|

|

|

|

|||||

|

|

Eli Lilly and Company’s LLY stock moved past the 50-day Simple Moving Average (SMA) last week after trading below the same since the end of July. When a stock's price moves above its 50-day SMA, it signals a potential bullish trend.

Lilly’s stock seems to be recovering after declining sharply post its second-quarter results. Despite beating estimates for both earnings and sales in the second quarter, LLY’s stock crashed on Aug. 7 as the much-awaited data from the ATTAIN-1 phase III study on its oral GLP-1 candidate, orforglipron for obesity, failed to impress investors.

However, in late August, Lilly announced top-line data from the third of the seven phase III studies on orforglipron, the ATTAIN-2 study, which was conducted in people with obesity and type II diabetes. The ATTAIN-2 study met the primary and all key secondary endpoints for all three doses tested at 72 weeks. The ATTAIN-2 data met investor expectations and led to some improvement in the stock price. The ATTAIN-1 data led many investors to feel that the potential market for orforglipron is now less than previously expected. However, the data from the ATTAIN-2 study seems to have eased some of these concerns.

Lilly’s stock is up 18% since the second-quarter results, easing some of the recent negative sentiment. Is it the right time to buy the stock now? Let’s understand the company’s strengths and weaknesses to make an informed decision.

Lilly boasts a robust portfolio of treatments for diabetes and other cardiometabolic conditions, with its cardiometabolic division emerging as the company’s strongest segment. This success is largely attributed to its widely used GLP-1 therapies — Mounjaro for diabetes and Zepbound for weight loss.

Despite being on the market for only around three years, Mounjaro and Zepbound have become key top-line drivers for Lilly, with demand rising rapidly. Mounjaro and Zepbound account for around 50% of the company’s total revenues.

Though sales of Mounjaro and Zepbound were below expectations in the second half of 2024, their sales picked up in the first half of 2025, driven by launches of the drugs in new international markets and improved supply from ramped-up production. The positive trend is expected to continue in the second half.

Lilly is expanding its incretin production capability. In the first half of 2025, Lilly produced more than 1.6x the amount of salable incretin doses when compared to the first half of 2024, helped by its significant step-up in capacity. Lilly expects to bring more capacity online in the second half of 2025 and expects its production capabilities to increase further. Lilly expects to produce at least 1.8x the number of salable incretin doses in the second half of 2025 compared to the second half of 2024.

Lilly continues to launch Mounjaro in new countries like Mexico and Brazil. Lilly has now launched Mounjaro in most major markets.

Regulatory approvals for new indications are expected to further boost sales. In late December 2024, the FDA approved Zepbound for a second indication — moderate-to-severe obstructive sleep apnea in adults with obesity. Based on positive data from a phase III cardiovascular outcome study, Lilly plans to submit global regulatory applications to support a label cardiovascular indication by the end of 2025. Lilly is also conducting a phase III study for type 1 diabetes. A phase II study in metabolic dysfunction-associated steatohepatitis (MASH) met its primary endpoint in 2024. Rival Novo Nordisk’s NVO obesity drug, Wegovy was approved for treating MASH in August.

In 2025, Lilly launched additional Zepbound lower-priced vial doses and offered new savings for self-pay patients to boost sales.

Lilly is investing broadly in obesity and has several new molecules currently in clinical development with a range of oral and injectable medications with different mechanisms of action. These include two late-stage candidates, orforglipron, a once-daily oral GLP-1 small molecule, and retatrutide, a GGG tri-agonist and some mid-stage candidates, bimagrumab, eloralintide and mazdutide.

Top-line data from the ATTAIN-1 study (announced in April) in people with obesity (but without type II diabetes) showed that patients taking the highest dose of orforglipron lost more than 27 pounds or 12.4% of their body weight. In the ATTAIN-2 study in obese adults with type II diabetes, the highest dose (36 mg) of orforglipron delivered a weight loss of up to an average of 22.9 pounds or 10.5%. Lilly announced ATTAIN-2 data in August.

An oral pill like orforglipron has the potential to be a more convenient alternative to injectable treatments like Zepbound and Wegovy. Lilly plans to file regulatory applications for orforglipron in obesity later this year, setting up the timeline for a potential launch next year.

Lilly is also evaluating orforglipron in late-stage studies in other disease areas like obstructive sleep apnea and hypertension, and also plans to initiate a new phase III study in people with knee osteoarthritis pain in overweight or obesity later this year.

It also expects the first data readout from a phase III study on its triple-acting incretin, retatrutide, in osteoarthritis of the knees later in 2025.

LLY is also working to diversify beyond GLP-1 drugs by expanding into cardiovascular, oncology, and neuroscience areas. In 2025, it announced three M&A deals. It acquired Verve Therapeutics this month to add gene therapies for heart disease to its pipeline. Lilly has also entered into agreements to acquire Scorpion Therapeutics’ oncology drug and SiteOne Therapeutics’ non-opioid pain candidate.

In addition to Mounjaro and Zepbound, Lilly has secured approvals for several other new therapies over the past few years. These include Omvoh for treating ulcerative colitis and Crohn’s disease, BTK inhibitor Jaypirca for mantle cell lymphoma and chronic lymphocytic leukemia, Ebglyss for moderate-to-severe atopic dermatitis, and Kisunla (donanemab) for early symptomatic Alzheimer’s disease. These newly approved drugs are also contributing to Lilly’s revenue growth.

Lilly expects its new drugs, Mounjaro, Zepbound, Omvoh, Jaypirca, Ebglyss and Kisunla, along with the expanded use of existing drugs, to drive sales growth in the second half of 2025. It also expects the potential launch of new medicines, such as imlunestrant for metastatic breast cancer, to contribute to growth in 2025.

The obesity market is expected to expand to $100 billion by 2030, according to data from Goldman Sachs, which means fierce competition is inevitable. Lilly and Novo Nordisk presently dominate the market.

Mounjaro and Zepbound face strong competition from Novo Nordisk’s semaglutide medicines, Ozempic for diabetes and Wegovy for obesity.

Several other companies like Amgen AMGN and Viking Therapeutics VKTX are also making rapid progress in the development of more potent and convenient GLP-1-based candidates in their clinical pipeline.

NVO, LLY and VKTX are racing to introduce oral weight-loss pills, as Wegovy and Zepbound are both injectable drugs. Novo Nordisk has already filed a new drug application (NDA) for an oral version of Wegovy and also has several next-generation candidates in its obesity pipeline, like CagriSema (a combination of semaglutide and cagrilintide) and an oral pill, amycretin (a dual GLP-1 and amylin receptor agonist). The FDA is expected to decide on the Wegovy oral formulation NDA in the fourth quarter.

Viking Therapeutics’ dual GIPR/GLP-1 receptor agonist, VK2735, is being developed both as oral and subcutaneous formulations for the treatment of obesity. The company recently announced mixed top-line results from a mid-stage study evaluating the safety and efficacy of the oral formulation of VK2735. Though patients on the highest drug dose lost up to 12.2% of their body weight after 13 weeks of daily dosing compared with 1.3% in the placebo group, a significant number of patients also dropped out of the study. Phase III obesity studies with the subcutaneous formulation of VK2735 have also been initiated.

Amgen is developing MariTide, a GIPR/GLP-1 receptor, as a single dose in a convenient autoinjector device with a monthly and maybe less frequent dosing. In March, Amgen initiated two phase III studies on MariTide in obesity as part of its comprehensive MARITIME phase III program. Since June, Amgen has initiated two more phase III studies in other obesity related conditions.

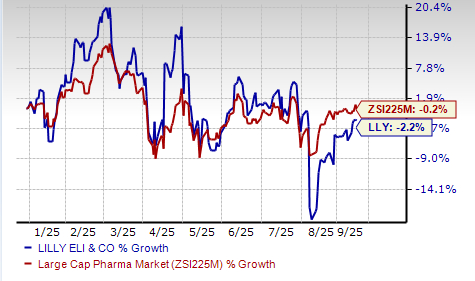

Lilly’s stock has declined 2.2% so far this year compared with the industry’s decrease of 0.2%.

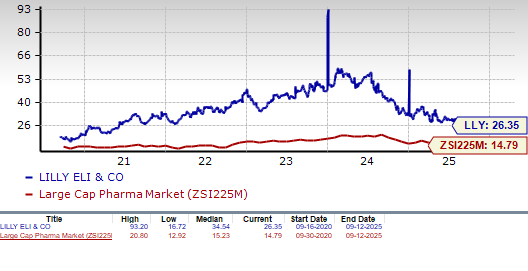

From a valuation standpoint, Lilly’s stock is expensive. Going by the price/earnings ratio, LLY’s shares currently trade at 26.35 forward earnings, much higher than 14.79 for the industry. However, LLY’s stock is trading below its 5-year mean of 34.54.

The Zacks Consensus Estimate for 2025 has risen from $21.90 per share to $23.03 per share over the past 60 days, while that for 2026 has risen from $30.84 to $30.95 per share over the same timeframe.

Lilly’s tremendous success with Mounjaro and Zepbound has made it the largest drugmaker with a market cap of more than $700 billion. In 2025, Lilly expects to record revenues in the range of $60.0 billion to $62.0 billion, indicating an impressive year-over-year growth of more than 30%

We believe that LLY has solid growth prospects and a promising portfolio of new drugs and pipeline candidates. Consistently rising estimates also reflect investors’ optimistic outlook for the stock.

Despite an expensive valuation and rising competitive pressure, the stock’s recent price recovery suggests that investors who own this Zacks Rank #3 (Hold) company should retain the stock. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Long-term investors may consider buying the stock as it is trading below its 5-year mean. The stock moving past the 52-week SMA probably indicates better days ahead after a challenging year so far.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 7 hours | |

| 15 hours | |

| 18 hours | |

| 20 hours | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 |

These Stocks Lead Dow Jones In February. Hint: It's Not AI Companies.

AMGN

Investor's Business Daily

|

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite