|

|

|

|

|||||

|

|

Exact Sciences Corporation EXAS has launched the Cancerguard test, a new multi-cancer early detection (MCED) blood test now offered as a laboratory-developed test (LDT) in the United States. Cancerguard is the first commercially available MCED test of its kind that analyzes multiple biomarker classes to help detect a wide range of cancers, including those that often go undiagnosed until later stages when treatment options are limited.

The Cancerguard test is recommended for individuals aged 50-84 with no known cancer diagnosis in the past three years and can be considered annually.

After the Sept. 10 announcement, EXAS shares rose 2.2%, closing at $56.0 yesterday. The company’s latest introduction represents the culmination of nearly a decade of development and is backed by robust science in partnership with top academic institutions. Over 10 years, use of Exact Sciences’ MCED technology alongside current screening methods could cut stage IV cancer diagnoses by 42% and lower overall cancer-related mortality by 18%. Accordingly, we expect the upward trend in EXAS stock to continue.

Exact Sciences has a market capitalization of $10.37 billion at present. The Zacks Consensus Estimate for the company’s 2025 earnings per share (EPS) stands at 33 cents, a 243.5% improvement over 2024. In the trailing four quarters, it delivered an average earnings surprise of 329.9%.

Nearly 70% of U.S. annual cancer cases and deaths are known to occur in cancers with no recommended screening. According to the company, the Cancerguard test can help address this gap by complementing existing routine screening and extending the reach of early detection. With a simple blood draw, the test detects signals from more than 50 cancer types and subtypes, including some with the highest mortality rates, such as pancreatic, ovarian, liver, esophageal, lung and stomach cancers.

The test is supported by data from robust test-development studies, such as DETECT-A and ASCEND 2, which delivered 68% sensitivity across six of the deadliest cancers and 64% overall sensitivity across a broader range of cancers, excluding breast and prostate. The test also detected more than one-third of stage I or II cancers, demonstrating its ability to detect disease when it is most treatable. By achieving a 97.4% specificity, Cancerguard helps minimize false positives and avoid unnecessary procedures.

Furthermore, the company is actively enrolling up to 25,000 participants in the Falcon Registry Real-World Evidence study to inform future regulatory submissions, support payer discussions on coverage and reimbursement and guide efforts to include the Cancerguard test in clinical guidelines.

To support patient access, Exact Sciences has entered into an agreement with Quest Diagnostics to enable blood collection at the company’s approximately 7,000 patient access sites across the country.

Per a Grand View Research report, the global MCED market is estimated to be worth $1.12 billion in 2025, set to expand at a compound annual growth rate of 17% through 2030. The market’s growth is driven by the rising prevalence of multiple cancers, aided by the growing need to provide efficient methods to detect them at early stages to enable timely, appropriate treatment.

Last month, the company announced acquiring exclusive U.S. rights to current and future versions of Freenome’s blood-based, single-indication, colorectal cancer screening tests. The Freenome team recently submitted the last module of the pre-market application to the FDA.

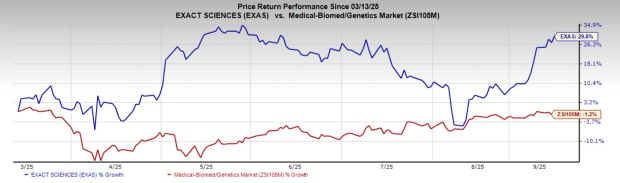

In the past six months, shares of EXAS have rallied 29.8% compared to the industry’s 1.2% fall.

Exact Sciences currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space include Masimo MASI, Phibro Animal Health PAHC and Envista NVST. While Masimo sports a Zacks Rank #1 (Strong Buy), Phibro and Envista each carry a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Masimo shares have jumped 29.6% in the past year. Estimates for the company’s 2025 earnings per share have increased 1.3% to $5.30 in the past 30 days. MASI’s earnings beat estimates in each of the trailing four quarters, the average surprise being 13.8%. In the last reported quarter, it posted an earnings surprise of 8.1%.

Estimates for Phibro Animal Health’s fiscal 2026 earnings per share have increased 6.5% to $2.45 in the past 30 days. Shares of the company have surged 87.3% in the past year compared with the industry’s flat growth. PAHC’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 27.9%. In the last reported quarter, it delivered an earnings surprise of 9.6%.

Estimates for Envista’s 2025 earnings per share have remained constant at $1.12 in the past 30 days. Shares of the company have rallied 11.3% in the past year compared with the industry’s flat growth. Its earnings yield of 5.4% also outpaced the industry’s 0.2% yield. NVST’s earnings topped estimates in each of the trailing four quarters, the average surprise being 16.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Mar-10 | |

| Mar-10 | |

| Mar-10 | |

| Mar-09 | |

| Mar-09 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about Finviz Elite