|

|

|

|

|||||

|

|

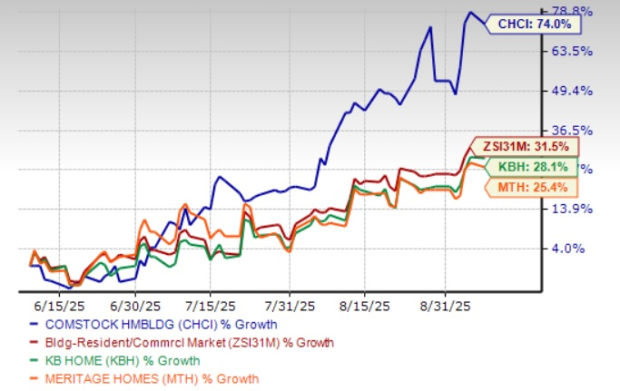

Comstock Holding Companies, Inc. CHCI shares have surged 74% in the past three months, significantly outpacing the industry’s 31.5% growth. The company has outperformed other industry players, including KB Home KBH and Meritage Homes Corporation MTH, which posted increases of 28.1% and 25.4%, respectively, in the same time frame. Comstock benefits from fee-based recurring revenues, expanding transit-oriented developments, rising parking demand, operational efficiency, and a debt-free balance sheet.

Comstock is a leading asset manager, developer, and operator of mixed-use and transit-oriented properties in the Washington, D.C. region, with a strong presence in Northern Virginia’s Dulles Corridor. Since 1985, it has developed, acquired, and managed millions of square feet across residential, commercial and mixed-use assets, highlighted by Reston Station and Loudoun Station. Operating under an asset-light, debt-free model, Comstock generates recurring fee-based revenues through long-term agreements with institutional investors, family offices, financial institutions and government entities. Its Anchor Portfolio features Class-A offices, luxury residential, hotels, retail and parking assets, supported by subsidiaries CHCI Commercial, CHCI Residential and ParkX.

Comstock delivered a 19.7% year-over-year revenue increase in the first half of 2025, fueled by asset management, property management, and parking operations, with ParkX parking services growing more than 55%. The company’s recurring fee-based model, supported by cost-plus and market-rate contracts under the 2022 Asset Management Agreement (AMA), provides predictable cash flows. This structure helps reduce exposure to real estate market volatility, ensuring steady revenue generation across cycles and reinforcing the long-term stability of Comstock’s business model.

Profitability strengthened as net income rose 63.5% to $3 million in the first half of 2025, while adjusted EBITDA advanced 38.4%. EPS improved to 29 cents from 18 cents, underscoring operating leverage as revenue gains outpaced expense growth, even with higher personnel costs. These results highlight Comstock’s ability to manage an expanding portfolio with financial discipline and operational efficiency. By converting revenue growth into stronger margins, the company demonstrated scalability and effective cost management, positioning itself to further expand profitability as the asset base grows.

Comstock’s balance sheet remains clean with $30.5 million in cash as of June 30, 2025, up from $28.8 million at year-end, and no outstanding debt. A fully undrawn $10 million credit facility provides additional flexibility to pursue growth without leverage risk. This conservative capital structure enhances resilience in volatile market conditions and supports the company’s ability to fund development, acquisitions and strategic projects. Strong liquidity and cash generation ensure that Comstock can continue executing its long-term pipeline while maintaining financial strength.

The long-term AMA with Comstock Partners, LC, running through at least 2035, underpins a robust pipeline anchored by Reston Station and Loudoun Station, which together will total nearly 10 million square feet at full build-out. Current projects include a JW Marriott hotel, a 420-unit residential tower, and 266,000 square feet of commercial space scheduled for phased delivery over the next year and beyond. These assets, complemented by new retail tenants across the portfolio, provide recurring fees, reinforce tenant diversity, and enhance occupancy, ensuring sustained value creation in high-growth, transit-oriented markets.

Comstock faces significant risks due to heavy reliance on affiliated revenue sources, with its business closely tied to a related-party agreement that could be terminated in the future. Its limited penetration beyond a narrow client base highlights a lack of diversification and restricts scalability in an evolving real estate landscape. Rising operating expenses further pressure margins, especially if growth does not keep pace with costs. Additionally, delayed recognition of incentive fees postpones potential earnings upside, while geographic and sectoral concentration heightens vulnerability to localized economic, political, and market disruptions.

From a valuation perspective, Comstock appears relatively expensive. Currently, CHCI is trading at 2.82X trailing 12-month EV/sales value, below the industry’s average of 1.18X. The metric also remains higher than the company’s peers, including KB Home (0.65X) and Meritage Homes (0.8X).

Comstock’s recurring fee model, debt-free balance sheet, and strong revenue growth provide stability, scalability and long-term value. However, concentrated revenue sources, rising costs, and reliance on affiliated agreements pose risks to diversification and earnings visibility. Also, its valuation is higher than the industry average. For long-term investors, CHCI’s strong fundamentals may justify holding the stock, but investors looking to add the stock to their portfolios may want to wait for a better entry point.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-10 | |

| Feb-10 | |

| Feb-10 | |

| Feb-10 | |

| Feb-07 | |

| Feb-07 | |

| Feb-06 | |

| Feb-06 | |

| Feb-06 | |

| Feb-06 | |

| Feb-05 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite