|

|

|

|

|||||

|

|

After a stretch of soft performance, Hologic’s HOLX latest quarterly results signaled progress across multiple fronts. The Breast Health business, which has drawn much attention from investors following a lackluster first half driven by both external factors and missed internal execution, is now on track to return to healthy growth in the final quarter of fiscal 2025. A consistent delivery of clinical and product innovation remains a key competitive advantage for this unit. Overall, Hologic anticipates mid-single-digit revenue growth and high single-digit earnings per share (EPS) growth in the fourth quarter, marking progress toward returning to its long-term financial goals.

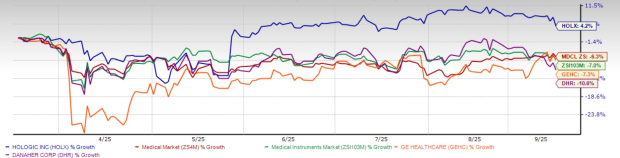

In the last six months, shares of HOLX have risen 4.2% against the industry’s 7% decline and the Zacks Medical sector’s 6.3% fall. The stock has also outpaced its close peers, GE Healthcare GEHC and Danaher Corp. DHR, which fell 7.3% and 10.6%, respectively.

The segment’s revenues not only improved sequentially in the third quarter of fiscal 2025 but also slightly exceeded the company’s expectations. Earlier this year, Hologic announced a new leadership team to strengthen future growth prospects. Actions taken included splitting the sales force between capital and disposable product sales representatives to match the distinct skill sets required. Combined with a more concrete selling strategy, the shift is expected to drive improved focus and performance within the commercial channels.

In addition, the team rolled out a new strategy to upgrade older end-of-life gantries, which is set to gain more traction in the fourth quarter and into 2026. Despite longer gantry replacement cycles, competitive gantry wins in recent quarters reinforce the company’s market leadership. Moreover, a 10-year retrospective study with Sanford Health found that high-resolution 3D mammography using Hologic’s Clarity HD software delivered higher cancer detection rates than the standard resolution 3D.

The role of AI in breast cancer detection is also becoming increasingly vital. Hologic’s latest innovation, the Genius AI Detection PRO, builds on its flagship Genius AI Detection 2.0 Solution, featuring advanced workflows, enhanced diagnostic accuracy and up to 24% reduction in radiologists’ overall reading time. The solution won the title of “Best New Imaging Technology Solution” by MedTech Breakthrough in May.

Hologic’s Endomagnetics acquisition (2024) has strengthened its interventional breast health portfolio with market-leading products and R&D capabilities. The company now sells Endomagnetics’ products directly through its domestic salesforce instead of the previous distributor, which contributed to 31.8% interventional growth in the fiscal third quarter. By leveraging its commercial channel capabilities, Hologic is well-positioned to capture the wireless localization market. In August, Endomag transitioned to the company’s organic growth rates.

Beyond Breast Health, Hologic’s strength in its other two core segments is also noteworthy. In Diagnostics, the global utilization of the Panther platform continues to reach new levels. The BV, CV/TV molecular diagnostic assay is a key driver, with massive potential to expand into the vast underpenetrated U.S. vaginitis market as awareness and reimbursement efforts continue. Panther Fusion respiratory assays have seen strong uptake this year, driven by a severe flu season. Fusion’s Open Access functionality allows labs to run their own lab-developed tests (LDTs) on the platform.

In the coming years, Hologic plans to diversify the Fusion menu with IVD tests for Gastrointestinal (GI) and hospital-acquired infections. Meanwhile, the Biotheranostics oncology business is gaining from the strong adoption of the Breast Cancer Index test, which is included in major guidelines for predicting the benefit of extended endocrine therapy. With only about 12% market penetration, Hologic expects Biotheranostics to emerge as a key growth platform in the future.

The GYN Surgical momentum is driven by international markets, where the company’s investments in commercial and market access capabilities have significantly expanded the access of its minimally invasive surgical products, such as MyoSure and NovaSure. The addition of Gynesonics further enhanced the fibroid treatment portfolio, while the Fluent Pro Fluid Management System is also gaining traction.

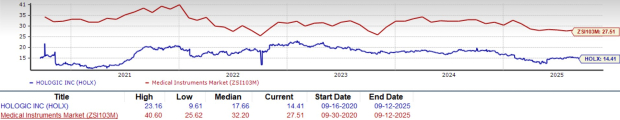

Carrying a Value Score of B, Hologic shares appear undervalued at current levels. The stock is trading at a forward five-year Price-to-Earnings (P/E) of 14.41X, lower than its industry’s 27.51X average. In comparison, GEHC and DHR are trading at P/E of 15.95X and 22.81X, respectively.

Outside the United States, the Diagnostics business remains challenged. Cytology, historically the largest contributor to the company’s China revenues, has been affected by rising tariff implications, anti-American sentiment and growing local competition. To derisk itself from future geopolitical turmoil, Hologic had lowered its China revenue forecast by $20 million, now expecting only $50 million. Its HIV testing business in Africa is expected to remain impacted by reduced USAID funding.

Tariffs also remain a concern. Based on planned mitigation efforts, the company anticipates direct tariff costs to be nearly $10 million-$12 million per quarter from fiscal 2026, down from the initial $20 million-$25 million forecast. This would translate to approximately 100 basis points of headwind to the gross margin compared to this year. Meanwhile, any further tariffs or trade restrictions by the United States or key markets could add additional pressure.

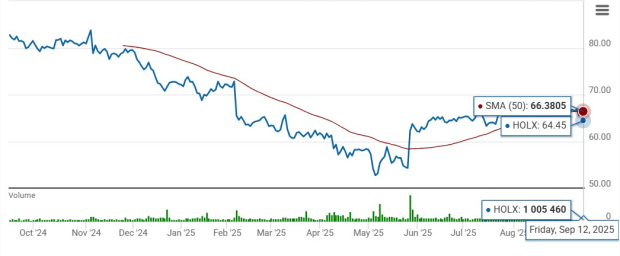

From a technical standpoint, the stock has been trading below the 50-day simple moving average (SMA) for a while, indicating a short-term bearish trend.

Hologic has a lot of existing and evolving strengths, from the BV, CV/TV in Diagnostics to Gynesonics in GYN Surgical, which are likely to support its long-term growth prospects. The company’s efforts to restore growth in Breast Health by the end of this year demonstrate its operational resilience. Supported by its attractive valuation, the Zacks Rank #3 (Hold) stock remains a worthwhile option for long-term investors to consider the potential gains. That said, potential investors should wait for a more favorable entry point as the company works to gain better visibility on its divisional headwinds and margin pressures. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-28 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite