|

|

|

|

|||||

|

|

Palantir stock is taking a break from its relentless run, with some investors wondering if artificial intelligence (AI) adoption is slowing.

Oracle just delivered a shocking forecast, backed by contracted sales, which will likely benefit Palantir along the way.

Palantir's stock is still outrageously expensive, so it won't appeal to every investor.

After a blistering run that spanned more than two years and produced stock price gains of 2,500% (as of this writing), Palantir Technologies (NASDAQ: PLTR) is taking a well-earned breather. From humble beginnings developing artificial intelligence (AI) solutions for the U.S. intelligence industry, the data mining and AI specialist branched out, creating solutions for enterprise. The advent of generative AI represented a compelling opportunity, fueling accelerating revenue and profit growth.

In recent months, some investors have begun to wonder if the implementation of AI is running out of steam. There has even been talk of an AI bubble, though most experts dismiss that notion outright.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Oracle (NYSE: ORCL) just provided compelling evidence that the implementation of AI continues unfettered.

Image source: Getty Images.

After market close on Tuesday, Oracle reported the results of the company's fiscal 2026 first quarter (ended Aug. 31), and on the surface, there were no surprises. Revenue increased 12% year over year to $14.9 billion, resulting in adjusted earnings per share (EPS) that climbed 6% to $1.47.

For context, analysts' consensus estimates were calling for revenue of $15 billion and EPS of $1.48, so Oracle fell short of Wall Street's expectations. On the other hand, the results accelerated compared to Q4, so there was a clear improvement.

However, investors were astonished to learn that the company had signed a veritable tidal wave of transactions that will fuel Oracle's growth for years to come.

The company's remaining performance obligation (RPO) -- which represents contractually obligated sales not yet included in revenue -- soared 359% to a record $455 billion. "We signed four multibillion-dollar contracts with three different customers in Q1," said CEO Safra Catz. "We expect to sign up several additional multibillion-dollar customers, and RPO is likely to exceed half a trillion dollars." Much of that is driven by robust demand for AI.

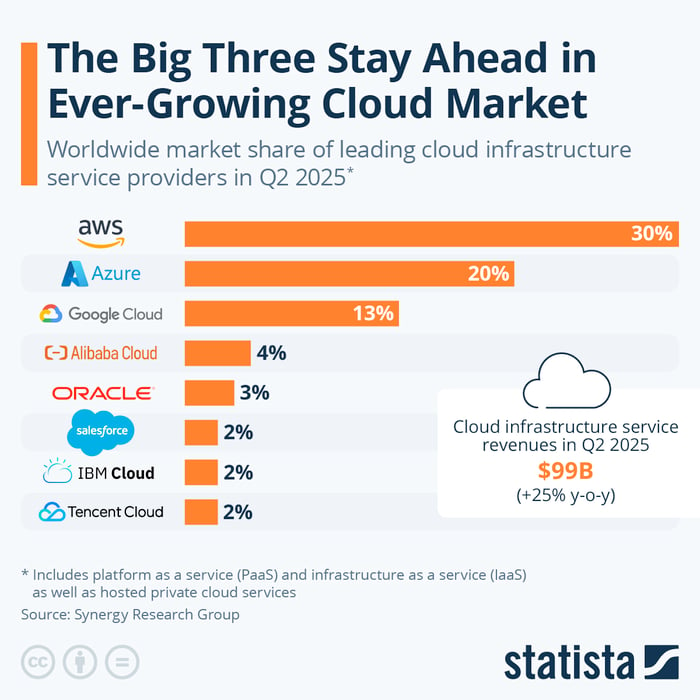

The biggest beneficiary of this dealmaking frenzy was Oracle Cloud Infrastructure (OCI), the company's cloud computing segment, which has long been considered an also-ran. In the 2025 calendar second quarter, OCI controlled just 3% of the cloud infrastructure market, while Amazon Web Services, Microsoft Azure, and Alphabet's Google Cloud captured 30%, 20%, and 13%, respectively.

Data source: Statista.

To say Oracle's long-term forecast could upend that paradigm in the years to come might well be an understatement:

Oracle executives also made it clear that the vast majority of the revenue in its guidance was already baked into the company's reported RPO. That means that any future deals will serve to increase its already impressive outlook. Oracle's backlog and the resulting outlook offer definitive proof that OCI is coming into its own and is poised to become a major player in the cloud infrastructure market.

Beyond the spectacular news for Oracle investors, the results provide insight into the broader AI landscape, and there are specific implications for Palantir.

Investors will recall that last year, the pair forged a wide-ranging partnership. As I wrote at the time, "Palantir will move Foundry workloads to Oracle Cloud. Furthermore, Palantir will make Gotham and Artificial Intelligence Platform (AIP) -- its generative AI offering -- deployable across Oracle's distributed cloud for the first time."

This made AIP available to a growing cross-section of enterprise users. As such, Palantir is well positioned to benefit as Oracle expands its AI and cloud infrastructure services.

AIP has been Palantir's primary growth driver in recent years. In the second quarter, the company's U.S. commercial segment (which includes AIP) grew 93% year over year and 20% quarter over quarter as enterprise businesses scramble to adopt AI tools that provide a proven return on investment (ROI).

Furthermore, Palantir offers boot camps, hands-on-keyboard sessions where developers work hand in hand with Palantir engineers to create solutions for real-world business challenges. AIP is embedded deeply into existing customer systems to provide users with specific, actionable insights in real time.

Oracle's forecast reveals that the company plans to expand its cloud footprint by more than sevenfold over the coming five years. Given Palantir's strong ties to Oracle Cloud, this provides a growing pool of potential customers for Palantir to tap along the way.

While the future looks bright, Palantir's valuation will likely be a stumbling block for some investors, as the stock is currently selling for 196 times next year's expected earnings, so it isn't for the faint of heart. On the other hand, the stock's recent decline provides a more reasonable entry point than just weeks ago.

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $649,037!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,086,028!*

Now, it’s worth noting Stock Advisor’s total average return is 1,056% — a market-crushing outperformance compared to 188% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of September 8, 2025

Danny Vena has positions in Alphabet, Amazon, Microsoft, Palantir Technologies, and Tencent. The Motley Fool has positions in and recommends Alphabet, Amazon, International Business Machines, Microsoft, Oracle, Palantir Technologies, Salesforce, and Tencent. The Motley Fool recommends Alibaba Group and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

| 48 min | |

| 3 hours | |

| 6 hours | |

| 10 hours | |

| 14 hours | |

| 20 hours | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite