|

|

|

|

|||||

|

|

The market's inclination toward digital learning, particularly AI-based alternatives, is favoring the edtech market and the firms operating within it, such as Chegg, Inc. CHGG and Udemy, Inc. UDMY. Additionally, the demand for personalized or adaptive learning in K-12, higher education and adult learning programs is also driving the industry. Both stocks have drawn investor interest as the sector witnesses the rise of AI-driven tools and shifting demand dynamics.

Chegg operates a direct-to-consumer subscription model, offering digital study aids, homework help and increasingly, AI-driven tutoring for college and post-secondary learners. On the other hand, Udemy operates as an online learning and teaching marketplace connecting instructors who create and publish courses with learners who purchase or subscribe to them.

Let’s dive deep and closely compare the fundamentals of the two stocks to determine which one is a better investment now.

This California-based education technology company, with a market cap of approximately $152.7 million, is currently focusing on revamping Chegg Study, its core academic product, into a Personalized Learning Assistant through AI. This transformation into a personalized learning coach helps students improve their chances of graduating through a more effective learning process.

Besides Chegg Study, the company is also benefiting from its investments in the Busuu and Skills business, highlighting growth areas including language learning, workplace readiness and upskilling. Busuu is the language learning business that recently underwent AI integration, offering CHGG a distinct edge in the market. The AI-powered features like Speaking Practice and Speaking Bites have boosted engagement, conversions and retention. Through the second half of 2025, the B2C segment under CHGG’s Busuu business will focus on product innovation, especially emphasizing AI integration to drive personalization. Under the B2B segment, the focus will remain on rolling out Guild into the English learning vertical and expanding its offering with Learning Pathways.

The company is also working on reducing its total operating expenses across multiple fronts, including workforce reduction and office closures, necessary cuts in operating expenses, lease and real estate rationalizations and significant capital expenditure reductions. Through these restructuring efforts, during the first six months of 2025, Chegg’s total operating expenses declined year over year by 72% to $202.5 million. CHGG expects to realize adjusted expense savings of between $165 million and $175 million for 2025, with an additional $100-$110 million in adjusted savings expected in 2026.

This California-based online learning and teaching provider, with a market cap of about $1.05 billion, is gaining from its AI-powered innovation strategies and subscription model offerings. With approximately 70% of its top line now being subscription-based, the company continues to emphasize subscription products across its business. To help individual learners navigate career changes and career learning, Udemy is working on expanding its subscription offering with several options aligned to specific career goals. Given the trends for its subscription business, the company remains well-positioned to reach consumer subscriptions of more than 250,000 by the end of 2025 and target more than double this value by the end of 2026.

Besides the subscription-based model, UDMY’s expansion efforts for the partnership ecosystem are boding well. In April 2025, Udemy partnered with Indeed to integrate Udemy's comprehensive content with its vast career marketplace. Also, the collaboration with UKG, a leading provider of HR, payroll and workforce management solutions, enabled the seamless integration of the Udemy Business segment with UKG Pro and UKG Ready. This will ensure a streamlined enterprise learning management system that aligns with existing workflows and simplifies administrative tasks for L&D professionals.

Moreover, Udemy is also working on diversifying its revenue streams through new products and services, and focusing on key regions (such as Brazil, India and Japan) through targeted campaigns and a localized content strategy.

However, macroeconomic uncertainties, weaker market sentiments and foreign exchange headwinds are looming over Udemy, despite the aforementioned tailwinds, which are restricting its prospects. This is mainly hitting its Consumer segment, whose revenues declined year over year by 6% in the first half of 2025 to $143.1 million. Although subscriptions are growing, the majority of consumer revenues remain transactional, making the business vulnerable to slowdowns in discretionary spending. Efforts like career accelerators and advertising pilots are indeed promising, but still at an early stage.

As witnessed from the chart below, in the past six months, Chegg’s share price performance stands significantly above Udemy’s alongside the Zacks Internet - Software industry and the Zacks Computer and Technology sector.

Considering valuation, over the last five years, Udemy has been trading above Chegg on a forward 12-month price-to-sales (P/S) ratio basis.

Overall, from these technical indicators, it can be deduced that CHGG stock offers an incremental growth trend with a discounted valuation, while UDMY stock offers a diminishing growth trend with a premium valuation.

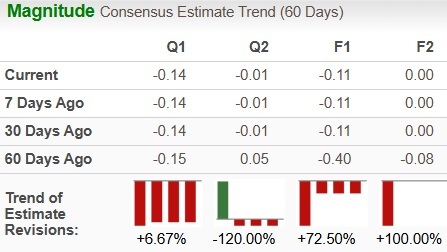

CHGG’s bottom-line estimates for 2025 indicate a loss per share, while those of 2026 indicate break-even earnings. Over the past 60 days, the loss estimates for 2025 have contracted to 11 cents per share, while those of 2026 have contracted to a breakeven point. Although the estimated figures for 2025 indicate a downtrend of 114.7% year over year, estimates for 2026 indicate 100% growth.

CHGG EPS Trend

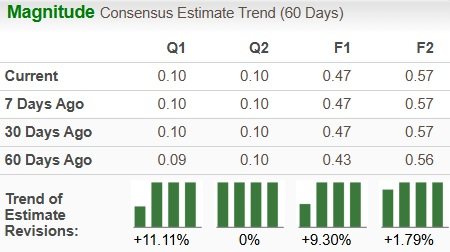

The Zacks Consensus Estimate for UDMY’s 2025 and 2026 EPS indicates year-over-year growth of 193.8% and 20%, respectively. The 2025 and 2026 EPS estimates have trended upward over the past 60 days.

UDMY EPS Trend

The education technology sector is benefiting from heightened demand for AI-driven and personalized learning solutions, positioning both Chegg and Udemy for long-term growth. However, when viewed through fundamentals, valuation and near-term execution, the two stocks diverge in investment appeal.

Chegg, which currently sports a Zacks Rank #1 (Strong Buy), is in the midst of a transformation, repositioning its flagship Chegg Study product into an AI-powered Personalized Learning Assistant. Besides, the integration of Busuu’s AI capabilities in language learning and its workplace upskilling initiatives are strengthening engagement and retention.

On the other hand, Udemy, which currently carries a Zacks Rank #3 (Hold), is successfully scaling its subscription-based model (with expectations to double consumer subscriptions by 2026) and cashing out on the strategic partnerships with companies like Indeed and UKG, supporting long-term demand. However, foreign exchange headwinds, Consumer segment weakness and reliance on discretionary spending remain significant risks.

Thus, its cost discipline, AI-led repositioning and relative valuation discount make CHGG a more compelling near-term buy compared with UDMY, which remains an attractive long-term player, but macro and valuation risks warrant caution in the near term, alongside its premium valuation. You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-15 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-10 | |

| Feb-10 | |

| Feb-10 | |

| Feb-10 | |

| Feb-10 | |

| Feb-09 | |

| Feb-09 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite