|

|

|

|

|||||

|

|

Merck MRK is likely to face several headwinds over the next few years that could impact its sales and profits, with the most significant being the upcoming loss of exclusivity for its blockbuster PD-L1 inhibitor, Keytruda, in 2028.The company's biggest revenue driver, Keytruda, generated sales of $15.16 billion in the first half of 2025, up almost 7% year over year.

Keytruda is approved for several types of cancer indications and accounted for more than 50% of the company’s pharmaceutical sales during the first half of 2025. The drug remains a key driver of Merck’s top-line growth.

Though Keytruda will lose patent exclusivity in 2028, its sales are expected to remain strong until then. Merck remains heavily dependent on Keytruda for growth, and the company is already working on different strategies to drive its long-term growth.

Secondly, Merck faces a significant challenge with the declining sales of its second-largest product, Gardasil, which is a vaccine for the prevention of certain cancers caused by human papillomavirus (HPV). Gardasil recorded sales worth $2.45 billion during the first half of 2025, down 48% on a year-over-year basis.

Gardasil sales have been declining due to weak performance in China, which resulted from sluggish demand trends amid an economic slowdown. Gardasil sales are expected to decline significantly in 2025 from 2024 levels. The company is also seeing lower demand for the vaccine in Japan. Sales are expected to remain weak in Japan in the second half of 2025.

Sales of vaccines like Proquad, M-M-R II, Varivax, Rotateq and Pneumovax 23 also declined during the first half of 2025.

Additionally, Merck expects an unfavorable impact from the Medicare Part D redesign under the Inflation Reduction Act (IRA), which took effect in 2025. In August 2023, the U.S. Department of Health and Human Services (“HHS”) selected Januvia as one of the first 10 medicines subject to government-set prices effective in 2026.

In January 2025, the HHS selected Janumet and Janumet XR for government price setting, which will take effect in 2027. Sales of Januvia/Janumet are expected to decline sharply from 2026 onward due to government price setting in 2026 and 2027, the anticipated patent expiry in 2026, and ongoing competitive pressure. Keytruda is expected to be subject to government price setting in 2027, which will take effect in 2029. This could subsequently result in a decline in U.S. sales.

Despite the ongoing headwinds and upcoming challenges, we believe Merck’s new 21-valent pneumococcal conjugate vaccine, Capvaxive, and pulmonary arterial hypertension (PAH) drug, Winrevair, have the potential to support top-line growth once Keytruda loses exclusivity in 2028. Both products have witnessed a strong launch so far.

Moreover, Keytruda sales are expected to remain strong until it loses exclusivity in 2028. Merck’s Animal Health business is a key contributor to its top-line growth, as Merck is recording above-market growth, and the trend continues in 2025.

In July 2025, Merck announced a new multi-year optimization initiative, which is expected to save $3 billion in annual costs by the end of 2027. The cost savings should boost the company’s bottom line.

In 2022, Congress passed the IRA in the United States, which brought significant changes to how drugs are covered and paid for under Medicare, including penalties for significant increases in the prices of drugs.

Among other measures, the IRA requires the HHS to effectively set prices for certain single-source drugs and biologics reimbursed under Medicare Part B and Part D.

Besides Merck, other players like J&J JNJ, Pfizer PFE, Eli Lilly LLY and Amgen also expect an unfavorable impact of the Medicare Part D redesign on their top line. J&J expects a negative impact of approximately $2 billion in sales due to the Medicare Part D redesign in 2025. The Part D redesign is primarily hurting sales of J&J’s drugs, including Stelara, Tremfya, and Erleada, as well as its pulmonary hypertension medications. Lilly expects the government price setting to hurt sales of its diabetes drug, Jardiance, from 2026.

The government's price setting is hurting the sales of Pfizer’s key drugs, including Vyndaqel, Ibrance, Xtandi, and Xeljanz. Amgen’s Enbrel and Otezla have been selected for Medicare price setting beginning in 2026 and 2027, respectively.

Year to date, shares of Merck have lost 15.3% compared with the industry’s decline of 0.6%. The stock has also underperformed the sector and the S&P 500 during the same time frame, as seen in the chart below.

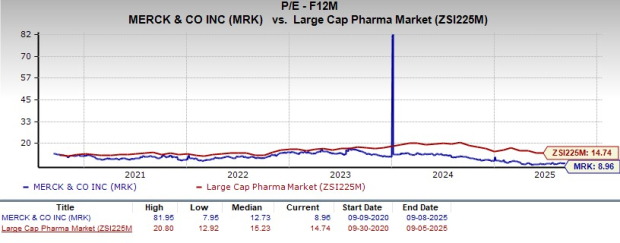

From a valuation standpoint, Merck appears attractive relative to the industry. Going by the price/earnings ratio, the company’s shares currently trade at 8.96 forward earnings, lower than 14.74 for the industry and its five-year mean of 12.73.

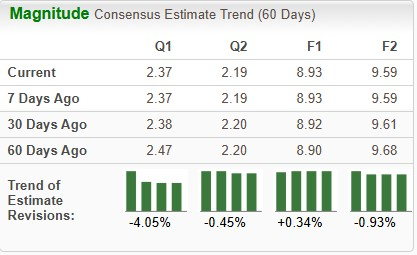

The Zacks Consensus Estimate for 2025 earnings has increased from $8.90 per share to $8.93, while the same for 2026 has decreased from $9.68 to $9.59 over the past 60 days.

Merck currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 5 hours | |

| 6 hours | |

| 6 hours | |

| 8 hours | |

| 9 hours | |

| 11 hours | |

| 12 hours | |

| 12 hours | |

| 12 hours | |

| 12 hours | |

| 13 hours | |

| 13 hours | |

| 14 hours | |

| 14 hours |

Stock Market Today: Dow, Tech Futures Slide; Nvidia, Palantir, Tesla Extend Losses (Live Coverage)

MRK

Investor's Business Daily

|

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite