|

|

|

|

|||||

|

|

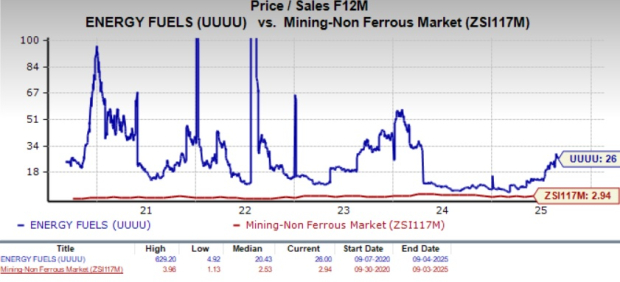

Energy Fuels UUUU is currently trading at a forward price-to-sales ratio of 26.00X, a significant premium to the non-ferrous mining industry’s 2.94X.

UUUU’s Value Score of F suggests that the stock is not so cheap and a stretched valuation at this moment.

In comparison, uranium stocks like Cameco CCJ and Centrus Energy LEU are trading at much lower price-to-sales multiples of 13.09X and 7.45X, respectively.

UUUU stock has gained 119% year to date, outperforming the industry’s 11.1% growth. The broader Zacks Basic Materials sector has gained 18.3% and the S&P 500 has moved up 10.2% in the same timeframe.

On Aug. 6, the company posted second-quarter 2025 results, with revenues plunging 52% year over year to $4.2 million. Energy Fuels sold 50,000 pounds of uranium on the spot market for $77 per pound, generating $3.85 million in uranium revenues. This marked a 55% decline from the year-ago quarter, due to lower sales volumes resulting from contract timing and the decision to retain inventory amid lower uranium prices. The company also recorded $0.28 million in heavy mineral sands revenues from the sale of 202 tons of rutile.

Lower revenues combined with exploration, development and processing expenses, as well as selling, general and administration expenses, led to a loss of 10 cents per share in the quarter, wider than the four cents loss reported in the year-ago quarter.

As of June 30, 2025, Energy Fuels had $253.23 million of working capital, comprising $71.5 million of cash, $126.4 million of marketable securities and $7.8 million in trade and other receivables, as well as $76.50 million of inventory.

The company has no debt on its balance sheet. This is commendable compared with Cameco’s debt-to-capital ratio of 0.13 and Centrus Energy’s 0.55.

Energy Fuels produced approximately 665,000 pounds of uranium from its Pinyon Plain, La Sal and Pandora mines, a sharp increase from the 115,000 pounds in the first quarter. This was attributed to exceptional performance at Pinyon Plain.

Backed by this momentum, Energy Fuels expects to produce 875,000-1,435,000 pounds of contained uranium in 2025. Processing activity will ramp up in the fourth quarter, with the company expecting to process 700,000-1,000,000 pounds of finished uranium for 2025.

Uranium sales are planned at 350,000 pounds in 2025, lower than the 450,000 pounds sold last year. The projection does not take into account any spot sales the company may make, in case prices go up. In 2026, Energy Fuels aims to sell between 620,000 and 880,000 pounds of uranium under its current portfolio of long-term uranium sales contracts.

The company expects lower uranium costs starting in the fourth quarter of 2025 as it begins processing low-cost Pinyon Plain ores. This will result in a total weighted average cost of goods sold between $23 and $30 per pound of uranium recovered, among the lowest in the world. With the integration of the company’s inventories with lower-cost Pinyon Plain output, the cost of goods sold for uranium sales is projected to fall to $50–$55 per pound through late 2025 and decline to $30–$40 per pound in early 2026.

Recently, Energy Fuels reached a significant milestone by producing the first kilogram of Dy oxide at pilot scale from its White Mesa Mill in Utah. Once it produces approximately 15 kilograms of Dy oxide, the company intends to produce high-purity terbium (Tb) oxide. It is targeting the fourth quarter of 2025 to deliver the first samples of Tb oxide.

Energy Fuels recently signed a Memorandum of Understanding with Vulcan Elements, aiming to establish a domestic supply chain for rare earth magnets that is independent of China. UUUU will supply initial quantities of high-purity "light" and "heavy" separated rare earth oxides to Vulcan, starting in the fourth quarter of 2025. Vulcan will then validate Energy Fuels' neodymium-praseodymium (NdPr) and Dy oxides for the production of rare earth magnets. Once validated, Vulcan and Energy Fuels will negotiate further long-term supply agreements.

The estimate for 2025 revenues is pegged at $40.80 million, indicating a 47.8% year-over-year decline. The company is expected to incur a loss of 33 cents per share in 2025.

The estimate for 2026 revenues is $122.05 million, implying a 199% year-over-year surge. The consensus estimate for earnings is pegged at one cent per share. This suggests that 2026 will be the company’s first year of profit since it started trading on the NYSE in December 2013.

Estimates for UUUU for 2025 and 2026 have undergone negative revisions over the past 60 days, as shown in the chart below.

Uranium prices have been impacted this year amid an adequate supply and uncertain demand. Even though prices have moved up recently to $76.70 per pound, it remains 4% below last year’s levels.

Despite lower prices currently, the long-term outlook for uranium remains strong, driven by the growing push for clean energy. Also, the push for supply chains independent of China is a growth opportunity for UUUU. Backed by its debt-free balance sheet, Energy Fuels is ramping up uranium production while developing significant REE capabilities. Taking UUUU’s current production levels and development pipeline into account, it has the potential to take its production level to 4-6 million pounds of uranium per year.

Energy Fuels’ Donald Project in Australia could start production by the end of 2027. It is one of the richest deposits of HREEs in the world and could complement UUUU’s domestic operations. Also, its Toliara Project in Madagascar and the Bahia Project in Brazil contain significant quantities of light and heavy REE oxides, which can be supplied to U.S. and European manufacturers.

Backed by Energy Fuels’ debt-free balance sheet, it is advancing its growth plans to capitalize on the expected surge in uranium and REE demand. Those who already own the stock may stay invested, given UUUU’s solid long-term prospects in both these markets. However, given its premium valuation, volatility in uranium prices and the expected loss this year, new investors can wait for a better entry point.

UUUU currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 4 hours | |

| 9 hours | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-21 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite