|

|

|

|

|||||

|

|

Pulse Biosciences PLSE has announced the publication of its first-in-human clinical feasibility study in the Journal Thyroid, highlighting the effectiveness of its proprietary Nanosecond Pulsed Field Ablation (nsPFA) technology for treating benign thyroid nodules. The study, conducted in Naples, Italy, showed strong outcomes in both safety and efficacy, with meaningful reductions in nodule size and symptom relief.

The publication underscores nsPFA’s potential to emerge as a differentiated treatment option for patients with benign thyroid nodules. With its nonthermal mechanism and favorable safety profile, the technology positions Pulse Biosciences to advance a promising alternative to current standard-of-care approaches.

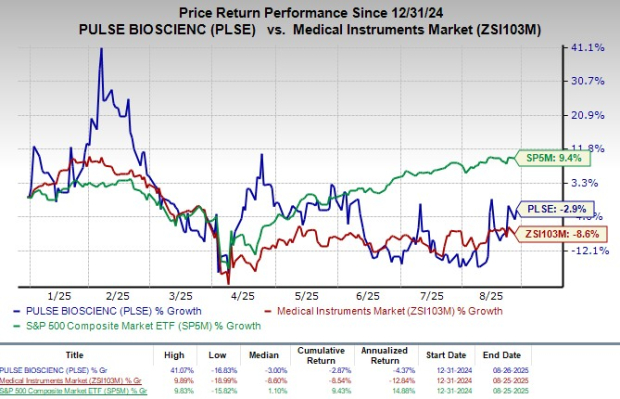

Following the announcement, the company's shares gained 2.6% at yesterday’s market closing. Shares of the company have lost 2.9% in the year-to-date period compared with the industry’s 8.6% decline. The S&P 500 has gained 9.4% in the same time frame.

This publication strengthens Pulse Biosciences’ long-term business prospects by positioning nsPFA as a disruptive alternative in the large benign thyroid nodule market, where current treatments are either invasive or less effective. Demonstrating strong safety and efficacy not only supports potential adoption by clinicians but also broadens the platform’s applicability across therapeutic areas, creating opportunities for regulatory expansion, partnerships, and recurring revenue growth.

PLSE currently has a market capitalization of $1.11 billion.

The first-in-human feasibility study, conducted at Ospedale del Mare in Naples, Italy, evaluated Pulse Biosciences’ nsPFA technology using the CellFX Percutaneous Electrode System under ultrasound guidance. The study was structured across three cohorts, with initial groups assessing tissue response through isolated ablations and the final group receiving full therapeutic treatment of benign thyroid nodules. The design allowed researchers to measure both the safety and effectiveness of nsPFA energy in a clinical setting.

Results demonstrated strong efficacy, with fully treated nodules showing an average 86% reduction in size at one year and reductions as high as 93%. Symptom improvement was observed early, with greater than 48% reduction noted within two weeks. Importantly, follow-up ultrasounds indicated no intranodular fibrosis or scarring, underscoring the favorable safety profile of nsPFA. These outcomes highlight the potential of the technology to deliver rapid, durable, and minimally invasive results compared to traditional approaches.

Per a report by Grand View Research, the global thyroid ablation devices market size was valued at USD 168.4 million in 2023 and is expected to expand at a compound annual growth rate of 9.58% from 2024 to 2030.

There is an increasing demand for thyroid ablation procedures as well as devices owing to the rising prevalence of thyroid cancer and thyroid nodules.

Currently, PLSE carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space that have announced quarterly results are Medpace Holdings, Inc. MEDP, West Pharmaceutical Services, Inc. WST and Boston Scientific Corporation BSX.

Medpace Holdings, sporting a Zacks Rank of 1 (Strong Buy), reported second-quarter 2025 EPS of $3.10, beating the Zacks Consensus Estimate by 3.3%. Revenues of $603.3 million outpaced the consensus mark by 11.5%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Medpace Holdings has a long-term estimated growth rate of 11.4%. MEDP’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 13.9%.

West Pharmaceutical reported second-quarter 2025 adjusted EPS of $1.84, beating the Zacks Consensus Estimate by 21.9%. Revenues of $766.5 million surpassed the Zacks Consensus Estimate by 5.4%. It currently flaunts a Zacks Rank #1.

West Pharmaceutical has a long-term estimated growth rate of 8.5%. WST’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 16.8%.

Boston Scientific reported second-quarter 2025 adjusted EPS of 75 cents, beating the Zacks Consensus Estimate by 4.2%. Revenues of $5.06 billion surpassed the Zacks Consensus Estimate by 3.5%. It currently carries a Zacks Rank #2 (Buy).

Boston Scientific has a long-term estimated growth rate of 14%. BSX’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 8.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite