|

|

|

|

|||||

|

|

First Majestic Silver Corp. AG scaled a new 52-week high of $9.83 yesterday before ending the session at $9.47. The upside follows news of positive exploration results and near-record metal prices.

First Majestic currently has a market capitalization of $4.68 billion and a Zacks Rank #3 (Hold).

Positive Exploration Results: On Wednesday, the company announced positive drilling results from its 2024/2025 exploration efforts at its Los Gatos Silver Mine. The drilling programs aimed to extend metal mineralization in the South-East Deeps, Central Deeps and North-West Deeps zones, yielding significant intersections of silver and base metal mineralization.

This follows encouraging drilling results from the ongoing exploration program at its San Dimas Mine, announced on Aug. 18. The 2025 exploration results at San Dimas further enhance the mine’s status as a top-tier asset in First Majestic's portfolio.

Record Q2 Performance: AG delivered adjusted earnings per share of 4 cents in the second quarter of 2025. The reported figure marks a significant improvement from the loss of 7 cents per share incurred in the year-ago quarter. First Majestic’s revenues surged 94% year over year to a record $264 million in the quarter under review.

Production reached 7.9 million silver-equivalent ounces in the second quarter of 2025. The figure includes 3.7 million silver ounces and 33,865 gold ounces. The AgEq ounces produced marked a solid 48% year-over-year increase, attributed to a 76% surge in silver production.

The upside was driven by increased production from the San Dimas and La Encantada mines, and contributions from the Cerro Los Gatos mine.

Strategic Acquisition: In January 2025, First Majestic completed the deal to acquire Gatos Silver, under which AG will gain a 70% interest in the high-quality and long-life Cerro Los Gatos Silver underground mine.

The Cerro Los Gatos mine, combined with First Majestic’s existing San Dimas Silver/Gold mine and the Santa Elena Silver/Gold mine, will boost AG’s annual production to 30-32 million ounces of silver equivalent. This includes silver ounces of 15-16 million.

The combined entity, with a pro-forma market capitalization of around $3 billion, will have an enhanced production profile with a strong balance sheet and margins. Meaningful synergies are expected through corporate cost savings, and supply-chain and procurement efficiencies. Acceleration and optimization of internal projects and exploration programs are expected to deliver meaningful value creation for its shareholders.

AG’s total silver production in the second quarter included a contribution of 1.5 million ounces from Cerro Los Gatos.

Increased Outlook: Backed by a strong second-quarter performance, the company increased its full-year consolidated production guidance to 30.6-32.6 million AgEq ounces from the previously announced 27.8-31.2 million AgEq ounces.

Near-Record Silver & Gold Prices: Silver prices reached a 14-year high above $41 per ounce in September as investors turned to safe assets amid global uncertainty. It is currently at $40.9 per ounce. This momentum in the prices of gold and silver is likely to boost AG’s results in the upcoming quarters.

Gold prices are also gaining from several factors that have contributed to its upward trajectory, including increased geopolitical tensions, a depreciating U.S. dollar, the potential for monetary policy easing and continuous purchasing by central banks. Backed by these factors, the yellow metal broke through the $3,578-per-ounce threshold for the first time in September 2025. Gold prices are currently at $3,530 per ounce, with investors awaiting U.S. labor reports.

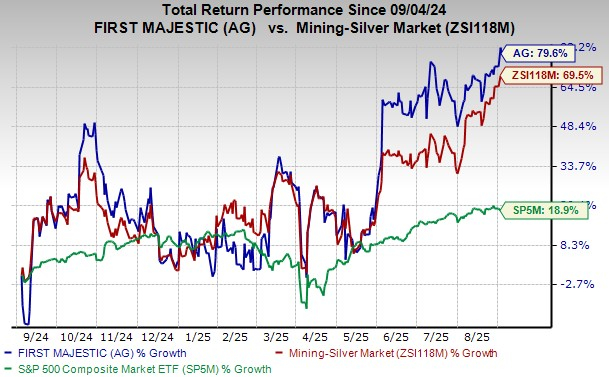

Shares of the company have surged 79.6% over the past year, outperforming the industry's 69.5% rally and the S&P’s 18.9% rise.

Some better-ranked stocks from the basic materials space are Agnico Eagle Mines AEM, Idaho Strategic Resources IDR and Carpenter Technology Corporation CRS. AEM flaunts a Zacks Rank #1 (Strong Buy) at present, and IDR and CRS carry a Zacks Rank #2 (Buy) each. You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for Agnico Eagle Mines’ 2025 earnings is pegged at $6.94 per share. The estimate indicates year-over-year growth of 64.1%. It has an average trailing four-quarter earnings surprise of 10%. Agnico Eagle Mines’ shares have surged 79.1% in a year.

Idaho Strategic Resources has an average trailing four-quarter earnings surprise of 2.6%. The Zacks Consensus Estimate for its 2025 earnings is pegged at 76 cents per share, indicating year-over-year growth of 13.4%. IDR shares skyrocketed 110% last year.

Carpenter Technology has an average trailing four-quarter earnings surprise of 8.4%. The Zacks Consensus Estimate for CRS’ 2025 earnings is pegged at $9.36 per share. Its shares surged 68% last year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 23 min | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite