|

|

|

|

|||||

|

|

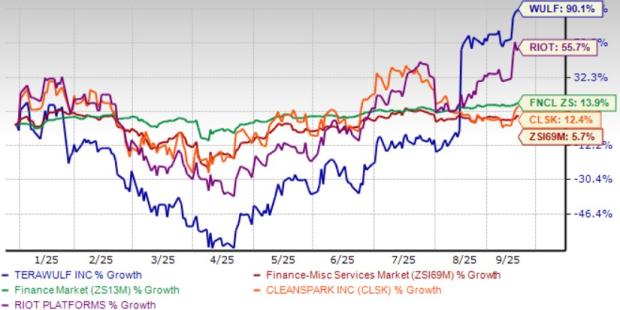

TeraWulf WULF shares have appreciated 90.1% year to date (YTD), underperforming the Zacks Financial- Miscellaneous Services industry and the Zacks Finance sector’s return of 5.2% and 13.4%, respectively. This vertically integrated owner and operator of next-generation digital infrastructure, purpose-built to support bitcoin mining and high-performance computing (HPC) workloads, reported revenues of $47.6 million, up 38% sequentially and 34% year over year in the second quarter of 2025.

WULF self-mined 485 bitcoin at the Lake Mariner facility in the second quarter of 2025, and bitcoin mining capacity jumped 45.5% year over year to 12.8 EH/s. As of June 30, 2025, TeraWulf owned approximately 70,300 miners, with approximately 65,100 operational at the facility. However, power cost per bitcoin self-mined jumped 98.5% year over year due to halving (in April), rising network difficulty and short-term power price volatility. Adjusted EBITDA was $14.5 million, down 25.6% year over year in the second quarter of 2025 against a negative $4.7 million in the first quarter of 2025.

However, TeraWulf expects power prices in Upstate New York to remain steady with historical levels for the rest of 2025. The company now expects 5 cents per kilowatt hour for the second half of the year and mining operations to contribute positively to EBITDA. However, WULF expects selling, general and administrative expenses between $50 million and $55 million compared with previous guidance of $40-$45 million due to accelerated growth in the company’s HPC business.

So, how should investors play WULF stock now? Let’s analyze.

TeraWulf is on track to deliver 72.5 MW of HPC colocation capacity under its data center lease agreements with Core42 Holding for GPU compute workloads. The WULF Den and CB-1 leases with Core42 are expected to start generating revenues in the third quarter of 2025.

WULF inked a deal with Fluidstack, a premier AI cloud platform that builds and operates HPC clusters. TeraWulf will deliver more than 360 MW of critical IT load at its Lake Mariner data center campus in Western New York. The Lake Mariner facility can expand up to 500 MW in the near term and up to 750 MW with targeted transmission upgrades. At the end of the second quarter of 2025, the facility had 245 MW of energized capacity supporting bitcoin mining infrastructure.

The deal represents roughly $6.7 billion in contracted revenues with total contract revenues expected to hit $16 billion. As per the deal, Alphabet’s GOOGL Google is backing Fluidstack’s lease obligations, which include early termination protections for the first 6 years. Alphabet is also providing $3.2 billion of credit support, and its total pro forma equity ownership in TeraWulf increases to approximately 14%.

WULF also secured a long-term ground lease for approximately 183 acres at the Cayuga site in Lansing, NY. The lease provides TeraWulf with exclusive rights to develop up to 400 MW of digital infrastructure capacity, with 138 MW of low-cost, predominantly zero-carbon power expected to be ready for service in 2026.

TeraWulf has outperformed peers, including Riot Platforms RIOT and Cleanspark CLSK. Shares of Riot Platforms and Cleanspark have returned 55.7% and 12.4%, respectively, YTD.

WULF faces significant competition from Riot Platforms and Cleanspark. Similar to TeraWulf, Riot Platforms is a vertically-integrated bitcoin mining company offering comprehensive and critical infrastructure to mine bitcoin. The company has been exploring the feasibility of developing a portion of RIOT’s power capacity for AI and HPC uses. Meanwhile, CleanSpark produced 2,012 bitcoins, a 28% increase year over year in the third quarter of fiscal 2025. Average Revenue Per Bitcoin was $99,000, which increased 50% year over year.

WULF shares are currently overvalued, as suggested by the Value Score of F.

In terms of price/book, TeraWulf is trading at 25.07X compared with the industry’s 3.67X, sector’s 4.33X, Riot Platforms’ 1.78X and Cleanspark’s 1.35X, suggesting a premium valuation.

However, the TeraWulf stock is currently trading above the 50-day and 200-day moving averages, indicating a bullish trend.

For 2025, the Zacks Consensus Estimate for TeraWulf’s loss has widened by 9 cents to 27 cents per share over the past 30 days. The company reported a loss of 19 cents per share in 2024.

TeraWulf Inc. price-consensus-chart | TeraWulf Inc. Quote

For third-quarter 2025, the Zacks Consensus Estimate for WULF’s loss has been unchanged at 4 cents per share over the past 30 days. The company reported a loss of 5 cents in the year-ago quarter.

WULF’s prospects improve from a lease deal with Fluidstack and the beginning of revenue generation from the WULF Den and CB-1 leases with Core42. Alphabet’s investment also bodes well for the TeraWulf stock. Investors already holding stock should continue to invest based on these positive developments.

However, TeraWulf suffers from a stretched valuation and uncertainty about tariffs that increase volatility in bitcoin trading. Increasing losses make the WULF stock risky for investors.

TeraWulf currently has a Zacks Rank #3 (Hold), which implies that investors should wait for a more favorable point to accumulate the stock. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 5 hours | |

| 6 hours | |

| 7 hours | |

| 7 hours | |

| 9 hours | |

| 12 hours | |

| 15 hours | |

| 17 hours | |

| 18 hours | |

| 19 hours | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite