|

|

|

|

|||||

|

|

Earth imaging satellite company Planet Labs (NYSE:PL) reported revenue ahead of Wall Street’s expectations in Q2 CY2025, with sales up 20.1% year on year to $73.39 million. On top of that, next quarter’s revenue guidance ($72.5 million at the midpoint) was surprisingly good and 5.6% above what analysts were expecting. Its non-GAAP loss of $0.03 per share was $0.01 above analysts’ consensus estimates.

Is now the time to buy Planet Labs? Find out by accessing our full research report, it’s free.

“Our second quarter results demonstrate incredibly strong momentum across our business, with record revenue and substantial growth in our backlog. The increased demand for our unique Earth intelligence, highlighted by pivotal contracts including one in collaboration with the German government, one with NATO, and others with the U.S. Department of Defense, underscores the critical role Planet plays in addressing global challenges and supporting peace and security,” said Will Marshall, Planet’s Co-Founder, Chief Executive Officer and Chairperson.

Pioneering the concept of "agile aerospace" with hundreds of small but powerful satellites, Planet Labs (NYSE:PL) operates the world's largest fleet of Earth observation satellites, capturing daily images of our planet to provide insights on deforestation, agriculture, and climate change.

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $262.5 million in revenue over the past 12 months, Planet Labs is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels. On the bright side, it can grow faster because it has more room to expand.

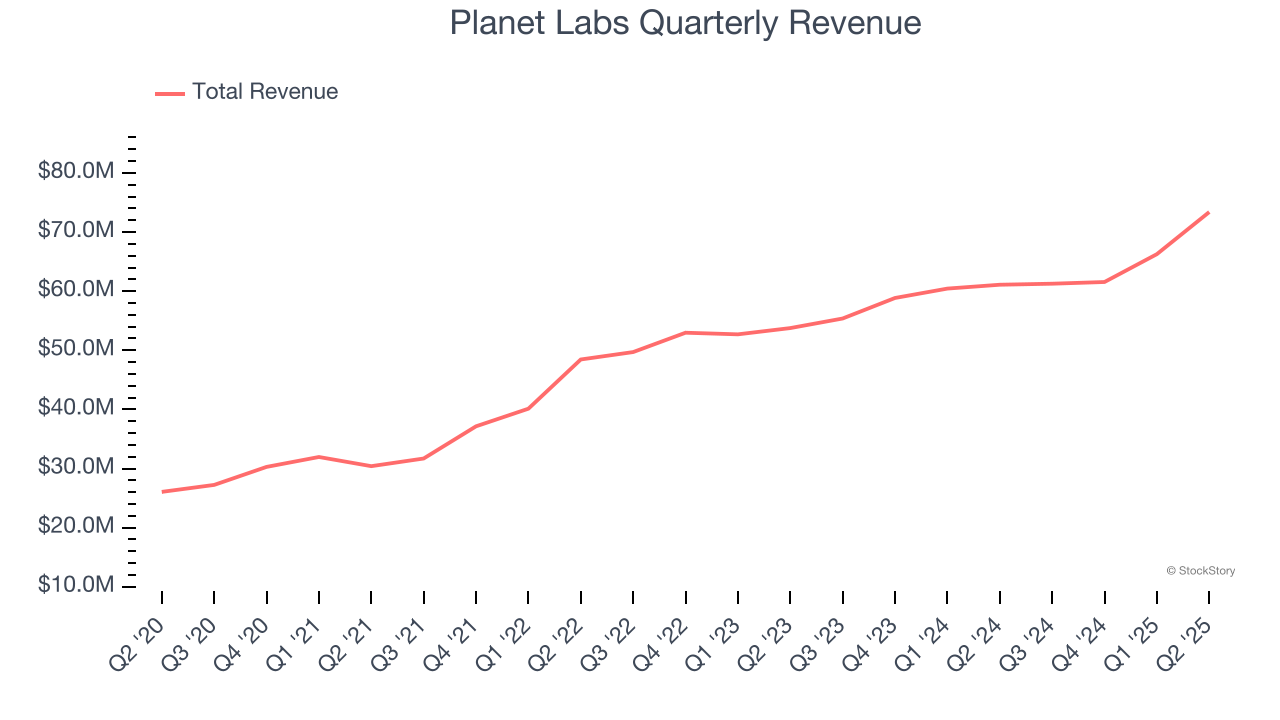

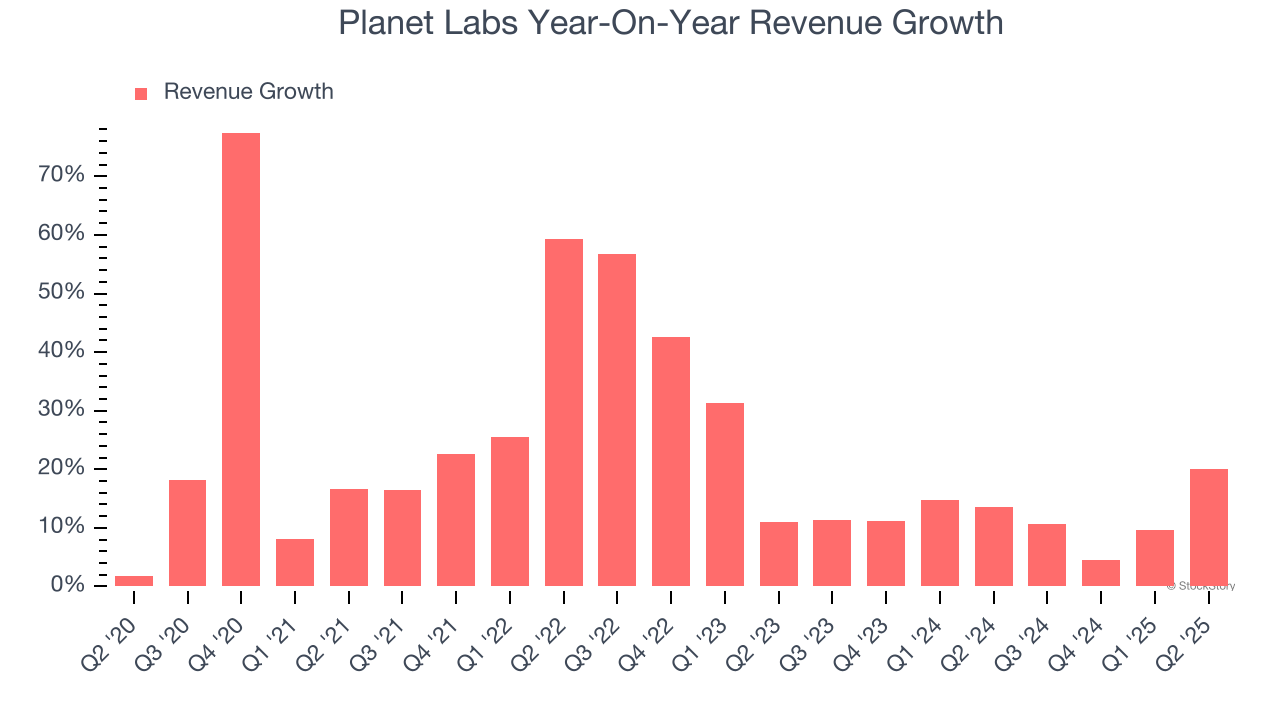

As you can see below, Planet Labs grew its sales at an incredible 22.3% compounded annual growth rate over the last five years. This is an encouraging starting point for our analysis because it shows Planet Labs’s demand was higher than many business services companies.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. Planet Labs’s annualized revenue growth of 12% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Planet Labs reported robust year-on-year revenue growth of 20.1%, and its $73.39 million of revenue topped Wall Street estimates by 11.2%. Company management is currently guiding for a 18.3% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 13.5% over the next 12 months, similar to its two-year rate. This projection is healthy and indicates its newer products and services will fuel better top-line performance.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

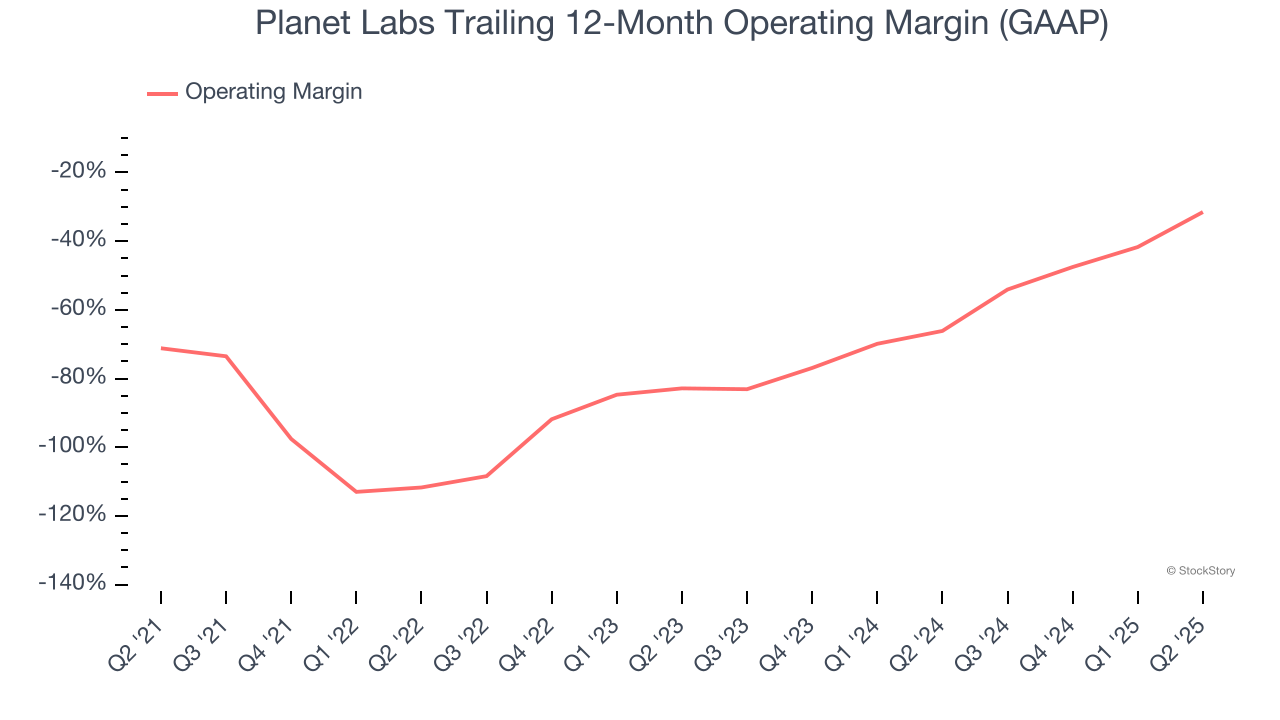

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Planet Labs’s high expenses have contributed to an average operating margin of negative 68.4% over the last five years. Unprofitable business services companies require extra attention because they could get caught swimming naked when the tide goes out.

On the plus side, Planet Labs’s operating margin rose by 39.7 percentage points over the last five years, as its sales growth gave it operating leverage. Still, it will take much more for the company to reach long-term profitability.

This quarter, Planet Labs generated a negative 24.5% operating margin.

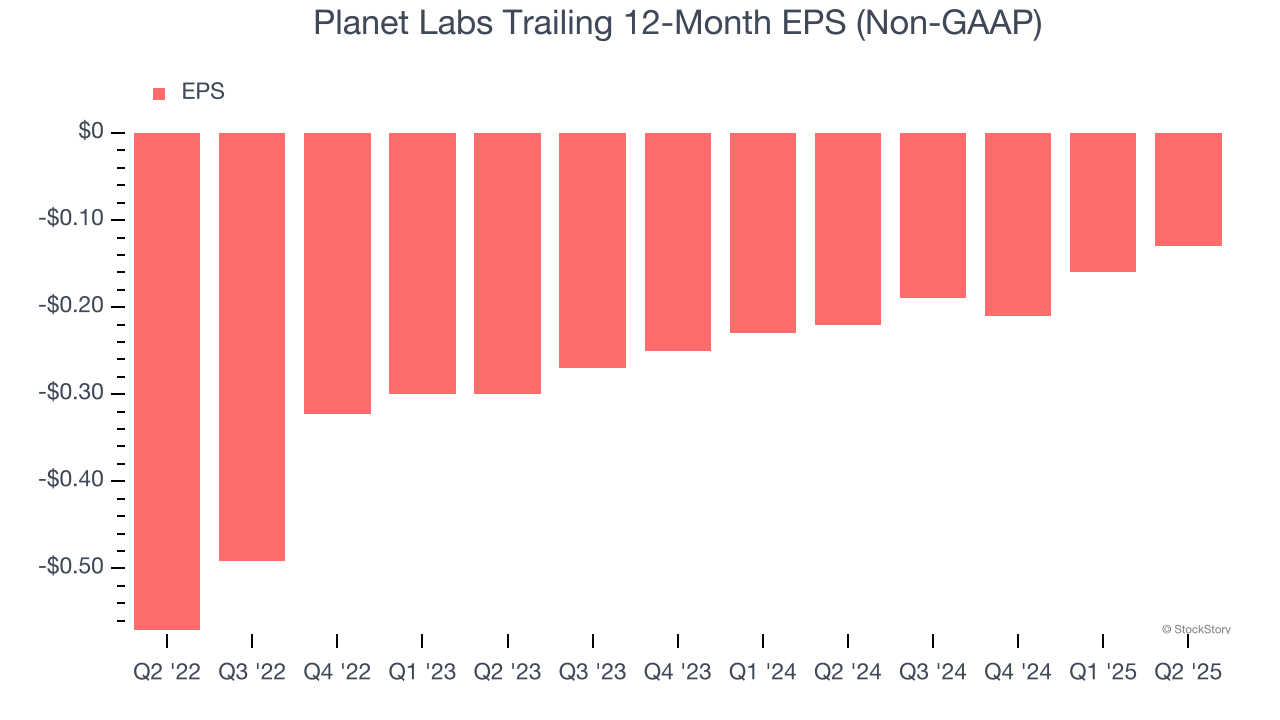

We track the change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Although Planet Labs’s full-year earnings are still negative, it reduced its losses and improved its EPS by 34.2% annually over the last two years.

In Q2, Planet Labs reported adjusted EPS of negative $0.03, up from negative $0.06 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Planet Labs to perform poorly. Analysts forecast its full-year EPS of negative $0.13 will tumble to negative $0.13.

This was a beat and raise quarter. It was good to see Planet Labs beat analysts’ revenue and EPS expectations this quarter. We were also excited its full-year revenue guidance was lifted. Zooming out, we think this was a very good print. The stock traded up 15.3% to $7.55 immediately following the results.

Indeed, Planet Labs had a rock-solid quarterly earnings result, but is this stock a good investment here? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.

| 13 hours | |

| Feb-22 | |

| Feb-21 | |

| Feb-20 | |

| Feb-19 | |

| Feb-18 | |

| Feb-17 | |

| Feb-15 | |

| Feb-15 | |

| Feb-13 |

AXA DCP partners with Planet Labs for near-real-time disaster monitoring

PL +5.26%

Life Insurance International

|

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite