|

|

|

|

|||||

|

|

Credo Technology Group Holding Ltd CRDO stock has surged 12.9% since the company reported strong first-quarter fiscal 2026 results on Sept. 3. It reported explosive revenue growth amid the AI infrastructure boom and provided robust guidance for fiscal 2026.

Driven by the stronger-than-expected financial performance, the stock hit a 52-week high of $142.57 before closing at $140.82 in the last session. Investors now have a crucial question: should they continue riding this momentum or lock in profits after a steep run-up?

Let’s unpack the company's recent results and long-term prospects and ascertain whether staying invested is wise.

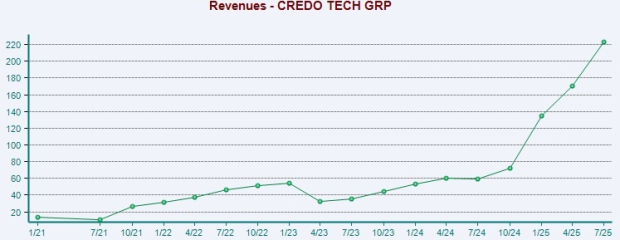

CRDO’s revenues surged 31% sequentially and a staggering 273.6% year over year to $223.1 million as hyperscalers and data center operators aggressively invest in AI infrastructure. The number far exceeded management’s revenue guidance of $185 million and $195 million.

Non-GAAP gross profit was $150.7 million in the first quarter compared with $37.6 million in the same period last year. Non-GAAP gross margin expanded 470 basis points to 67.6% during the quarter under review. Non-GAAP operating income was $96.2 million compared with $2.2 million reported in the prior year period.

The company generated a first-quarter fiscal 2025 cash flow from operating activities of $54.2 million, down $3.7 million sequentially, mainly due to higher working capital. As of Aug. 2, 2025, CRDO had $479.6 million of cash and cash equivalents and short-term investments compared with $431.3 million as of May 3, 2025.

Credo lies at the intersection of AI and data center build-outs with its active electrical cables (AECs), optical Digital Signal Processors (DSPs), and PCIe retimer solutions that address the growing need for high-speed, low-power connectivity in the data center space.

The most important element of Credo’s growth strategy is its leadership in the AECs space. In the last reported quarter, the AEC product line increased by healthy double digits sequentially. The demand for AECs is increasing as these offer up to 1,000 times more reliability with 50% lower power consumption than optical solutions, added CRDO. The extensive elimination of link fabs or intermittent losses of connection results in increased cluster reliability while lowering power consumption. Management highlighted that one customer is enabling an entire scale-out network to be built with AECs up to 7 meters long amid quadrupling of GPU density.

The adoption of rack-to-rack deployments is expected to boost further revenues from this product line. Moreover, the system-level approach provides it with a strong competitive moat. It owns the entire stack of SerDes IP, Retimer ICs, system-level design, qualification and production. This integrated approach allows faster innovation cycles and strong cost efficiency.

Strength in the optical business is another key catalyst. The portfolio consists of both DSP and linear receive optical or LRO solutions that support port speeds up to 1.6 terabits per second, aligning with hyperscaler plans for next-generation network architectures. It is investing heavily in both copper and optical solutions to diversify its market position. Its optical DSP segment maintained strong momentum, positioning the company to achieve a doubling of optical revenues again in the current fiscal year.

Another driver is Credo’s PCIe and Ethernet retimer businesses. CRDO added that recently launched PCIe retimer solutions were gaining “significant traction” and expects PCIe design wins in 2025 with production revenue in 2026. It is looking to capture the opportunity presented by the industry’s shift to 200-gig per lane scale-up solutions.

Credo’s recent quarterly performance has validated its positioning as one of the most critical enablers of hyperscaler AI infrastructure buildouts. In the fiscal first quarter, three hyperscalers each contributed over 10% of revenue, and there was a material revenue contribution from a fourth hyperscaler. It expects revenues from the additional hyperscaler to increase throughout fiscal 2026.

Management expects these three to four hyperscalers to exceed 10% of revenues in the upcoming quarters and fiscal year. Two additional hyperscalers are also expected to commence ramping in fiscal 2026. Customer diversification reduces concentration risk.

For fiscal 2026, the company anticipates mid-single-digit sequential revenue growth, resulting in roughly 120% year-over-year growth. The company had earlier projected revenues to surpass $800 million, implying more than 85% year-over-year growth.

The company expects non-GAAP operating expenses to rise by less than 50% year over year in fiscal 2026. Non-GAAP net margin is projected to be around 40% both in the upcoming quarters and for fiscal 2026.

For the second quarter of fiscal 2026, the company anticipates revenues to range between $230 million and $240 million.

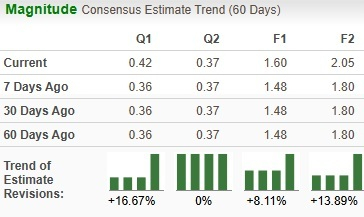

Analysts have also raised their earnings estimates over the past 60 days.

Nonetheless, management stated that though the guidance assumes the current tariff regime, it remains “fluid.” Any untoward change in tariff policy — especially on China-related supply chains — could directly impact margins.

While hyperscaler demand is a growth driver, it also poses risks. With just three to four hyperscalers making up the bulk of revenue, a change in spending or in-house solution from one of these customers could materially affect revenue numbers.

This, along with increasing market competition and macroeconomic uncertainties, may impact CRDO’s growth trajectory. Credo competes with semiconductor giants like Broadcom Inc. AVGO and Marvell Technology, Inc. MRVL.

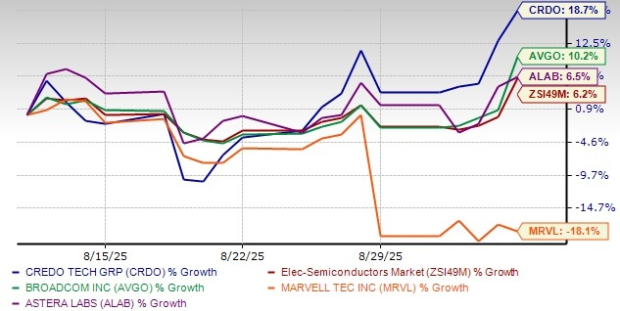

CRDO’s 18.7% surge in the past month is also much higher than peers like Broadcom, Marvell and Astera Labs ALAB.

Broadcom and Astera Labs have gained 10.2% and 6.5%, respectively, while Marvell is down 18.1%.

In terms of the forward 12-month Price/Sales ratio, CRDO is trading at 23.58, higher than the Electronic-Semiconductors sector’s multiple of 9.37.

In comparison, Broadcom trades at a forward 12-month P/S multiple of 21.34, while Astera Labs and Marvell Technology are trading at a multiple of 34.35 and 6.11, respectively.

In a market increasingly driven by AI tailwinds, CRDO stands out as a pure-play beneficiary with differentiated products, strong financials and increasing demand. However, premium valuation, hyperscaler concentration risk, competitive pressures, and macro uncertainties limit near-term upside potential.

With a Zacks Rank #3 (Hold), CRDO seems to be treading in the middle of the road. Investors looking to invest are better off waiting for a favorable entry point, while investors already having a position can retain the stock given the compelling long-term fundamentals.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 59 min | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 6 hours | |

| 6 hours | |

| 6 hours | |

| 6 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite