|

|

|

|

|||||

|

|

Bio-Rad Laboratories, Inc. BIO is well-poised to grow in the upcoming quarters, courtesy of its strong traction in the QX600 Droplet Digital PCR (ddPCR) platform. Demand for its quality control and immunology products in Clinical Diagnostics also remains strong. In addition, solid financial health boosts the stock’s appeal. Meanwhile, intense rival pressure and end-market softness may restrict Bio-Rad’s full growth potential.

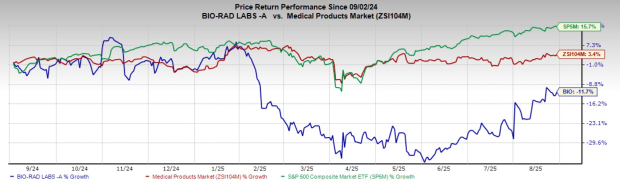

In the past year, shares of this Zacks Rank #3 (Hold) company have fallen 11.7% against the industry’s 3.4% growth. The S&P 500 composite has seen a 15.7% rise in the same time frame.

The renowned manufacturer and global supplier of clinical diagnostics and life science research products has a market capitalization of $8.06 billion. Bio-Rad’s earnings surpassed estimates in three of the trailing four quarters and missed in one, the average surprise being 34.5%.

Let’s delve deeper.

Digital PCR Business Backs BIO’s Growth: Bio-Rad’s QX600 ddPCR platform is currently robust and growing. This year, the company also introduced key assay expansions, including enhancements to the Vericheck assays for cell and gene therapy, showing a strong correlation between circulating tumor DNA and treatment outcomes in lung cancer. On June 30, Bio-Rad acquired Stilla Technologies to strengthen its ddPCR offering and facilitate entry into new molecular testing markets. Coinciding with this, the company launched the rebranded QX700 Series ddPCR instruments, which, together with QX Continuum, enhance the ddPCR portfolio for customers requiring a simplified workflow and flexibility at various budget levels. Following the Stilla acquisition, the company now expects ddPCR portfolio revenues to grow in the mid-single digits in 2025.

Clinical Diagnostics Continues to Gain Momentum: The business has now returned to its normalized growth rate post-pandemic, maintaining strong market positions globally for its platforms. Built on its long-standing reputation as a leading blood screening systems provider, Bio-Rad’s IH-500 blood typing system is considered a gold standard in immunohematology labs, offering the highest level of automation. The company introduced the IH-500 NEXT System in 2023, a fully automated system for ID cards to meet emerging demands and challenges in laboratory and health environments. Bio-Rad continues to invest in supporting the growth of this segment while building a position in the new molecular diagnostics segment. In the second quarter of 2025, Bio-Rad sustained solid demand for its quality control and immunology products.

Strong Solvency and Balance Sheet: Bio-Rad exited the second quarter of 2025 with cash and cash equivalents (including short-term investments) of $1.37 billion, and $1 million in short-term debt. Total debt (including current maturities) at the end of the second quarter was $1.20 billion, in line with the previous quarter’s level. The reported figure was lower than the corresponding cash, cash equivalent and investment levels.

Weakness in End Markets: The company continues to be negatively affected by the ongoing challenges impacting the biopharma market and small biotech companies. In early 2025, the U.S. government proposed reductions of federal funding to some institutions and companies that are part of Bio-Rad’s customer base. Although there have been signals of improvement, customers are still cautious about the funding environment and conservative in allocating capital. Added to this, large pharmaceutical companies are implementing cost-saving measures through corporate restructuring and R&D reprioritization. In the second quarter of 2025, revenues in the core Life Science Group fell 1.7% year over year and 2.7% on a currency-neutral basis,

Tough Competitive Pressure: Bio-Rad operates in a highly competitive environment dominated by firms varying from large multinational corporations with significant resources to start-ups. Also, the competitive and regulatory conditions in the markets where the company operates limit its ability to switch to strategies like price increases and other drivers of cost increases. Further, the extension of the public tender commitments to multiple years by the government, resulting in a reduced number of annual tenders, has led to aggressive tender pricing by Bio-Rad’s competitors.

The Zacks Consensus Estimate for Bio-Rad’s 2025 earnings per share (EPS) has increased 5% to $9.69 in the past 30 days.

The Zacks Consensus Estimate for the company’s 2025 revenues is pegged at $2.58 billion, which indicates a modest 0.6% rise from the year-ago reported number.

Some better-ranked stocks in the broader medical space are Envista NVST, Masimo MASI and Phibro Animal Health PAHC.

Envista has an estimated earnings growth rate of 15.2% for fiscal 2026 compared with the S&P 500 composite’s 11.7% growth. Shares of the company have rallied 16% compared with the industry’s 3.4% rise. NVST’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 16.50%.

NVST carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Masimo, carrying a Zacks Rank #2, has an estimated long-term earnings growth rate of 12.5% compared with the industry’s 9.9%. Its earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, with the average surprise being 9.17%. MASI shares have rallied 18.9% against the industry’s 15.4% fall in the past year.

Phibro Animal Health, carrying a Zacks Rank #2, has an earnings yield of 6.3% against the industry’s -0.3%. Shares of the company have surged 76.5% compared with the industry’s 3.4% growth. PAHC’s earnings outpaced estimates in each of the trailing four quarters, with the average surprise being 27.9%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 11 hours | |

| Feb-23 | |

| Feb-23 | |

| Feb-21 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite