|

|

|

|

|||||

|

|

The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how ManpowerGroup (NYSE:MAN) and the rest of the professional staffing & hr solutions stocks fared in Q2.

The Professional Staffing & HR Solutions subsector within Business Services is set to benefit from evolving workforce trends, including the rise of remote work and the gig economy. With companies casting a wider net to find talent due to remote work, the expertise of staffing and recruiting companies is even more valuable. For those who invest wisely, the use of predictive AI in recruitment and screening as well as automation in HR workflows can enhance efficiency and scalability. On the other hand, digitization means that talent discovery is less of a manual process, opening the door for tech-first platforms. Additionally, regulatory scrutiny around data privacy in HR is evolving and may require companies in this sector to change their go-to-market strategies over time.

The 7 professional staffing & hr solutions stocks we track reported a mixed Q2. As a group, revenues beat analysts’ consensus estimates by 1.4% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 9.4% since the latest earnings results.

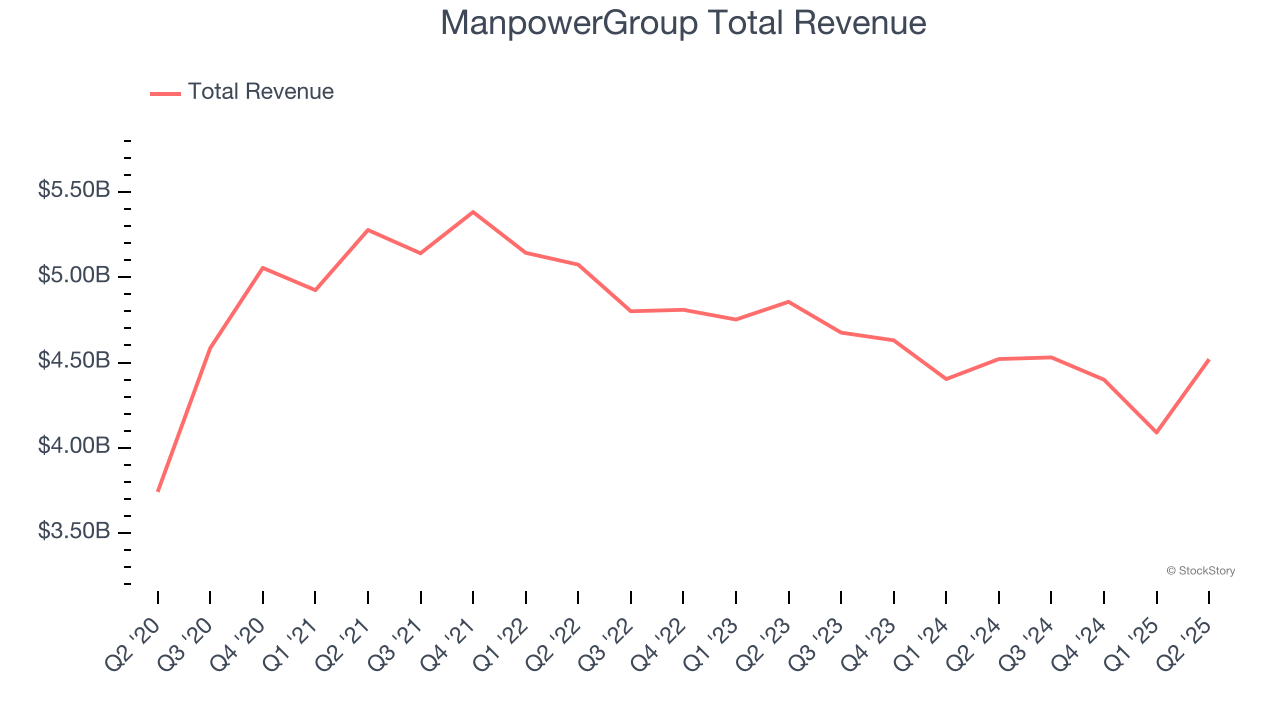

Founded during the post-World War II economic boom when businesses needed temporary workers, ManpowerGroup (NYSE:MAN) connects millions of people to employment opportunities through its global network of staffing, recruitment, and workforce management services.

ManpowerGroup reported revenues of $4.52 billion, flat year on year. This print exceeded analysts’ expectations by 3.6%. Overall, it was a strong quarter for the company with a solid beat of analysts’ EPS guidance for next quarter estimates and an impressive beat of analysts’ organic revenue estimates.

Jonas Prising, ManpowerGroup Chair & CEO, said "During the quarter, we continued to make strong progress in executing our plans to Diversify, Digitize and Innovate – with a focus on expanding our role as the strategic workforce partner of choice for our clients as tech transformation gathers pace. Although demand remains mixed across our global markets as employers adapt to economic and geopolitical volatility, we are beginning to see positive signs of stabilization in the US and parts of Europe. We remain focused on achieving market share gains while we make further adjustments to our cost base. Our ongoing investments in strengthening our digital core to accelerate AI adoption will ensure we are well positioned to accelerate progress and provide even more value to clients and candidates in future quarters."

ManpowerGroup scored the biggest analyst estimates beat of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 1.8% since reporting and currently trades at $42.35.

Is now the time to buy ManpowerGroup? Access our full analysis of the earnings results here, it’s free.

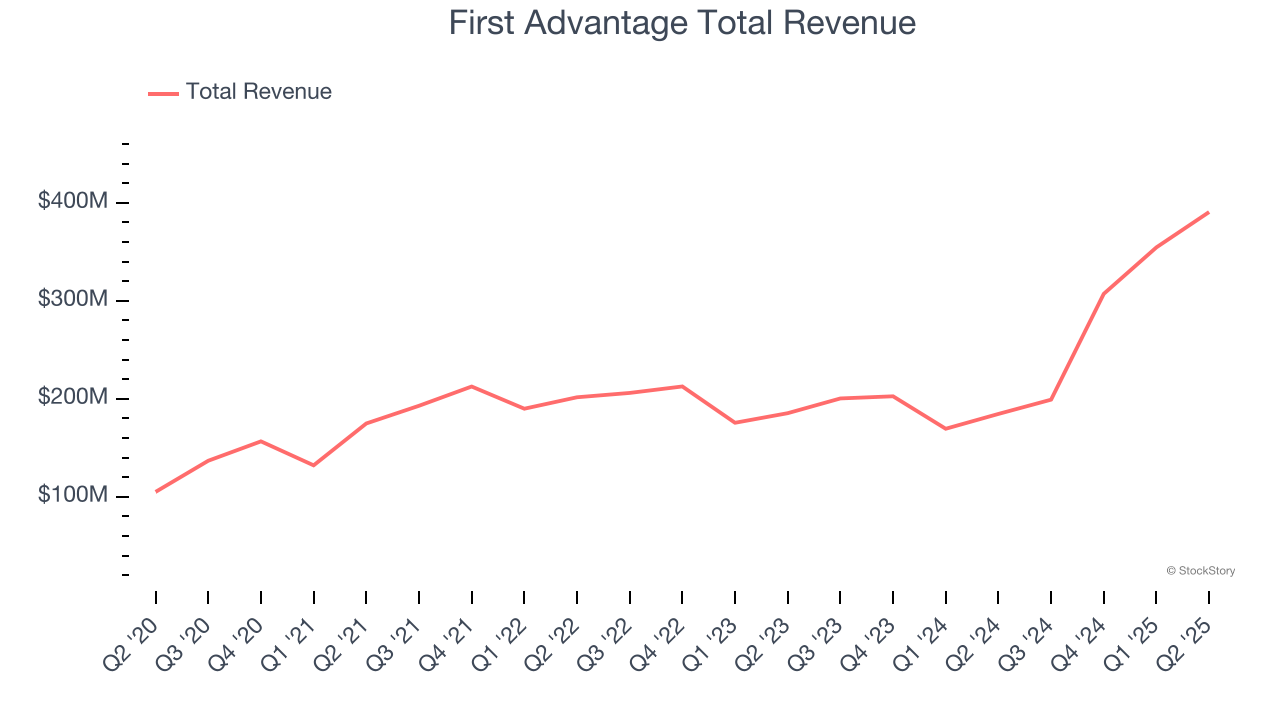

Processing approximately 100 million background checks annually across more than 200 countries and territories, First Advantage (NASDAQ:FA) provides employment background screening, identity verification, and compliance solutions to help companies manage hiring risks.

First Advantage reported revenues of $390.6 million, up 112% year on year, outperforming analysts’ expectations by 2.7%. The business had a very strong quarter with a beat of analysts’ EPS estimates and a decent beat of analysts’ full-year EPS guidance estimates.

First Advantage pulled off the fastest revenue growth and highest full-year guidance raise among its peers. However, the results were likely priced into the stock as it’s traded sideways since reporting. Shares currently sit at $16.36.

Is now the time to buy First Advantage? Access our full analysis of the earnings results here, it’s free.

Pioneering the professional employer organization (PEO) industry it helped establish, Insperity (NYSE:NSP) provides human resources outsourcing services to small and medium-sized businesses, handling payroll, benefits, compliance, and HR administration.

Insperity reported revenues of $1.66 billion, up 3.3% year on year, in line with analysts’ expectations. It was a disappointing quarter as it posted a significant miss of analysts’ EPS guidance for next quarter estimates.

Insperity delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 7.4% since the results and currently trades at $55.22.

Read our full analysis of Insperity’s results here.

Operating as a professional employer organization (PEO) that serves over 8,000 companies with more than 120,000 worksite employees, Barrett Business Services (NASDAQ:BBSI) provides management solutions that help small and mid-sized businesses handle human resources, payroll, workers' compensation, and other administrative functions.

Barrett reported revenues of $307.7 million, up 10% year on year. This result beat analysts’ expectations by 2.6%. It was a strong quarter as it also recorded a beat of analysts’ EPS estimates.

The stock is up 9.9% since reporting and currently trades at $48.80.

Read our full, actionable report on Barrett here, it’s free.

With roots dating back to 1948 as the first specialized recruiting firm for accounting and finance professionals, Robert Half (NYSE:RHI) provides specialized talent solutions and business consulting services, connecting skilled professionals with companies across various fields.

Robert Half reported revenues of $1.37 billion, down 7% year on year. This number topped analysts’ expectations by 1.1%. It was a satisfactory quarter as it also produced EPS in line with analysts’ estimates.

Robert Half had the slowest revenue growth among its peers. The stock is down 11.6% since reporting and currently trades at $37.49.

Read our full, actionable report on Robert Half here, it’s free.

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

| 12 hours | |

| Feb-23 | |

| Feb-17 | |

| Feb-05 | |

| Feb-04 | |

| Feb-03 | |

| Feb-02 | |

| Jan-31 | |

| Jan-30 | |

| Jan-30 | |

| Jan-30 | |

| Jan-29 | |

| Jan-29 | |

| Jan-29 | |

| Jan-29 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite