|

|

|

|

|||||

|

|

Charles Schwab SCHW and Interactive Brokers Group IBKR are two prominent online brokerage firms offering commission-free trading platforms. Of late, both have been benefiting from heightened market volatility and increased retail investor participation.

While Schwab remains a powerhouse in wealth management, offering a full-service ecosystem trusted by millions of long-term investors, IBKR is a pure-play electronic brokerage player that serves more advanced traders with its comprehensive tools.

With both firms witnessing increases in trading revenues since the beginning of this year, investors are bullish on their near-term growth prospects amid a favorable trading backdrop. So far this year, shares of Schwab have gained 31.4% and the Interactive Brokers stock has rallied 43.3%. Both stocks have fared better than the industry, the Zacks Finance sector and the S&P 500 Index in the same time frame.

Therefore, the question arises: which brokerage stock — Schwab or Interactive Brokers — offers greater upside in the evolving trading market? Let us break down their fundamentals, financial performance, growth prospects and more before taking any decision.

With $10.8 trillion in total client assets (as of June 30, 2025) and a dominant position in both retail brokerage and advisor custody, Schwab benefits from deep client relationships and recurring revenue streams. Its acquisition of TD Ameritrade (“TDA”) in 2020 solidified its leadership among retail and institutional investors.

A key strength of SCHW is its diversified revenue base, which includes net interest income (NII), asset management fees and advisory services fees. Higher interest rates have significantly boosted the company’s net interest margin (NIM). Its focus on repaying high-cost bank supplemental funding balances will further drive NIM in the near term. By June 2025-end, the bank's supplemental funding balance was down 70% to $27.7 billion from the peak of $97.1 billion recorded in May 2023.

Schwab’s registered investment advisor (RIA) custody business is one of the largest in the United States, and demand for independent advisors continues to grow. The integration of TDA enhanced the company’s ability to scale and serve this high-margin segment.

SCHW has been quietly modernizing its platform to appeal to younger investors, with improved digital tools and plans to launch spot Bitcoin and Ethereum trading by mid-2026. This move aligns with changing investor behavior, as clients seek diversification. The company’s scale and trusted platform position it well to serve as a bridge between traditional finance and digital assets, especially as cryptocurrency adoption becomes increasingly mainstream.

Interactive Brokers’ technological superiority remains one of its strongest aspects. The company processes trades in stocks, futures, options and forex on more than 160 exchanges across several countries and currencies.

Superior technology usage has kept IBKR’s compensation expenses relative to net revenues (10.9% in the first half of 2025) below its industry peers. Further, the company has been emphasizing developing proprietary software to automate broker-dealer functions, leading to a steady rise in revenues.

The company’s technological superiority, combined with easier regulations to improve product velocity, will support its net revenues through higher client acquisitions. Net revenues are expected to strengthen further in the quarters ahead, given the solid Daily Average Revenue Trades (DARTs) and robust trading backdrop, driven by higher market participation.

Interactive Brokers is expanding globally with a series of strategic moves. Earlier this month, IBKR launched zero-commission U.S. stock trading in Singapore. Last month, it launched NISA accounts to help Japanese investors build wealth tax-free. In May, it extended the trading hours for Forecast Contracts to nearly 24 hours a day, while in April, it launched the prediction markets hub in Canada to capitalize on the rising demand for event contracts. In November 2024, IBKR introduced Plan d’Epargne en Actions accounts to boost its offerings for its French clients.

The launch of IBKR Lite has enabled investors to trade commission-free and is, thus, expected to improve the company’s market share. The launch of Impact Dashboard, an innovative sustainable investing tool, has made the company the first major brokerage firm to allow investors to align their portfolio with their values easily. The introduction of IBKR Desktop, the next-generation desktop trading application for Windows and Mac, marks a new chapter for innovation.

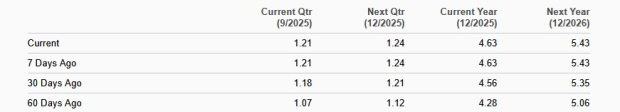

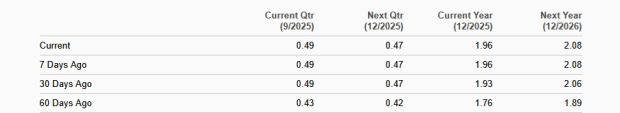

The Zacks Consensus Estimate for Schwab’s 2025 earnings is pegged at $4.63, which indicates year-over-year growth of 42.5%. Earnings estimates for 2026 of $5.43 indicate 17.2% growth. Over the past 30 days, estimates for both 2025 and 2026 have been revised 1.5% upward, respectively.

In comparison to SCHW, analysts are less optimistic about IBKR’s prospects. The consensus estimate for IBKR’s 2025 earnings is $1.96, which indicates 11.4% year-over-year growth. For 2026, the earnings estimate is $2.08, which implies growth of just 6.1%. Earnings estimates for 2025 and 2026 have been revised 1.6% and 1% higher, respectively, over the past 30 days.

Hence, in terms of earnings growth prospects, Schwab clearly has an edge over Interactive Brokers.

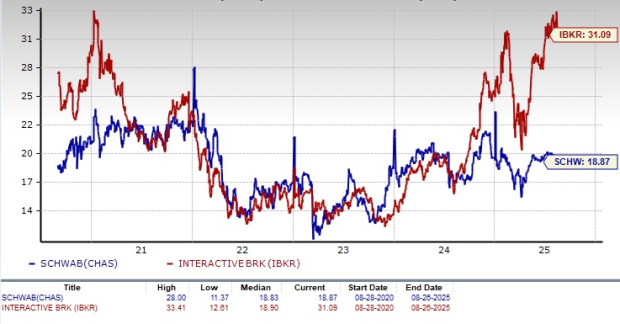

Valuation-wise, SCHW is currently trading at a 12-month forward price-to-earnings (P/E) of 18.87X. The IBKR stock, conversely, is trading at a P/E (F12M) of 31.09X.

While both stocks are trading at a premium to the industry average of 14.63X, the Schwab stock is relatively inexpensive compared with Interactive Brokers.

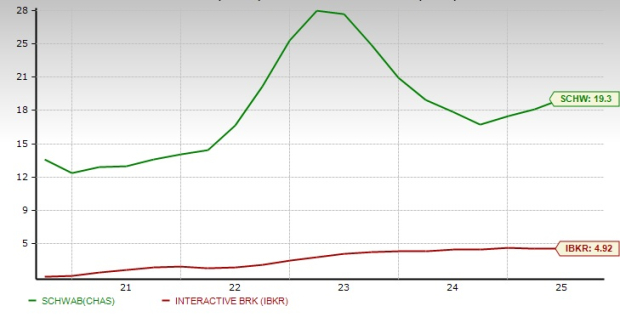

SCHW’s return on equity (ROE) of 19.3% is way above IBKR’s 4.92%. This reflects that Schwab uses shareholder funds more efficiently to generate profits than Interactive Brokers.

Interactive Brokers remains a dominant, tech-driven brokerage, favored by professional and institutional investors. Its global reach, low-cost model and powerful trading tools continue to support consistent revenue growth.

Then again, SCHW leverages its massive asset base, stable earnings and trusted platform to deliver long-term value. Schwab offers a balanced blend of scale, profitability and strategic adaptability without compromising its conservative approach. It offers a compelling mix of reliability and growth potential in an evolving financial landscape.

While Interactive Brokers’ innovation in areas like Forecast Contracts, GlobalTrader and IBKR Desktop is impressive, its earnings outlook is relatively muted, with only modest growth expected in the next two years. Combined with a lower ROE and premium valuation than Schwab, it suggests that while IBKR is a stable, well-run business, it may not match Schwab’s upside potential in a growth-focused portfolio.

At present, both Schwab and Interactive Brokers sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-15 | |

| Feb-14 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite