|

|

|

|

|||||

|

|

Myriad Genetics, Inc. MYGN recently announced that The Lancet Oncology has published a study demonstrating the performance of the company’s Precise MRD in patients with oligometastatic clear-cell renal cell carcinoma (ccRCC).

The latest development is expected to bolster the company’s Oncology business.

Following the news, shares of MYGN declined 2.7% to $6.61 last Friday.

Myriad Genetics’ growth strategy for its Oncology business focuses on expanding companion diagnostics, driving market growth through new clinical guidelines, and introducing new offerings. We expect the latest development to boost the market sentiment toward MYGN stock in the upcoming days.

The company currently has a market capitalization of $615.02 million. Its earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 210%.

The Phase 2 trial of metastasis-directed radiotherapy without systemic therapy (MRWS) for oligometastatic ccRCC and investigation of circulating tumor DNA (ctDNA) as a personalized biomarker was an investigator-initiated single-arm trial enrolling patients with ccRCC and up to five metastases (NCT03575611). The study is among the largest trials conducted to date in this setting and includes one of the longest follow-up periods evaluating sequential metastasis-directed therapy without systemic therapy for ccRCC. The Precise MRD Test was used to evaluate ctDNA levels as part of an exploratory endpoint to determine the association of translational biomarkers with patient outcomes.

The Precise MRD Test is a tumor-informed, whole genome sequencing (WGS) based test that monitors hundreds to thousands of tumor-specific variants, enabling exceptional sensitivity and quantification of ctDNA in the blood of patients with cancer.

The study demonstrated that circulating tumor DNA (ctDNA) levels were associated with patients’ response to metastasis-directed radiation therapy (MDT). Precise MRD was able to detect ctDNA levels in patients with very low tumor burden. This may allow patients who are candidates for metastasis-directed radiotherapy without systemic therapy (MRWS) to delay or avoid systemic treatments, sparing them from serious side effects and supporting treatment de-escalation.

Additionally, 94% of patients tested at baseline had ctDNA levels below 100 ppm, which falls in the ultrasensitive testing range. Those who tested positive with Precise MRD prior to MRWS progressed to systemic therapy within a median time of 27 months, whereas those who tested negative were maintained on MDT for a median time of 54 months. In those who were ctDNA negative and maintained on MDT, overall survival was not compromised, with survival rates of 94% at two years and 87% at three years.

Image Source: Zacks Investment Research

Per a Grand View Research report, the global MRD testing market size is projected to reach $4.50 billion by 2030, at a CAGR of 10.1% from 2025 to 2030. The market growth is driven by rising cancer incidence and prevalence, technological advancements in diagnostic tools, and integration with personalized medicines.

Last week, Myriad Genetics published results from a meta-analysis in the Journal of Clinical Psychopharmacology, stating the superiority of the company’s GeneSight Psychotropic test over treatment-as-usual (TAU). The large-scale data analysis, along with merging data from many independent studies, is evident of the clinical utility of the GeneSight Psychotropic test for patients with major depressive disorder (MDD) who have experienced at least one treatment failure.

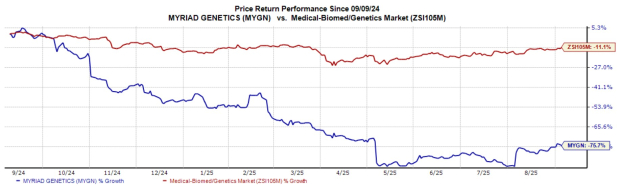

In the past year, MYGN’s shares have lost 75.5% compared with the industry’s decline of 11.1%.

Myriad Genetics currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are Envista NVST, Medpace MEDP and Phibro Animal Health PAHC. Envista, Boston Scientific and IDEXX Laboratories carry a Zacks Rank #2 (Buy) each at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Shares of Envista have rallied 16.7% in the past year compared with the industry’s 5.2% growth. Its earnings yield of 5.4% has also outpaced the industry’s -0.9% yield. NVST’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 16.5%.

Medpace’s shares have rallied 31.3% in the past year. MEDP’s earnings beat estimates in each of the trailing four quarters, the average surprise being 13.9%. It has a historical EPS growth rate of 30.9% compared with the industry’s 0.6%.

Shares of Phibro have jumped 29.1% in the past year against the industry’s 14% decline. PAHC’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 27.9%. It has an earnings yield of 6.3% compared to the industry -0.3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 | |

| Mar-04 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite