova boasts a debt-free balance sheet, diversified exposure across wind, grid, hydro, and nuclear, and improving earnings estimates, though its premium valuation and nuclear-related risks temper near-term efficiency. While GEV has outperformed Vestas over the past year, VWDRY has delivered stronger recent momentum over the past quarter. Vestas, with its pure-play wind focus, superior ROE, and more attractive valuation, offers capital efficiency but less diversification.

Thus, investors seeking long-term diversified growth may lean toward GEV, while those favoring near-term momentum and value could prefer VWDRY.

Both GEV and VWDRY stocks carry a Zacks Rank #3 (Hold) at present. You can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 4 hours | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-22 |

How Will Dow Jones Futures Open After Trump Hikes Global Tariff To 15%?

GEV

Investor's Business Daily

|

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite