|

|

|

|

|||||

|

|

Wrapping up Q2 earnings, we look at the numbers and key takeaways for the medical devices & supplies - specialty stocks, including STAAR Surgical (NASDAQ:STAA) and its peers.

The medical devices industry operates a business model that balances steady demand with significant investments in innovation and regulatory compliance. The industry benefits from recurring revenue streams tied to consumables, maintenance services, and incremental upgrades to the latest technologies, although specialty devices are more niche. The capital-intensive nature of product development, coupled with lengthy regulatory pathways and the need for clinical validation, can weigh on profitability and timelines. In addition, there are constant pricing pressures from healthcare systems and insurers maximizing cost efficiency. Over the next several years, one tailwind is demographic–aging populations means rising chronic disease rates that drive greater demand for medical interventions and monitoring solutions. Advances in digital health, such as remote patient monitoring and smart devices, are also expected to unlock new demand by shortening upgrade cycles. On the other hand, the industry faces headwinds from pricing and reimbursement pressures as healthcare providers increasingly adopt value-based care models. Additionally, the integration of cybersecurity for connected devices adds further risk and complexity for device manufacturers.

The 7 medical devices & supplies - specialty stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 3.6%.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 5.5% since the latest earnings results.

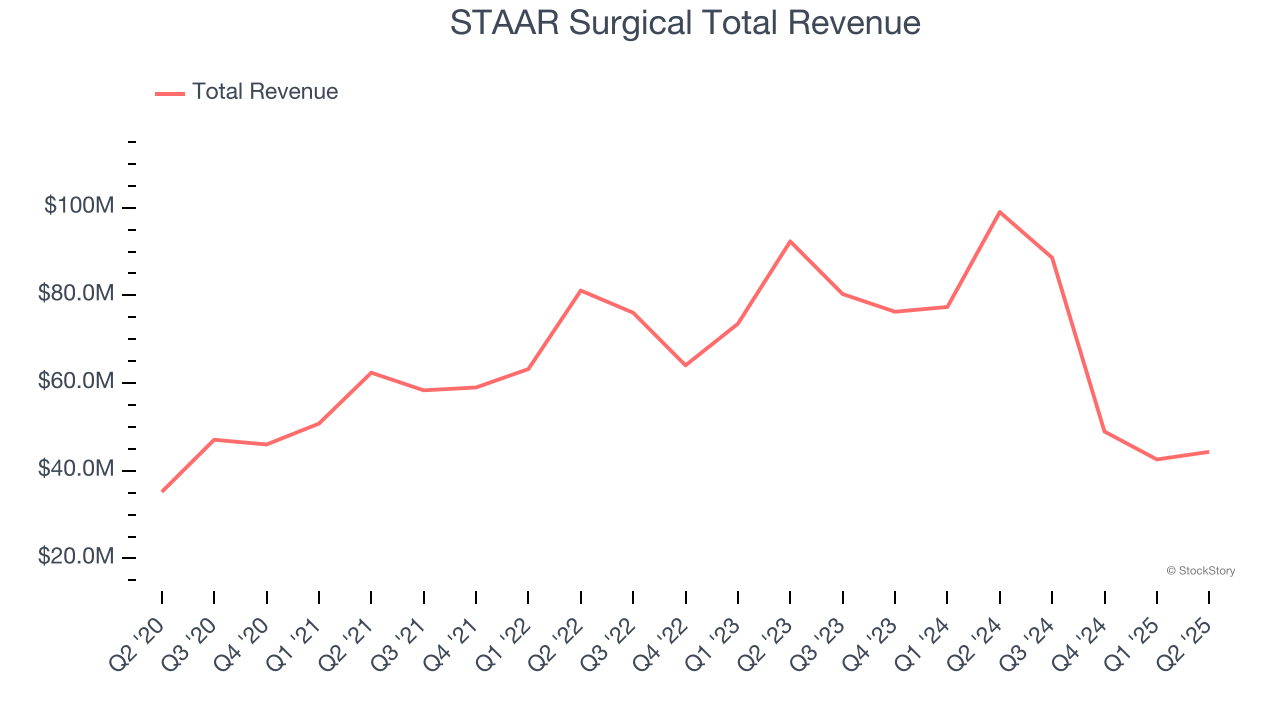

With over 2.5 million implants performed worldwide, STAAR Surgical (NASDAQ:STAA) designs and manufactures implantable lenses that correct vision problems without removing the eye's natural lens.

STAAR Surgical reported revenues of $44.32 million, down 55.2% year on year. This print exceeded analysts’ expectations by 9.6%. Overall, it was an incredible quarter for the company with a solid beat of analysts’ constant currency revenue estimates and a beat of analysts’ EPS estimates.

STAAR Surgical pulled off the biggest analyst estimates beat but had the slowest revenue growth of the whole group. Unsurprisingly, the stock is up 3.1% since reporting and currently trades at $27.70.

Is now the time to buy STAAR Surgical? Access our full analysis of the earnings results here, it’s free.

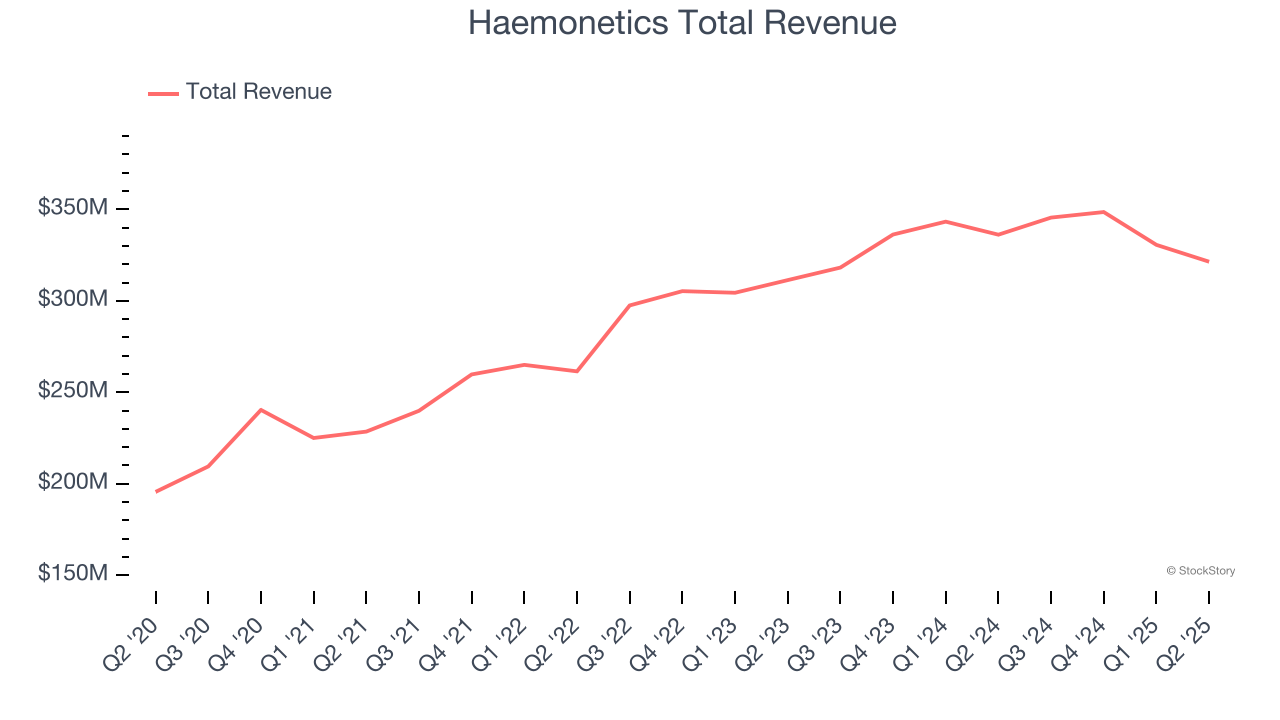

With roots dating back to 1971 and a mission to improve blood-related healthcare, Haemonetics (NYSE:HAE) provides specialized medical devices and software for blood collection, processing, and management across plasma centers, blood banks, and hospitals.

Haemonetics reported revenues of $321.4 million, down 4.4% year on year, outperforming analysts’ expectations by 6.6%. The business had a very strong quarter with a solid beat of analysts’ organic revenue and EPS estimates.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 31.1% since reporting. It currently trades at $52.20.

Is now the time to buy Haemonetics? Access our full analysis of the earnings results here, it’s free.

Offering an alternative for the millions who struggle with traditional CPAP machines, Inspire Medical Systems (NYSE:INSP) develops and sells an implantable neurostimulation device that treats obstructive sleep apnea by stimulating nerves to keep airways open during sleep.

Inspire Medical Systems reported revenues of $217.1 million, up 10.8% year on year, exceeding analysts’ expectations by 1.2%. Still, it was a softer quarter as it posted full-year revenue guidance missing analysts’ expectations.

Inspire Medical Systems delivered the weakest full-year guidance update in the group. As expected, the stock is down 38.6% since the results and currently trades at $80.11.

Read our full analysis of Inspire Medical Systems’s results here.

With a nearly 170-year history dedicated to vision care and eye health innovation, Bausch + Lomb (NYSE:BLCO) develops and manufactures a comprehensive range of eye health products including contact lenses, pharmaceuticals, surgical devices, and consumer eye care solutions.

Bausch + Lomb reported revenues of $1.28 billion, up 5.1% year on year. This number beat analysts’ expectations by 2.2%. Taking a step back, it was a satisfactory quarter as it also produced full-year revenue guidance slightly topping analysts’ expectations.

Bausch + Lomb delivered the highest full-year guidance raise among its peers. The stock is up 3.5% since reporting and currently trades at $15.19.

Read our full, actionable report on Bausch + Lomb here, it’s free.

With operations spanning 64 countries and a portfolio of over 10 new products launched in 2023 alone, Globus Medical (NYSE:GMED) develops and sells implantable devices, surgical instruments, and technology solutions for spine, orthopedic, and neurosurgical procedures.

Globus Medical reported revenues of $745.3 million, up 18.4% year on year. This print topped analysts’ expectations by 0.7%. Zooming out, it was a satisfactory quarter as it also logged a solid beat of analysts’ constant currency revenue estimates but full-year EPS guidance in line with analysts’ estimates.

Globus Medical scored the fastest revenue growth but had the weakest performance against analyst estimates among its peers. The stock is up 8.5% since reporting and currently trades at $58.74.

Read our full, actionable report on Globus Medical here, it’s free.

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

| Feb-26 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-19 | |

| Feb-18 | |

| Feb-17 | |

| Feb-09 | |

| Feb-05 | |

| Feb-05 | |

| Feb-04 | |

| Feb-03 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite