|

|

|

|

|||||

|

|

The buy now, pay later (“BNPL”) boom has shaken up the payments industry, giving shoppers instant flexibility and merchants a conversion boost. Two names lead the conversation: Affirm Holdings, Inc. AFRM, the high-growth disruptor with pay-over-time plans, and PayPal Holdings, Inc. PYPL, the established digital payments giant now doubling down on installment offerings.

The showdown here is more than growth vs. scale. Investors are asking: Does Affirm’s explosive trajectory outweigh PayPal’s stability and cash firepower, or is the safer play also the smarter one? Let’s dig into the numbers and crown the stronger contender.

Affirm has been one of the fastest-growing fintech stories of the past few years. With billions in gross merchandise volume (GMV) and deep merchant ties — think Shopify, Costco, World Market, etc. — it has embedded itself across e-commerce checkout. Its AI-driven underwriting and risk models are helping improve loan performance while giving merchants higher conversion and basket sizes.

AFRM’s momentum remains strong. User and merchant growth continues to climb, with nearly 360,000 merchant partners, and analysts see room for further expansion into high-frequency, small-ticket transactions and international markets. Affirm is building a recognizable brand in a space where trust is critical. This will likely increase repeat usage and transaction volume.

But the bull case has limits. Affirm does not have a sustainable profit-generating history yet and has high debt levels and reliance on credit market conditions. Its long-term debt-to-capital of 71.8% is significantly higher than PayPal’s 35.9%. High rates amplify funding costs, and regulators in many major markets are circling BNPL with potential guardrails that could bite. Its fourth-quarter fiscal 2025 results will give further insight into its operations.

Affirm faces intense competition from established mobile wallets, traditional payment providers, and other BNPL rivals, which can limit its pricing flexibility. Many competitors benefit from broader consumer and merchant networks, diversified product suites, and stronger brand equity, factors that could weigh on Affirm’s market share growth. Walmart’s switch to Klarna underscores the risk. Notably, Klarna is reportedly targeting a September IPO at a valuation of $13–$14 billion, a move that could further intensify competition.

PayPal brings a very different toolkit to the BNPL fight. Instead of betting solely on installment loans, PayPal is leveraging its 438 million active accounts, merchant APIs, and platforms like Venmo and Braintree to keep users and merchants inside its ecosystem. BNPL is one more hook in an already sticky network. In the second quarter of 2025, its BNPL total payment volume rose more than 20% year over year.

PayPal’s financials underscore its strength. The company generated $1.7 billion in free cash flow in the first half of 2025 and is guiding toward $6-$7 billion for the full year, implying a strong back half ahead. This robust cash generation not only fortifies operations but also fuels shareholder-friendly initiatives. Over the past year, PayPal repurchased $6 billion worth of stock, highlighting its ability to both invest for growth and return capital to investors.

PayPal’s disciplined cost-cutting is paying off, driving margin expansion and giving management confidence to raise 2025 guidance. The company now projects transaction margin growth of 5–6%, up from its earlier 4–5% outlook. Its efficiency edge is further underscored by a return on capital of 16.6%, far ahead of Affirm.

Despite its dominance in digital payments, PayPal is not insulated from intensifying competition in branded checkout and peer-to-peer transfers. As new fintech players flood the space and merchants gain more options, pressure on take rates could temper its revenue growth over time.

Affirm currently trades at a lofty 6.17X price-to-sales ratio, a valuation that bakes in aggressive growth expectations but leaves little cushion if momentum slows. PayPal, by contrast, is priced at a more grounded 1.94X, offering investors a far more balanced entry point. While Affirm’s premium reflects its growth expectations, PayPal’s valuation looks more compelling for those seeking upside with less risk. PYPL currently carries a Value Score of A, while AFRM carries a Value Score of F.

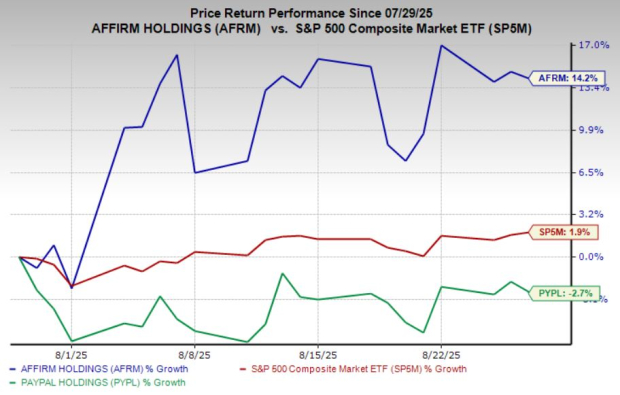

Affirm has notched a 14.2% gain over the past month, but short bursts of momentum are not unusual for high-growth fintech names, especially in the BNPL space, where valuations swing quickly on headlines. By contrast, PayPal shares dipped 2.7% in the same period, a modest pullback that hardly overshadows its stronger balance sheet, cash generation and scale advantages.

Analysts currently lean in PayPal’s favor. Over the past month, it has witnessed 14 upward estimate revisions against no opposite movement for the full-year 2025 earnings, which is pegged at $5.22 per share. The Zacks Consensus Estimate indicates 12.3% year-over-year growth. It beat earnings in each of the past four quarters with an average surprise of 9.9%.

PayPal Holdings, Inc. price-consensus-eps-surprise-chart | PayPal Holdings, Inc. Quote

In contrast, the consensus estimate for AFRM’s fiscal 2025 earnings of 5 cents witnessed no upward or downward movements over the past month. However, it indicates significant improvement from the year-ago loss of $1.67 per share. It also beat the estimates in all the past four quarters with an average surprise of 102.2%.

Affirm Holdings, Inc. price-consensus-eps-surprise-chart | Affirm Holdings, Inc. Quote

Affirm’s brand strength, rapid merchant adoption, and momentum-driven rally highlight its disruptive appeal. However, the lack of consistent profitability, elevated debt levels, and fierce competition cast a shadow over its growth story. PayPal, by contrast, blends scale, profitability and financial flexibility. With robust free cash flow, shareholder returns, and improving margins, it offers both resilience and upside.

PYPL’s lower valuation and consistent earnings trajectory make it the steadier and smarter bet in the BNPL faceoff. While Affirm currently carries a Zacks Rank #3 (Hold), PayPal has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| Feb-15 |

Companies Are Replacing CEOs in Record Numbersand Theyre Getting Younger

PYPL

The Wall Street Journal

|

| Feb-15 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 |

Financial Stocks Are Falling. It's About More Than AI - Heard on the Street

AFRM -11.99%

The Wall Street Journal

|

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite