|

|

|

|

|||||

|

|

Amtech Systems ASYS and Applied Materials AMAT operate at the core of the semiconductor ecosystem. Applied Materials is a global leader, providing a wide range of tools used by the biggest chipmakers, while Amtech Systems focuses on a smaller niche with its thermal processing and silicon wafer equipment.

Both ASYS and AMAT are heavily invested in the new generation of semiconductor chips that are used to power artificial intelligence (AI). However, from an investment point of view, one stock offers a more favorable outlook than the other right now. Let’s break down their fundamentals, growth prospects, market challenges and valuation to determine which stock offers a more compelling investment case.

Amtech Systems has identified advanced packaging as a significant growth opportunity, particularly within AI infrastructure. In the third quarter of fiscal 2025, the company observed a strengthening demand for its equipment used in advanced packaging applications, which is essential for AI infrastructure.

During the third quarter, sales of equipment used in AI infrastructure were five times higher than a year ago and made up about 25% of Thermal Processing Solutions’ revenues. This shows how quickly AI demand is becoming an important part of Amtech Systems’ business. Moreover, management stated that bookings during the third quarter suggest that AI-related demand should remain strong going forward. This uptick in demand is expected to serve as a growth catalyst.

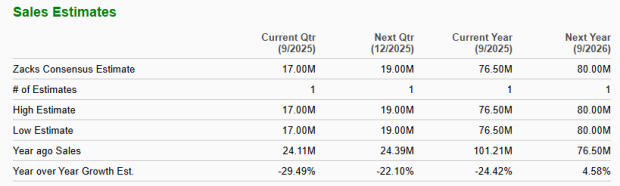

In alignment with this positive momentum, Amtech Systems projected revenues of $17-$19 million for the fourth quarter of fiscal 2025, where growth in AI-related equipment sales is expected to be the major growth catalyst. Moreover, management stated that bookings during the third quarter suggest that AI-related demand should remain strong going forward. This uptick in demand is expected to serve as a growth catalyst. Though the consensus mark for top-line estimates for fiscal 2025 revenues suggests a decline of 24.4%, it is forecasted to mark a recovery in fiscal 2026 with an estimated year-over-year increase of 4.6%.

Additionally, Amtech Systems has made substantial progress in restructuring its operations to improve cost efficiency and better align with evolving market demands. These efforts are already yielding tangible results. Over the last year and a half, it has reduced its factory footprint by reducing its manufacturing factories from seven sites to four sites, while shifting some production to partners.

A core element of this transformation is the adoption of a semi-fabless manufacturing model, which has effectively reduced fixed costs and improved operational leverage. During the last earnings call, management stated that these steps have resulted in $13 million of annual savings.

Applied Materials is a global leader in the supply chain of semiconductor fabrication equipment, covering key processes in chip manufacturing, which include deposition, etching and inspection. Applied Materials’ long-term growth prospects remain highly compelling due to its leadership in AI-driven semiconductor technology.

Due to the proliferation of AI and its rapid adoption by enterprises, Applied Materials is experiencing strong traction in its Sym3 Magnum etch system, Cold Field Emission eBeam technology, gate-all-around, backside power delivery and 3D DRAM technology nodes crucial for developing high-performance processing and memory chips used for AI and HPC workloads.

Applied Materials’ Sym3 Magnum etch system has generated more than $1.2 billion in revenues since its launch in February 2024. Additionally, in the third quarter of fiscal 2025, management projects AMAT's revenues from DRAM customers to grow more than 50% in fiscal 2025.

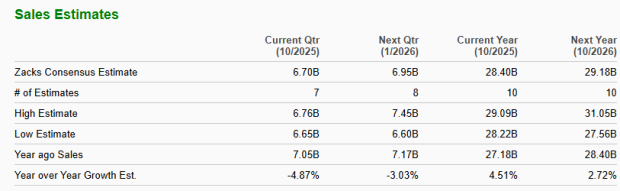

However, U.S. government restrictions on selling advanced semiconductor equipment to Chinese manufacturers are hurting Applied Materials’ sales and growth outlook. The Zacks Consensus Estimate for AMAT’s fiscal 2025 and 2026 revenues indicates year-over-year growth of 4.5% and 2.7%, respectively.

Year to date, Amtech Systems shares have appreciated 69.6%, while Applied Materials shares have gained 3.2%.

Amtech Systems is trading at a forward sales multiple of 1.66X, below Applied Materials’ 4.60X. While both companies are of high quality, Amtech Systems’ discounted valuation makes it look more reasonably priced.

Amtech Systems and Applied Materials are both critical to the future of semiconductors, but ASYS stands out as a better stock at this moment.

Although AMAT’s positioning as a provider of tools for deposition, etching and inspection is crucial for AI-driven semiconductor technology, the near-term headwinds like the U.S.-China trade war and uncertainty arising for AMAT from these dynamics make it less attractive at present. In contrast, Amtech Systems is demonstrating faster momentum in AI-related equipment sales, while driving meaningful operational improvements, and trades at a more attractive valuation.

Currently, Amtech Systems flaunts a Zacks Rank #1 (Strong Buy), making the stock a must-pick compared to Applied Materials, which has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 4 hours | |

| Feb-16 | |

| Feb-16 | |

| Feb-15 | |

| Feb-14 | |

| Feb-14 | |

| Feb-14 | |

| Feb-14 | |

| Feb-14 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 |

Stocks to Watch Friday Recap: Applied Materials, Coinbase, DraftKings

AMAT +8.08%

The Wall Street Journal

|

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite