|

|

|

|

|||||

|

|

NVIDIA Corporation NVDA recently reported yet another stellar quarterly performance, reinforcing its dominance in the artificial intelligence (AI) and semiconductor markets. On Aug. 27, the company reported second-quarter fiscal 2026 revenues of $46.74 billion, marking a 56% year-over-year surge and surpassing the consensus estimate by 1.3%.

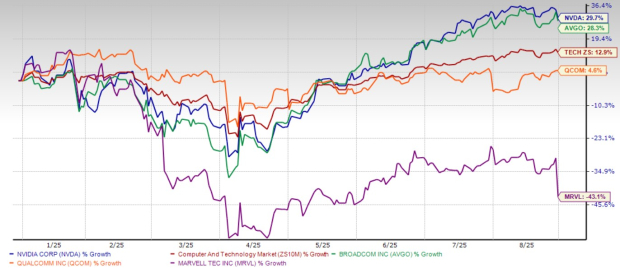

Back-to-back strong quarterly financial results have instilled investors’ confidence in the stock. Shares of NVIDIA have soared 29.7% year to date, outpacing the Zacks Computer and Technology sector’s gain of 12.9%.

NVDA stock has also outperformed other major semiconductor players, including Broadcom AVGO, QUALCOMM QCOM and Marvell Technology MRVL. Year to date, shares of Broadcom and QUALCOMM have risen 28.3% and 4.6%, respectively, while Marvell Technology stock has fallen 43.1%.

With a record-breaking data center segment and strong demand for AI-driven computing solutions, NVIDIA's growth story remains compelling. However, with the stock trading just 5.6% below its 52-week high of $184.48, investors might be wondering: Should they buy, sell or hold NVDA right now?

NVIDIA’s Data Center business remains the backbone of its financial strength. In the second quarter, the segment generated $41.1 billion in revenues, representing 87.9% of total sales. This marked a staggering 56% year-over-year increase and 5% sequential growth. This robust rise was mainly driven by higher shipments of the Blackwell GPU computing platforms that are used for the training and inference of large language models, recommendation engines and generative AI applications.

The demand for NVIDIA’s Hopper 200 and Blackwell GPU computing platforms has been a key catalyst as cloud providers and enterprises scale their AI infrastructure. Large cloud service providers contributed the majority of Data Center revenues, indicating continued hyperscale investment in AI-driven computing.

With AI adoption accelerating across industries, NVIDIA's stronghold in data centers makes it a critical beneficiary of this trend. The company’s leadership in AI chip development positions it well for sustained revenue growth in this segment.

Beyond revenue growth, NVIDIA demonstrated exceptional financial discipline. The company reported non-GAAP gross margins of 61%, maintaining profitability despite rising operational expenses. Non-GAAP operating income jumped 51% year over year to $30.17 billion, reflecting the company’s ability to convert strong revenue growth into bottom-line gains.

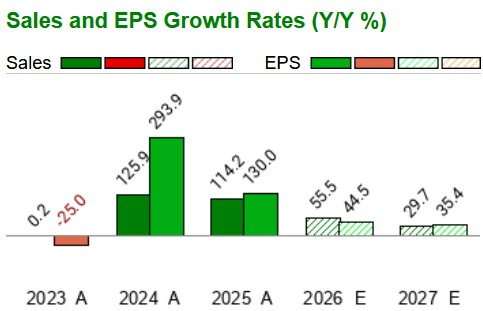

NVIDIA’s outlook for the third quarter of fiscal 2026 remains upbeat. The company projects third-quarter revenues to increase 55% year over year to $54 billion, reflecting continued momentum in AI-driven demand. Gross margins are expected to remain strong at 73.5% despite increasing costs associated with ramping up Blackwell production. The Zacks Consensus Estimates for fiscal 2026 and 2027 indicate continued growth momentum for the company’s top and bottom lines.

NVIDIA’s cash flow generation also remains robust. It generated free cash flow of $13.45 billion in the second quarter and $39.58 billion in the first half of fiscal 2026. The company ended the second quarter with $56.79 billion in cash, cash equivalents and marketable securities, up from $53.7 billion in the previous quarter. This strong liquidity position enables NVIDIA to reinvest in research & development, expand manufacturing capabilities and return capital to shareholders.

In the fiscal second quarter, the company returned $244 million to its shareholders through dividend payouts and repurchased stocks worth $9.72 billion. In the first half of fiscal 2026, NVIDIA paid $488 million in dividends and bought back shares worth $23.82 billion.

Valuation-wise, NVIDIA is overvalued, as suggested by the Value Score of D.

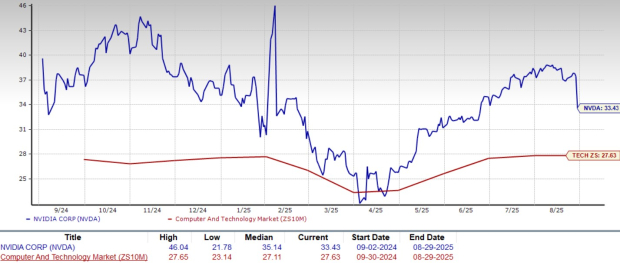

In terms of forward 12-month Price/Earnings (P/E), NVDA shares are trading at 33.43X, higher than the sector’s 27.71X.

Compared with other major semiconductor players, NVIDIA is trading at a lower P/E multiple than Broadcom, while at a higher multiple than Marvell Technology and QUALCOMM. At present, Broadcom, Marvell Technology and QUALCOMM are trading at P/E multiples of 37.07, 19.46 and 13.55, respectively.

NVIDIA's outstanding second-quarter earnings results reaffirm its position as a leader in AI-driven computing. The company’s record Data Center revenues, strong profit margins and optimistic guidance for the third quarter of fiscal 2026 highlight its continued growth trajectory. While valuation is on the higher side, the company’s momentum, both operationally and financially, supports holding the stock.

NVIDIA carries a Zacks Rank #3 (Hold) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 49 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour |

Stock Market Today: Dow Skids As EU Makes Trump Tariff Move; These Gold Stocks Shine (Live Coverage)

NVDA

Investor's Business Daily

|

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite