|

|

|

|

|||||

|

|

Dave Inc.’s DAVE stock has skyrocketed 473.4% over the past year. The company’s shares have significantly surpassed the industry’s 73.8% surge and the 18.8% rise in the Zacks S&P 500 Composite.

Meanwhile, DAVE has outperformed its industry peer Futu Holdings’ FUTU 199.2% upsurge and First Advantage Corporation’s FA 19.9% fall.

The six-month price performances also show that DAVE’s growth exceeds that of Futu Holdings and First Advantage. Dave has boomed 151%, outpacing Futu Holdings and First Advantage’s 54.3% and 16.7% growth, respectively.

The remarkable upsurge that the stock has experienced over the past year, as well as in the past six months, is highly appealing to investors. The vital question that needs to be answered is whether investors can benefit in the long run by buying the stock now. Let us find out.

DAVE’s expanding membership acts as its primary growth driver. In the first half of 2025, the company showed consistency in acquiring members, driving its top line. Dave witnessed 4% growth in its monthly transacting members (MTM) from the preceding quarter to 2.6 million in the June quarter. A $1 increase in average customer acquisition costs resulted in DAVE’s new member count increasing 26.9% from the preceding quarter.

This expanding member base elevates Dave’s financial performance. In the second quarter of 2025, operating revenues rose 21.9% from the preceding quarter to $131.7 million, and ExtraCash originations registered 20% growth to $1.8 billion. The new fee structure model enhanced the company’s profitability position, with adjusted EBITDA showing 15.2% growth from the March-end quarter.

Although this customer base expansion improves the financial condition of the company, it raises the credit risks. In the June quarter, DAVE reported a 28-day delinquency rate of 2.4%, a whopping 900-basis-point increment, highlighting financial stress among the growing customer base, raising questions about CashAI’s prowess.

We believe that DAVE is highly confident in its CashAI underwriting engine, which is why it announced the complete implementation of CashAI v5.5 on Sept. 10. This version nearly doubles CashAI’s feature set from the previous models and optimizes encircling the new fee structure. This model is trained on more than 7 million recent ExtraCash originations that have reached full maturity.

The company revealed that the early results of this model improved risk ranking, resulting in a higher average approval amount, strong conversion, and lower delinquency and loss rates. Having witnessed DAVE’s credit risk mitigation strategy in the past quarters, we are bullish on CashAI’s capability to improve credit performance and gross profit expansion.

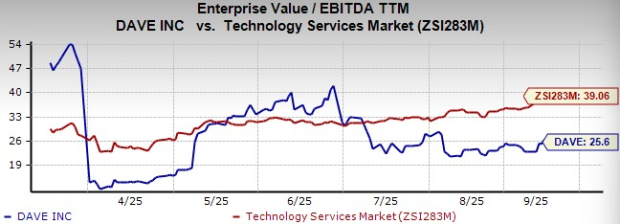

DAVE is priced at 18.73 times forward 12-month EPS, lower than the industry’s average of 28.59 times. Dave’s trailing 12-month EV-to-EBITDA ratio is 25.6, which is below 39.06, which is the current industry average. Both these metrics highlight Dave’s discounted appearance, which is considered to be a major green flag for investors.

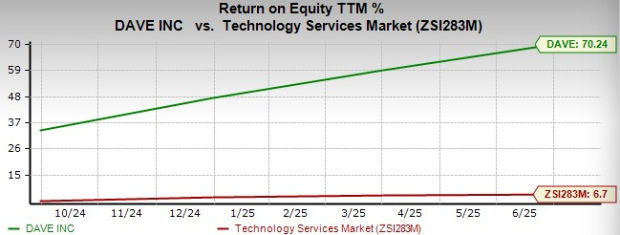

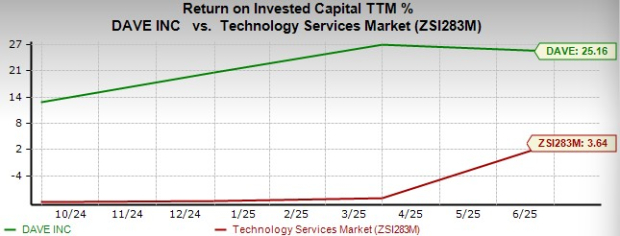

Dave’s return on equity (ROE) is remarkably higher than the industry average. Currently, its ROE is 70.2% while the industry average hovers at 6.7%. It displays that the company’s efficiency in generating returns for shareholders exceeds the industry benchmark manifold. In terms of capital utilization, Dave surpasses the industry as well, as evidenced by the company’s 25.2% return on capital invested and the industry average of 3.6%.

On the liquidity front, DAVE’s current ratio of 9.51 in the second quarter of 2025 exceeds the industry average of 1.78. When compared with the historical figure, we witness a consistent improvement in liquidity position as evidenced by 10.7% growth from the preceding quarter and a 9.7% increase from the year-ago quarter. That being said, a current ratio of more than 1 certainly elevates DAVE’s position in covering short-term obligations.

The Zacks Consensus Estimate for the company’s 2025 revenues is set at $511.9 million, suggesting a 47.5% increase from the prior-year reported level. The same is expected to rise 20.2% year over year in 2026.

The consensus estimate for 2025 earnings per share is $9.72, hinting at an outstanding surge of 85.5% from the year-ago reported level. The same is expected to hike 28.6% year over year in 2026.

Over the past 60 days, one EPS estimate each for 2025 and 2026 has been revised upward with no downward adjustments. In the same period, the Zacks Consensus Estimate for 2025 earnings has increased 11% and that for 2026 has grown 5.7%. These upward revisions highlight analysts' confidence.

Dave’s growth strategy revolves around drawing in more customers, which not only improves its financial performance but also increases its credit risks. To tackle the rising credit risks, the company has introduced a version of its CashAI underwriting engine, which has delivered promising initial results. This compels us to believe that DAVE’s endeavors to expand its member base will be accompanied by improved credit quality, which will increase the top line while minimizing default.

DAVE’s profitability and liquidity position surpass its industry benchmark. That being said, the stock possesses a discounted valuation, suggesting significant growth potential in the future. The company’s top and bottom-line outlook appears strong with positive EPS revision, highlighting analyst confidence.

Banking on these positives, we recommend that investors buy this stock now to enjoy long-term gains.

DAVE carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 3 hours | |

| 4 hours | |

| 4 hours | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite